Market News and Charts for July 13, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

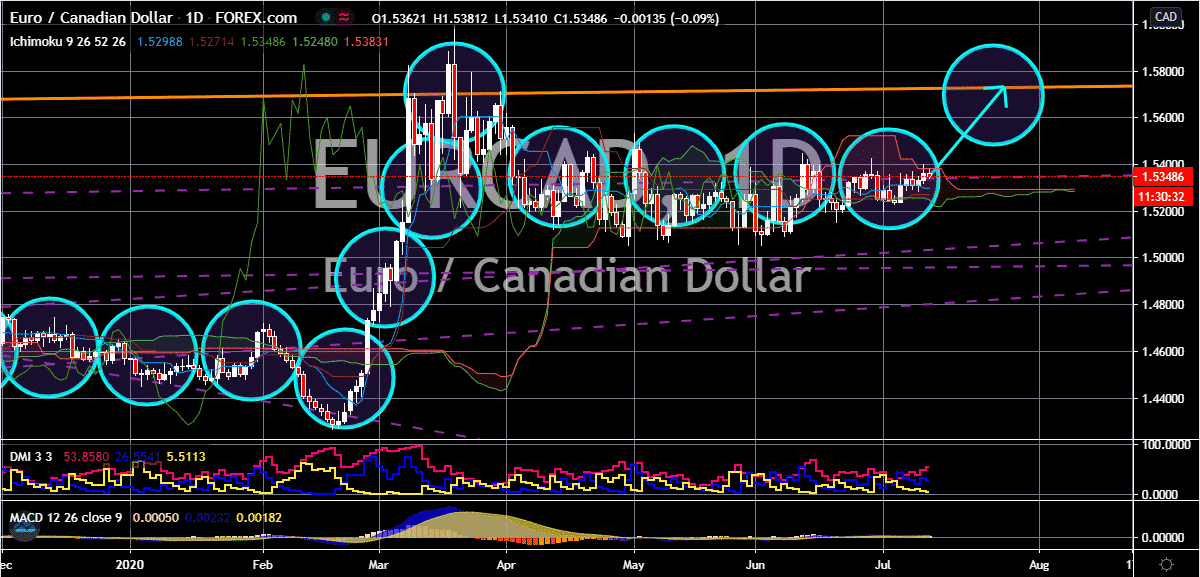

EUR/CAD

The euro momentarily slows down against the Canadian dollar but it’s quite evident that the bullish investors are looking to form a really tight upward wedge pattern. The euro to loonie trading pair is still on track to reach its resistance on the latter part of the month, reaching ranges last seen in early March. However, as of writing, the euro is seen on a critical level in which if it manages to break through, could open opportunities for gains. Investors of the pair are highly focused on other fundamentals because of the lack of any crucial eurozone economic news this week. This includes the possible entrance of Croatia, Bulgaria, and Romania to the eurozone which would, of course, have an impact on the currency’s strength. Just recently, it was reported that the Bulgarian lev and Croatian kuna have finally been included in the ERM II exchange rate mechanism, a huge feat for the two countries as it is considered to be the vestibule of the euro.

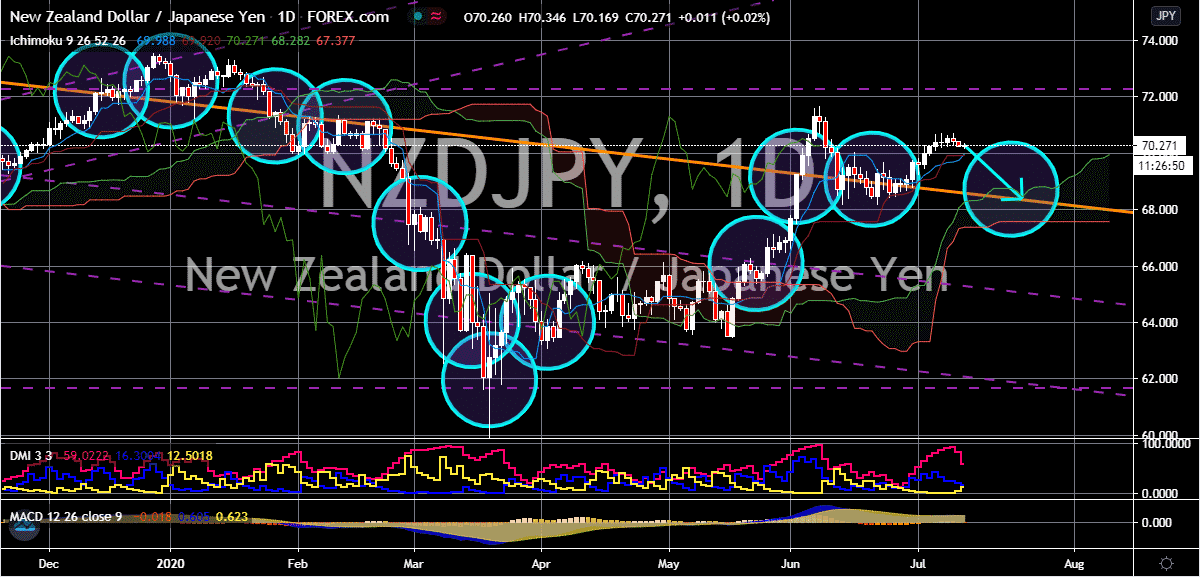

NZD/JPY

The New Zealand dollar’s confidence appears to be faltering, but not that much, against the safe-haven currency Japanese yen. The reason for this is because the US equity market is seemingly defying the concerns in the global market. However, the exchange rate is widely forecasted to take a gradual U-turn and head downwards towards its support level. The Japanese yen is growing stronger as countries all around the world continue to see record numbers of new infections, particularly in the United States. This prompts investors to worry about the outlook of the global economy especially considering that a potential coronavirus drug wouldn’t be produced miraculously in just a few weeks. On the other hand, the Japanese yen gets a much-needed boost in the foreign exchange market when HSBC said that it is the cleanest safe-haven asset. The British investment banking firm placed the spotlight on the yen after saying that it could dominate soon.

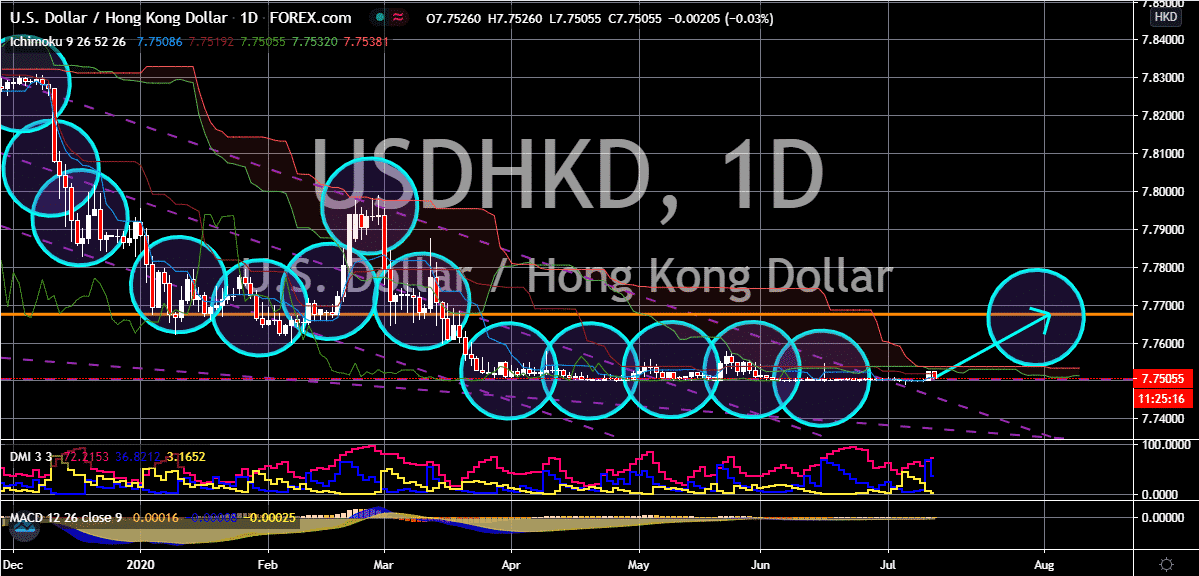

USD/HKD

The Hong Kong dollar remains formidable against the US dollar but there’s hope for bullish investors. See, the demand for safe-haven currencies such as the US dollar could sake the strong pegged currency, allowing bulls to prop up prices towards their resistance level soon. This scenario is probable due to the fact that investors are getting more and more concerned about the global economy’s outlook amidst the rising number of cases. However, there is also a chance that the Hong Kong dollar will remain dominant. Headlines say that the US is threatening to remove the pegged exchange rate with the Hong Kong dollar. And some experts believe that the attempt would not actually work well saying that Washington cannot unilaterally revoke the peg. Earlier his week it was reported that US President Donald Trump’s top advisors were planning ways to strike the currency in a bid to punish China’s decision to enforce a new national security law.

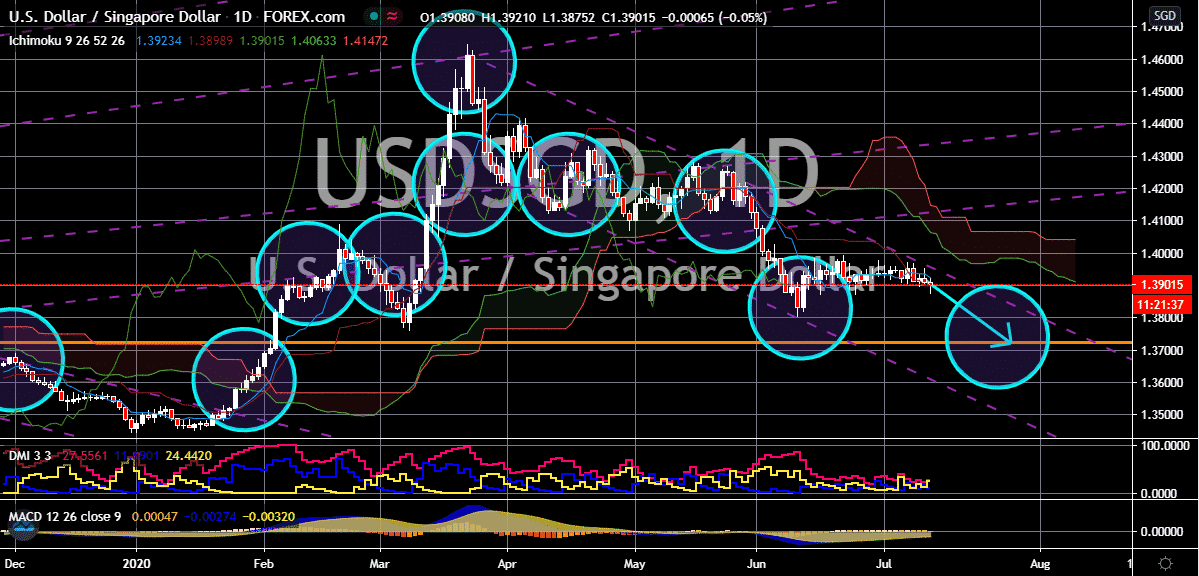

USD/SGD

The Singaporean dollar is defying the poor performance of the MSCI Singapore which has fallen significantly more than the Dow. There isn’t much news that could tell how the fate of the Singaporean dollar would go, but experts believe that the Asian currency will dominate the US dollar. The beloved US dollar is seen trading lower in Asian sessions this Monday, extending its poor performance from last week. The main reason why the buck is buckling is the triple whammy of economic uncertainties, the rising number of new infections, and that is mixed with the reported positive sentiment in the market. Looking at it at first, it could be a lot to take in, but the main thing is that the US dollar’s once-dominant stature is slowing fading away. Moreover, the Monetary Authority of Singapore, the country’s central bank, is scheduled to release its second quarter gross domestic product data on Tuesday which could support the direction of the pair.