Market Cycle Psychology – Trading Psychology Guide

Emotions have a huge impact on trading. So, it is important to learn more about emotions and their role.

Are you familiar with market cycle psychology?

To make a long story short, market cycle psychology is the idea that market movements are influenced and also reflect investors’ emotional states.

It is an integral part of behavioral economics. Market cycle psychology is heavily linked to the fluctuating investor sentiment that determines psychological market cycles.

It is no secret that emotions have a huge influence on trading. Still, it is important to mention that investor sentiment is hardly singular. That is, there are a number of contradicting sentiments at any point in time.

You need to remember that market cycle psychology isn’t necessarily about the dominance of a single sentiment. It is about a response to the aggregated or average market sentiment.

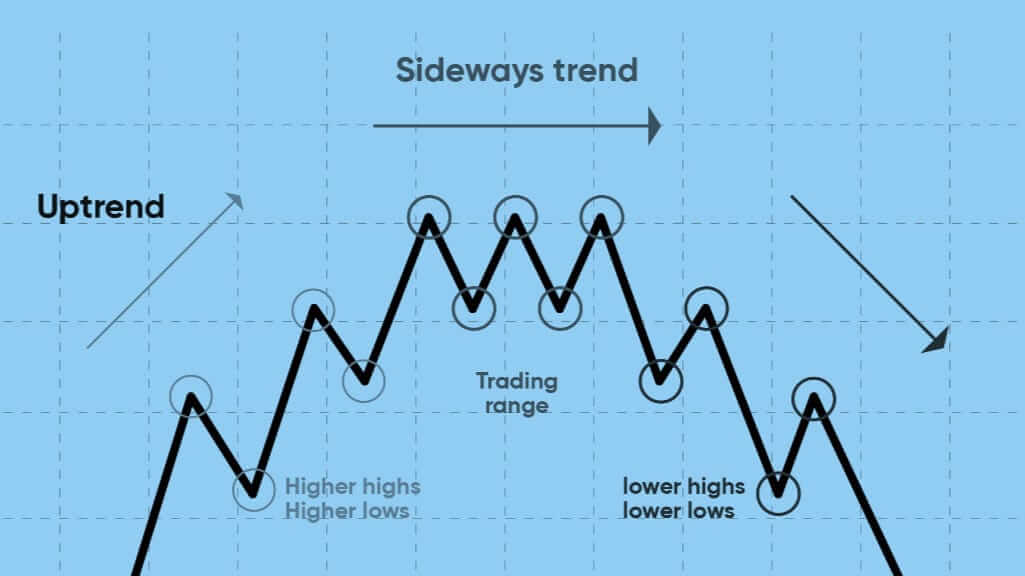

Now, let’s take a look at market cycles.

They refer to trends or patterns that form over time within various market ecosystems.

Importantly, new market cycles don’t emerge out of the blue. New market cycles start when patterns form in specific market sectors.

Interestingly, these trends usually originate from factors connected to innovation or market regulations.

It isn’t easy to identify a market cycle. For example, analysts can only usually locate a market cycle after the above-mentioned market cycle has ended.

Depending on the market being analyzed, a market cycle can be as short as several minutes or extend into several months or even years. For instance, day traders have the opportunity to consider ten-minute intervals.

What makes market cycle psychology so interesting?

People who aren’t familiar with market cycle psychology may ask, “How do Investors Use Market Psychology?”

For example, if you understand how market psychology works, you can take advantage of bullish runs. Moreover, it will be easier for you to mitigate the effects of a negative bearish market.

As stated above, market cycles are often only identifiable after they have long passed.

There are investors who use TA (technical analysis) indicators in order to assess the market’s psychological state.

For instance, the RSI (Relative Strength Index). Another similar indicator is the MACD (Moving Average Divergence Convergence.) The MACD is used in crypto and stock trading.

Important cryptocurrencies

There are thousands of cryptocurrencies in circulation. However, the vast majority are relatively unknown outside of the crypto community.

People usually hear about Bitcoin, which is the largest cryptocurrency in terms of market capitalization. Moreover, it is the world’s first decentralized cryptocurrency. Bitcoin has also become the de facto standard for cryptocurrencies.

Apart from Bitcoin, there are other important cryptocurrencies as well. So, let’s focus on some of the most important cryptocurrencies.

Ethereum is a good option. It is a decentralized software platform that enables smart contracts as well as decentralized applications to be built and run without any control or interference from a third party.

Ethereum aims to create a decentralized suite of financial products that anyone can freely access, regardless of nationality and ethnicity.

Ether is Ethereum’s platform-specific cryptographic token. This cryptocurrency is used in order to pay validators who stake their coins for their work for the blockchain.

Ether was launched in 2015. It is the second-largest cryptocurrency when it comes to market capitalization after Bitcoin. However, Ether lags behind Bitcoin by a significant margin.

Tether

You have probably heard about Tether. It was one of the first and most popular of a group of so-called stablecoins.

The vast majority of cryptocurrencies have experienced frequent periods of dramatic volatility. Interestingly, Tether and other stablecoins try to smooth out price fluctuations in order to attract users who may otherwise be cautious.

The price of Tether is tied directly to the U.S. currency because the developers claim to hold one U.S. dollar for every circulating USDT.

The history of Tether dates back to 2014. It has gained popularity all over the world. So, it makes sense to gather more information about Tether.

Effectively, Tether allows users to use a blockchain network and related technologies in order to transact in fiat currencies while reducing the volatility as well as complexity often associated with digital currencies.

We also need to note that Tether is the third-largest cryptocurrency when it comes to market capitalization.

What about a Binance Coin?

First of all, it is desirable to remember that Binance Coin is a utility cryptocurrency. It operates as a payment method for the fees associated with trading on the world’s one of the most popular crypto exchanges. As the name implies, this crypto exchange is Binance.

At the time of writing, Binance Coin is the fifth-largest cryptocurrency in terms of market capitalization.

Binance is one of the most popular crypto exchanges. Changpeng Zhao founded it.

In the beginning, Binance Coin was an ERC-20 token. The above-mentioned cryptocurrency operated on the Ethereum blockchain. Let’s not forget that it utilizes a PoS consensus model.

In conclusion, it is vital to understand how emotions affect traders, often turning the most logical thinkers into irrational investors. Novice traders should remember that the market is always changing, and external events often influence the market outlook.

It is quite hard to control your emotions. Still, you should do your best in order to reduce risk.