Lynx review

Lynx Review (lynxbroker.com): Detailed broker analysis

| General Information |

|

|---|---|

| Broker Name: | Lynx |

| Broker Type: | Forex & CFD |

| Country: | Netherlands |

| Operating since year: | 2006 |

| Regulation: | Netherlands Authority for the Financial Markets (AFM) |

| Address: | Herengracht 527, 1017 BV Amsterdam, Netherlands |

| Broker status: | Active |

CONTENT

- General Information & First Impressions

- Fund and Account Security

- Registration at Lynx

- The Trading Accounts

- Lynx’s Trading Platform

- Funding and Pricing

- Trading Products at Lynx

- Leverage and Other Crucial Trading Information

- Customer Service at Lynx

- Conclusion

General Information & First Impressions

Lynx is an experienced brokerage that focuses on providing trading and investing services to European clients. It started out in 2006, making it quite a bit more experienced than most online brokerages. Lynx operates from the Netherlands, or more precisely Herengracht 527, 1017 BV Amsterdam. As a part of our ongoing mission to present relevant brokers, we’ve decided to take a closer look at this one. As such, our Lynx review will tell you all you need to know about the brokerage’s features and service.

And as always, we’ll start with our first impression, which comes from the broker’s website. Surprisingly, Lynx didn’t let time run it over, and unlike most older brokerages, its website looks modern. More importantly, it feels like a current website and handles like one, handling quite smoothly. However, we do have one gripe with it in that it’s confusingly organized and creates information overload.

One other major complaint is that it doesn’t tell you it only serves specific European countries from the get-go. As such, traders might spend valuable time researching the service only to find out the broker is unavailable. The list is quite strict too, with only ten countries present. You only find that out once you press the “Open account” button.

So that drags down our first impressions down quite a bit. We value ease of information over ease of use, let alone visual elements. And as we just mentioned in our Lynx review, it’s fairly easy to get lost and confused. That’s especially true for newer traders and investors, deeming the broker somewhat abstruse.

Fund and Account Security

While trading specifications are important when choosing a new brokerage, safety is more so. As such, for each one of our broker reviews, we inspect account and fund safety and trustworthiness as an extension. Keep in mind that brokers keep most of their safety precautions under wraps, so we can only see what’s publicly available. As such, the broker’s exact security measures are likely slightly to moderately stronger than we can see.

With that said, Lynx definitely does seem like it has its security under control. First of all, it’s regulated, which means a lot in the current online brokerage landscape. Its licenser is the Netherlands Authority for the Financial Markets (AFM). And while it’s not a common regulator for brokers, that’s because few online brokers work from the Netherlands. The institution is valid and even more stringent than some well-known loose regulators malicious brokers sometimes use.

The regulator guarantees a decent dose of safety, both for funds and accounts. However, we couldn’t find anything that’d make us more confident in Lynx. There’s no mention of fund segregation and no dedicated security webpage. We do know they use encryption and likely authenticators since the broker asks for your phone number when you sign up.

Our trust rating is a bit shaky since the broker is unclear with its information, as we said earlier in our Lynx review. Even online trust rating outlets have some poor scores from users, which doesn’t speak in Lynx’s favor. Upon closer inspection, most of the negative reviews are service complaints that don’t concern security. While that’s not great either, it’s worse for brokers to be unsafe than sub-par service-wise. Overall, there’s little indication that Lynx would try and scam you or have a security breach.

Registration at Lynx

As we just explained, registration at Lynx has the issue of not being honest from the start. You can only register from particular countries, wasting the research time you might’ve put in beforehand. However, once you select your country, lynxbroker.com redirects you to the website with the corresponding language. That makes registration fairly simple in terms of understanding the data you need to submit and not translating more obscure info.

However, as the second step in the registration process, you need to submit your phone number. We understand that’s a measure against fake accounts and perhaps even regulator mandatory, but it’s unfortunate. That means you’re unavailable to simply check the broker out without committing too much of your personal data. Lastly, we should also note that some traders have recently expressed discontent at how long account verification takes.

The Trading Accounts

The account data is where Lynx’s lack of information starts to really show. Unlike most modern brokers, Lynx’s account page doesn’t show you nearly any precise information. Also, there’s no simple way to find out what the minimum deposit is. From third-party sources, it seems like the threshold is about €3,000, which is between $3,400 and $3,500. That’s quite high and cements Lynx as a sub-par choice for newer traders.

As for the live account types, there are distinctions, but the division is on a legal basis. There are individual, joint, and corporate investment accounts and cash or margin versions for each. The differences between the three might concern minimal deposits, fees, max trade sizes, margin requirements, and such, but the broker is unclear on that matter. However, a lack of distinction between accounts means the broker isn’t very modular. That works against luxury investors that might expect privileges for high deposits.

Lastly, we should talk about the cash and margin distinctions. They’re another likely legal requirement that separates traders. Essentially, margin accounts are for trading derivatives, while cash is for everything else.

Lynx’s Trading Platform

Another significant part of any broker’s service is its platform. For its downloadable terminal Lynx grants its users access to a proprietary platform, Trader Workstation (TWS). However, while the software is custom, Interactive Brokers was the company that developed it, not Lynx. We’ll talk more about the link between the two brokers later in our Lynx review.

The software itself looks a bit dated and, as older trading terminals usually do, confounding. It’s nothing extremely complex, so users can adapt to it over time, but it’s not nearly as user-friendly as modern platforms. As for its functionality, it has fairly sophisticated analytical capabilities, earning it a solid score.

For browser trading, Lynx has its self-developed LYNX Basic platform. The software is simpler to grasp than TWS but is also much more basic. It’s a solid choice for traders that want a quick trading experience and not necessarily a thorough one.

The details on the mobile versions are a bit fuzzy, but it’s clear that Lynx does offer one. It’s likely closer to the web platform than downloadable terminal functionality-wise. Trading Apps tend to favor simple trading, so the broker’s solution fulfills its role.

Funding and Pricing

Funding and pricing are a crucial part of any broker’s trading experience. If you can’t get money in and out of your account quickly and relatively effortlessly, you’re bound for frustration. As for service pricing, it directly impacts how much money you get to take home when all is said and done. Both of these need to be good for a pleasant and beneficial trading experience.

Unfortunately, that may not exactly be the case at Lynx. First of all, payments take quite a while to process, up to four days for deposits. Withdrawals are equally sluggish, potentially creating difficulties if your trading goes awry. To make matters worse, the only funding method is transferring via banks, which many traders consider a dated practice. The only good thing we have to say about funding at lynxbroker.com is that it offers 21 base currencies.

The pricing is not much better. As we said in an earlier section of our Lynx review, the initial requirement is steep, at between $3400 and $3500. Not only that, but the broker uses fees to fund itself. That isn’t an issue when the costs are relatively low, but they aren’t. They are medium to high and attached to many parts of the service.

Trading incurs fees that depend on the asset and volume of the trade. There’s a minimal $5 per transaction fee for stocks, and for EURUSD, the lowest charge is $4. Withdrawals also have a 1% charge past the first one each month. The broker has an inactivity fee, which disincentivizes buy-and-hold tactics.

Overall, the broker is expensive to get into and expensive to maintain. It gets a solid chunk of your earnings and has both percentage-based and flat charges. That means it takes a lot from both low and high-budget investors.

Trading Products at Lynx

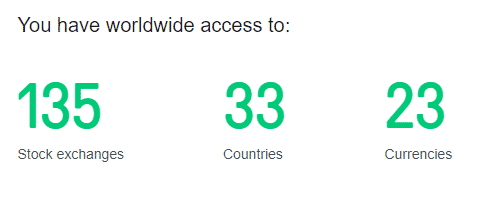

As with other parts of the service at Lynx, the exact info on the assets is difficult to make out. You’re likely starting to see a pattern in our Lynx review where a lack of clarity is a significant problem. The broker is adamant about its ability to connect to 135 stock exchanges in over 33 countries. That lets it stay active around the clock and is definitely a significant advantage.

However, the exact availability of the materials is a bit unclear. If Lynx can offer traders all the assets across all the exchanges, that’d be a great trading product library. However, we can’t be confident that’s the case.

Lynx also doesn’t offer CFDs, which cuts it off from offering some assets that traders like, such as cryptocurrencies. We understand why that’s the case, but it still may be a letdown to some. So the broker has some limitations, and the extent of the rest of its selection is unclear. Here are the asset classes we’re confident are present at lynxbroker.com

- Stocks

- ETFs

- Leveraged Products

- Futures

- Future Options

- Stock Options

- Equity Futures

- Bonds

- Metals

- Currency

- Indices

Leverage and Other Crucial Trading Information

In this section of our Lynx review, we’ll tell you about the other trading info we couldn’t place elsewhere. For starters, we’ll cover the leverage, which sits at a low max of 1:40 at Lynx. Margin traders are used to ten times that, making the leverage disappointing to some.

Another key information is that the Lynx maintains the right to transmit orders through Interactive Brokers, indicating it’s not self-sufficient. Unfortunately, there’s not much to include for Lynx beyond that. It claims to have earned some rewards from dubious sources, and we all know how much that means. Its reputation seems to be underwhelming, especially for a broker that’s been around for as long as it has. Lynx doesn’t have an education section or any of the convenience features modern brokers usually do.

Customer Service at Lynx

Lynx’s customer support works from 8 AM to 10 PM, which covers the time most traders go about their business. Still, we’d be happier with a 24-hour work time. One edge that Lynx’s customer service has is that it seems to work on weekends, unlike with most brokerages. You can reach Lynx via phone or email, with no live chat option present.

Phone: +31 020 625 15 24

Email: [email protected]

Conclusion

The primary things that would drive people towards Lynx are its experience and a lack of other choices. In the countries where Lynx operates, there’s not much diversity in choosing online brokers. As such, the competition isn’t as steep as it is on a global level. Unfortunately, Lynx may very well be the top choice for some people with limited online brokerage access.

However, when compared with other online brokers, it’s always a step behind. The fees are slightly higher, the wait times are a bit longer, and it’s just a bit less convenient. And dragging behind competitors doesn’t get you success in the cut-throat online brokerage world. With how easy it is to switch to another broker for most traders, we see little merit in using Lynx.

As you could see from our Lynx review, security may be its primary selling point due to regulation and experience. But even that gets dragged down with how careless the broker is about providing exact service details.

Lynx isn’t the worst broker we’ve seen by any means, and we don’t think it’s a scam either. However, you’ll likely find numerous significantly better brokers if you look around a bit more. So unless your choices are severely limited, we’ll conclude our Lynx review by suggesting you find a better brokerage.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Leading forex broker

A leading forex broker brand. The signals are reliable and trading instruments are affordable.

Did you find this review helpful? Yes No

Good trading brokers

Good broker signals. Customer service is great too. I get a good profit from the signals and never had any problem on withdrawals.

Did you find this review helpful? Yes No

Expensive yet worth it

Great opportunity to make money. A bit expensive to open an account but I get good returns so far.

Did you find this review helpful? Yes No