Late Yesterday, I Called the S&P 500 Ambush As Likely Over

The downswing potential I warned about yesterday came. Heavy selling continued as the Fed threw cold water in assessing the recovery pace and didn‘t signal readiness to prop it up even more than it does currently. That‘s a disappointment even though nobody really discusses V-shaped recovery anymore. Its pace is uneven – one of the few things that were quite „equally distributed“ yesterday, was sectoral losses in the S&P 500.

The investors jumped on the selling bandwagon, confirming my yesterday‘s reservations:

(…) We have the Fed meeting later today. While I am not looking for hawkish surprises or any outright optimism, the investors aren‘t taking chances. Sell now, ask questions later seem to be the mantra before the U.S. open.

With volatility spiking to levels unseen since September and October 2020, the question on everyone‘s mind is whether this is the start of another corrective move. As well as how fast stocks would recover. Make no mistake about it, they will recover – the bull isn‘t over by a long shot, and as I‘ve written in my Monday‘s 2021 prognostications, this year will be still a good one for stocks.

Let‘s assess the damage yesterday‘s selling has done, and look at the course ahead (charts courtesy of stockcharts.com).

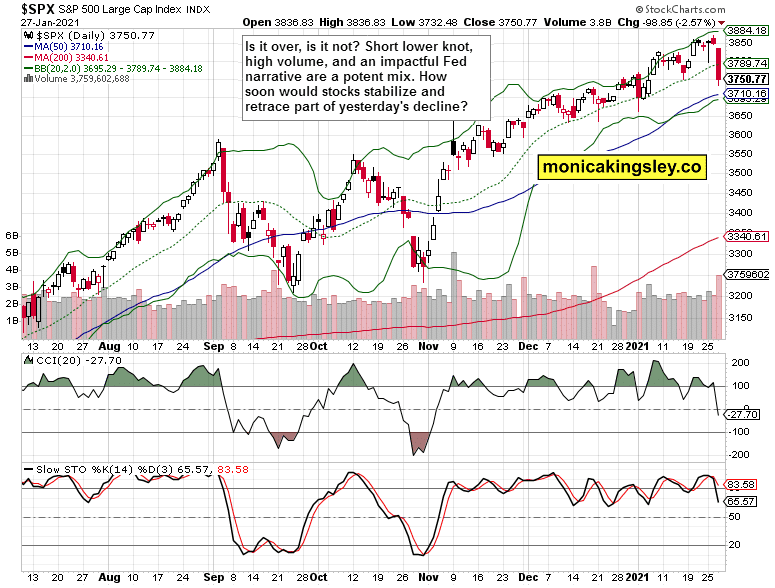

S&P 500 Outlook

The selling wave in the S&P 500 didn‘t stop with yesterday‘s Fed and picked up steam instead. While the daily indicators flashed their sell signals, this doesn‘t rule out stabilization next. That would disappoint those calling for a (10% or similar) correction. The bull market is intact, and one tough Fed assessing the situation on the ground, won‘t end it.

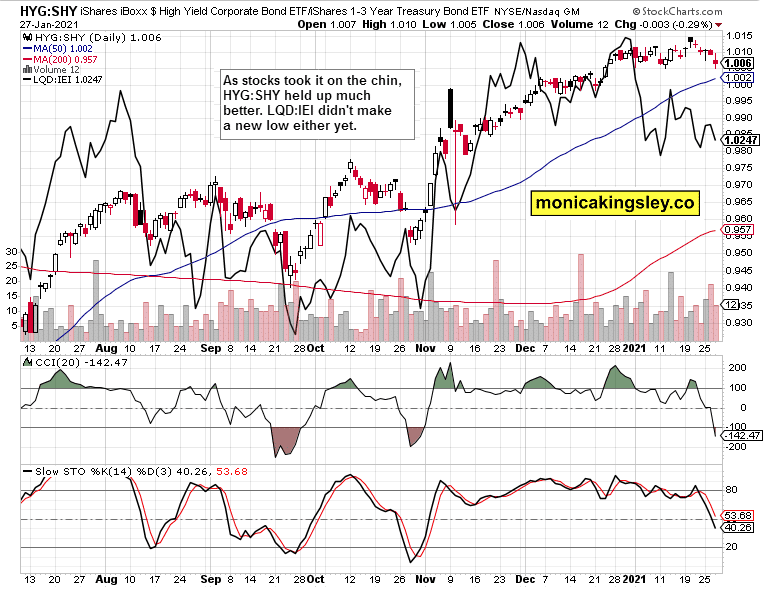

Credit Markets

High yield corporate bonds to short-term Treasuries (HYG: SHY) held up much better than the stocks did. Moreover, investment-grade corporate bonds to longer-dated Treasuries haven‘t broken below their recent lows either. Unless they do, that‘s a good sign for stocks to get their act together. Regardless of the weak price recovery attempts thus far.

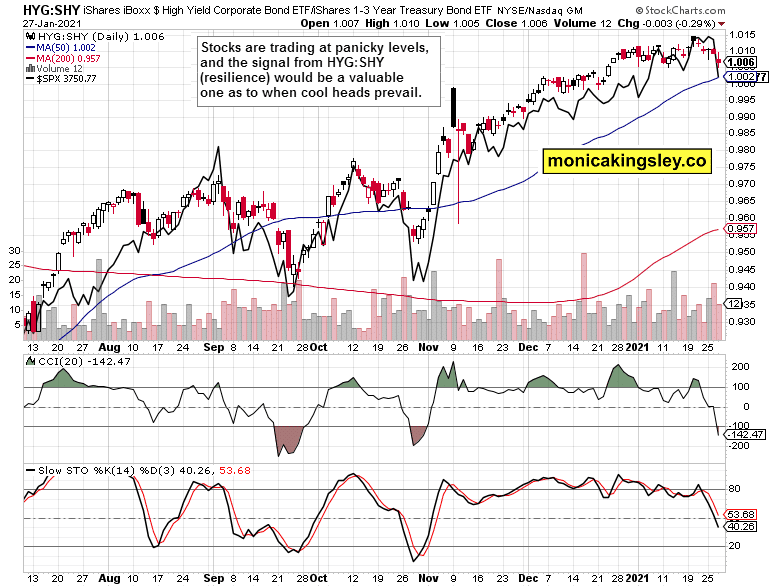

The ratio of high yield corporate bonds against short-term Treasuries (HYG: SHY) with the S&P 500 overlaid (black line) shows how far the very short-term vulnerability in stocks that I highlighted yesterday, had reached.

While I did strike an optimistic tone in the runup to Tuesday‘s regular session open, the bulls missed a good opportunity to act. And the resultant signals favored the bears to step in on Wednesday, which they did. Changing the tone is the essence of my trading style – assessing momentary outlook and concluding accordingly.

What about following through selling and the reflexive rebound – which of the two would win the day?

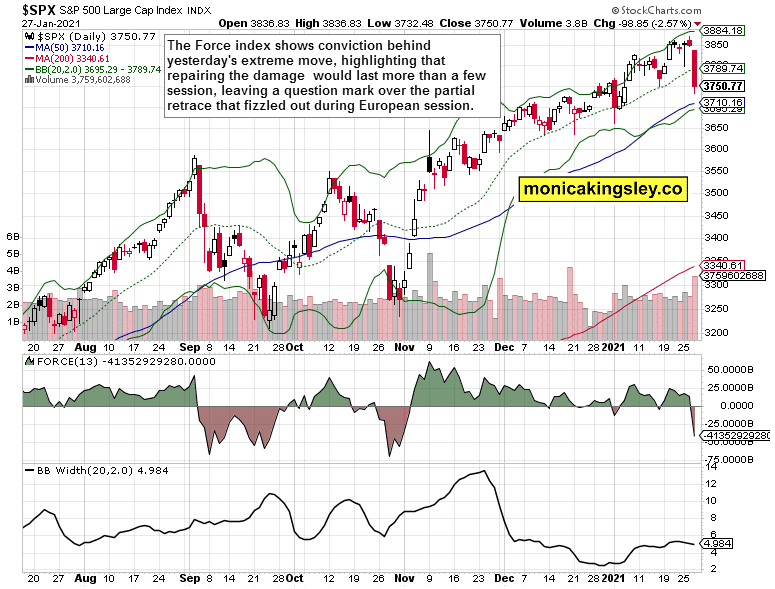

More S&P 500 Clues

The Force index in the S&P 500 plunged deeply into negative territory. Short-term damage has been done while Bollinger Bands (a measure of volatility) barely budged, and both moving averages‘ slopes remain intact. As I have called publicly and verifiably outside of my website at the onset of today‘s Asian session that we‘re likely to witness partial recovery in today‘s regular session, it appears well underway.

And little wonder, if you look at volatility ($VIX) to get a feel for how extraordinary yesterday‘s move was.

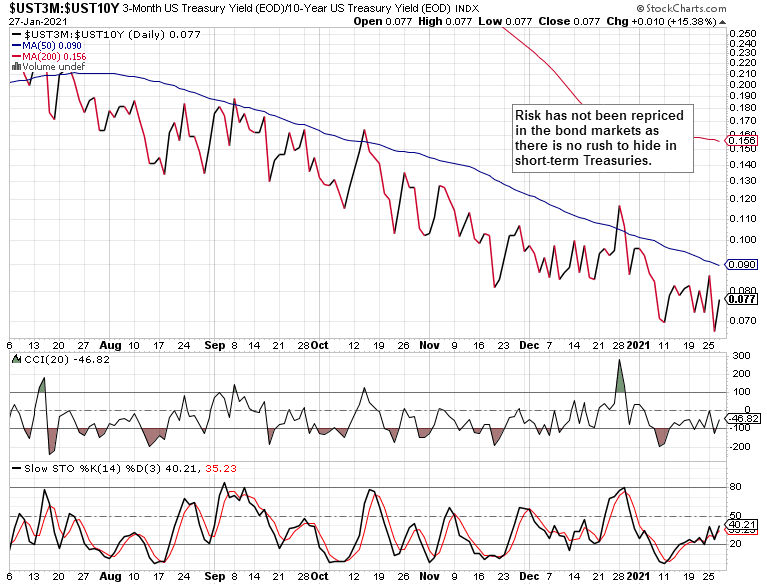

The spread between 3-month and 10-year Treasuries shows that the game hasn‘t really changed. That has also made me vocal about not getting scared out by yesterday‘s slide in stocks.

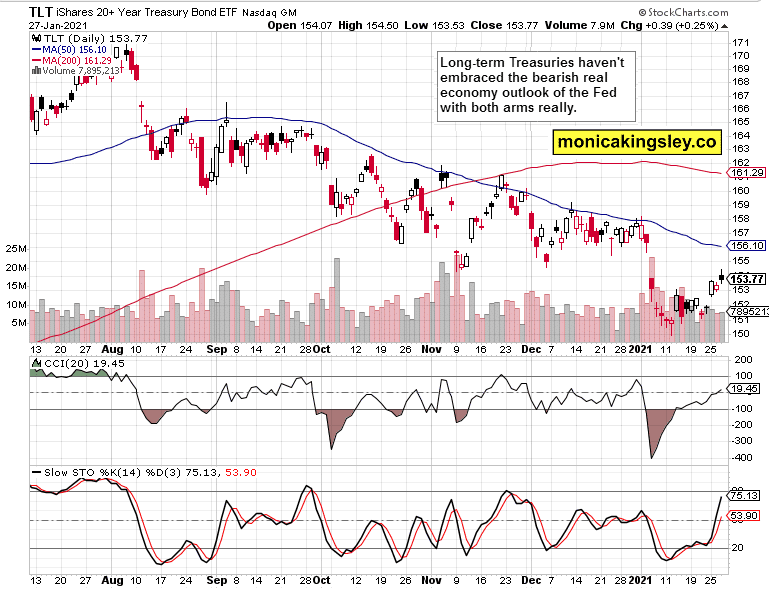

Where is the rally in Treasuries (TLT ETF)? The intraday performance would have been expected to be much better thanks to the gloomy Fed views. Yet it wasn‘t. While Treasuries may pause at these levels or even rise next, they don‘t look to me to exert momentary pressure on stocks in any way.

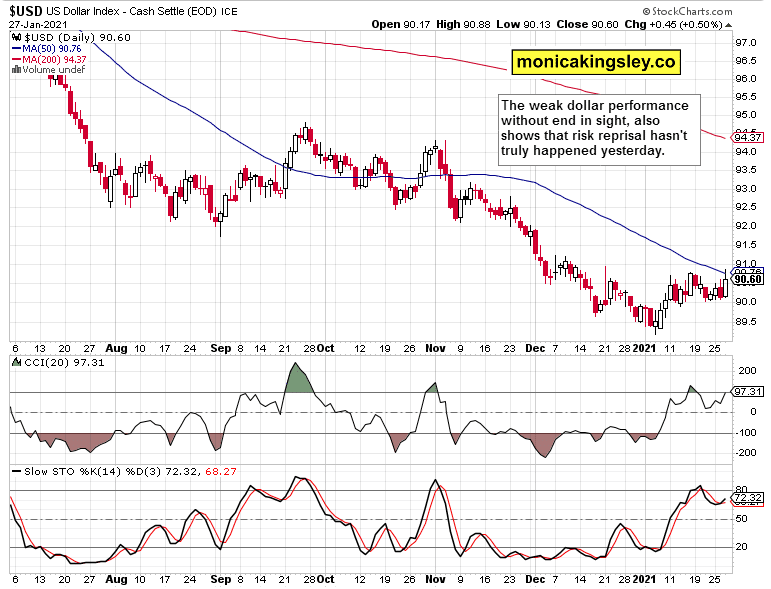

Long upper knot, selling into temporary strength, that‘s all there was to a dollar rally? That‘s another clue that stocks have overreacted.

Summary

The anticipated downswing brought a bloodbath across the board, and it indeed enticed the buyers to act – just as the odds favored. Gold held relatively well, and none of the other indicators were in place to declare the move to be the start of a real correction. My open long position is in black! Again, see today‘s action for proof that the bull market wasn‘t endangered in the least…

Trading position (short-term; futures; my take): the already initiated long positions (100% position size) with stop-loss at 3525 and initial upside target at 3900 are justified from the risk-reward perspective. Below, you‘ll find my time-tested approach to money management per trade.

If you’re using e-mini S&P 500 futures, 1-point move in the S&P 500 amounts to $50. Multiply that with the difference between the entry and stop-loss, and better don’t risk more than 6% or maximum 8% of your trading account on this trade alone.

Thank you for reading today‘s free analysis, which is available in full at my home site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and the upcoming Gold Trading Signals.

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley based on availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor.

Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument