Interest Rate Report and Impact on AUD/USD

The Australian central bank took the first step towards easing its massive stimulus on Tuesday, as employment proved to be far stronger than previously expected. However, real rate increases are still a distant prospect. The Australian Reserve Bank left the interest rate at a record low of 0.1% in the expected move. It reiterated the need for that setting to remain unchanged until 2024 to boost pressure on wages and inflation.

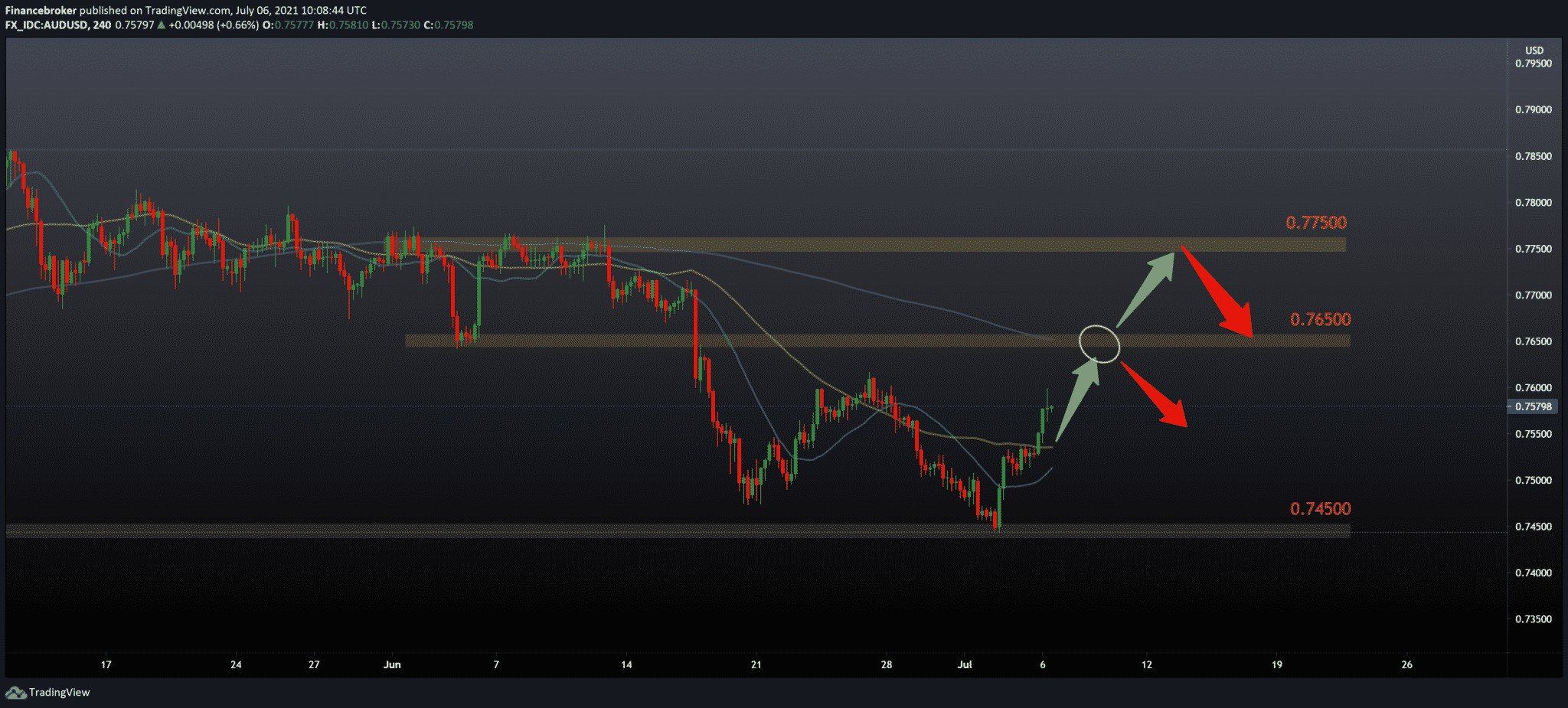

It also retained the April 2024 bond for its three-year yield target of 0.1%, as expected. Also, it announced the third round of its quantitative easing program, but to a lesser extent than the previous rounds. All in all, small adjustments to the RBA’s quantitative easing program and its comments have forced markets to see the decision as bullish, with the Australian dollar jumping nearly 1% to $ 0.75980. Market prices suggest the risk of a rate increase at the end of 2022.

However, Governor Philip Love pushed market prices, saying that the board “does not think” about hiking even in 2023. This is mainly because it expects inflationary pressures to remain subdued. Love hailed Australia’s sharper and faster economic recovery from the recession caused by the pandemic but said wage growth remained moderate and that growth was likely to be only gradual.

The RBA

Today’s decisions are made against the background of the economy, which returned earlier in the overtime period and is stronger than expected, he said at a press conference. Our central scenario remains that the condition for increasing the cash rate will not be met by 2024. Earlier, the RBA said 2024 at the earliest, which led some economists to adjust the adjustment positively.

Westpac economist Bill Evans said that the decision of the RBA not to extend its three-year goal to November 2024 and reduce the bond purchase program are two clear signs that the policy is tightening. This is a more positive statement than we expected, highlighted by the decision to reduce it in September, Evans said.

The RBA said it would slow purchases of Australian government bonds from September to $ 4 billion from the current $ 5 billion. Analysts in a Reuters poll expected a flexible setup. “However, this policy change is in line with our view that the first-rate increase will come in March 2023 – much earlier than the current” central scenario (RBA), “Evans added.

Conclusion

In contrast, others read the statement as negative, bearish. “They see a stronger recovery … but not enough to suggest a slowdown in interest rates,” said AMP chief economist Shane Oliver. The RBA cut interest rates three times last year to current record lows. Moreover, it launched a massive bond-buying program to cut borrowing costs and boost spending.

Monetary stimulus and government fiscal support boosted the Australian economy by $ 2 trillion. That means it is now higher than pre-pandemic levels. The job market is shrinking rapidly, the real estate market is heating up, and consumer spending is rising.

The RBA acknowledged the rapid economic recovery. But stressed the recent outbreaks of the virus as a significant uncertainty in Sydney, Australia’s largest city, which is currently under a strict blockade of the coronavirus.

-

Support

-

Platform

-

Spread

-

Trading Instrument