Inflation Trades – Rebounding or Sinking

Again, today’s report will be shorter than usual and focus on select charts to drive position details of all five publications.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

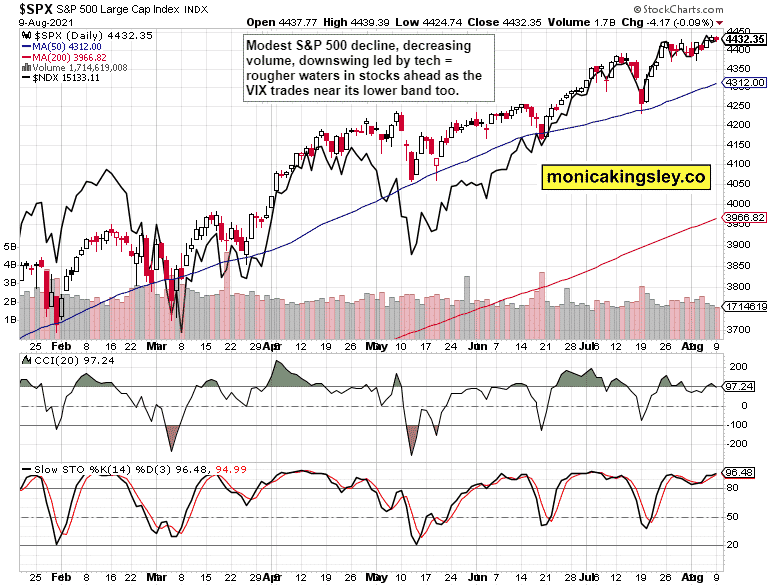

S&P 500 and Nasdaq Outlook

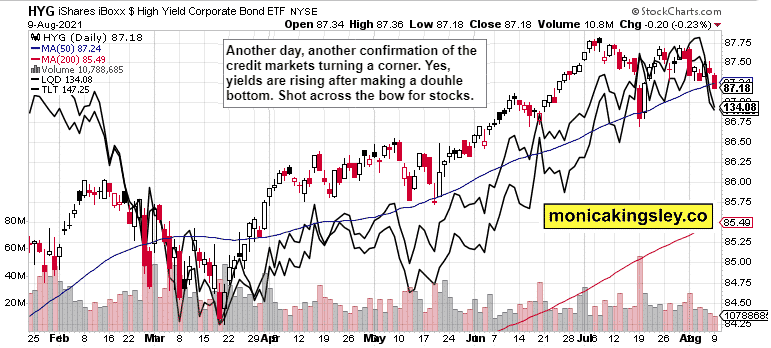

Credit Markets

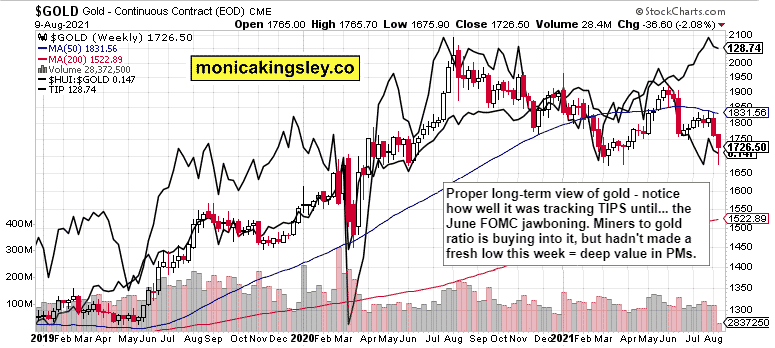

Gold, Silver and Miners

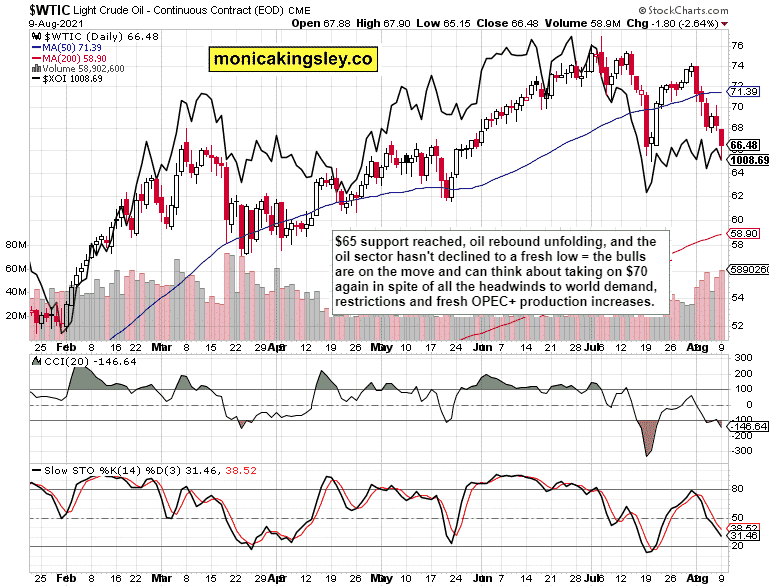

Crude Oil

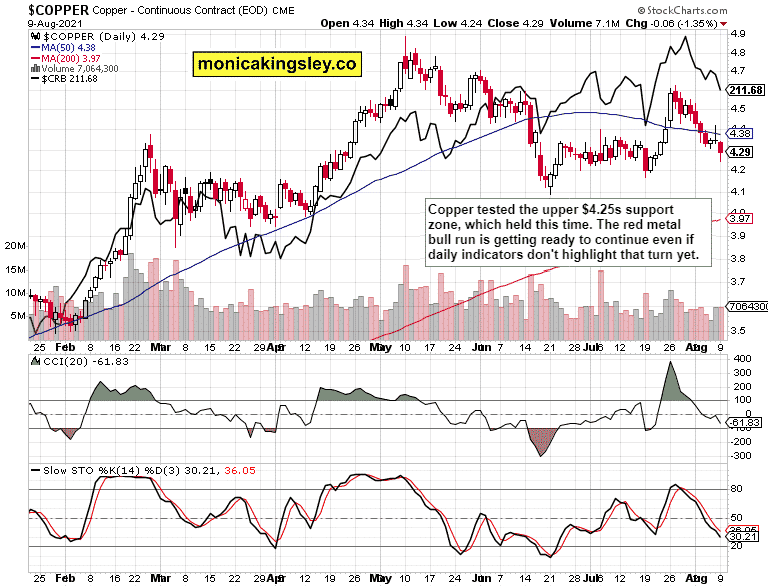

Copper

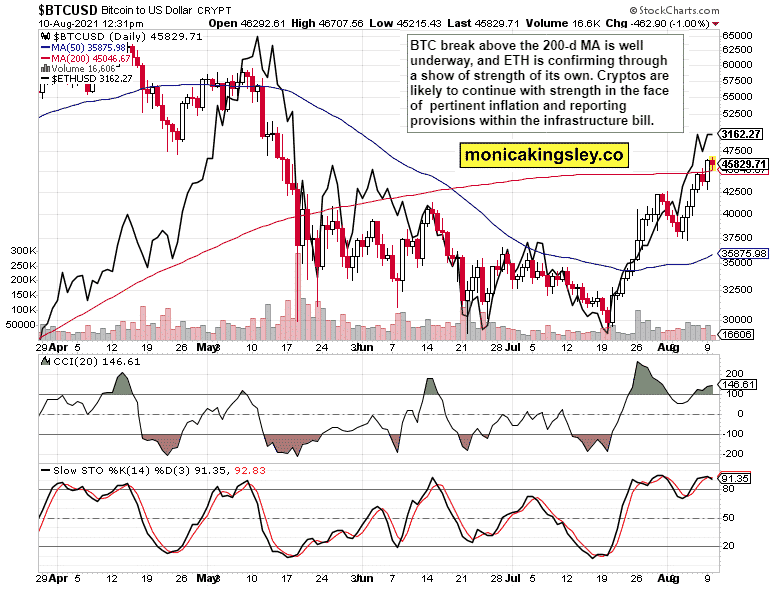

Bitcoin and Ethereum

Summary

In place of summary today, please see the above chart descriptions for my take.

Thank you for reading today‘s free analysis, which is available in full at my home site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www. monicakingsley.co

[email protected]

* * * * *

All essays, research and information, represent analyses and opinions of Monica Kingsley that are based on availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor.

Please know that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you also agree that she is not responsible for any decisions you make. Investing, trading and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings. She may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument