How to Count Pips on Tradingview – Get The Information

Have you ever wondered how to count pips on the tradingview exactly? What are the necessary steps one motivated and ambitious Forex trader needs to take to achieve so successfully?

Whether you’re an experienced trader on the dynamic and volatile Forex market or you’ve just been trying to move from the status quo and master new techniques, understanding how to count pips on tradingview is useful for many reasons.

But before we tell you all the “little secrets of the great masters’ ‘ about all that, let’s first see what pips are, shall we?

What are pips in the Forex industry?

Pips in the Foreign exchange industry refer to a specific price move in a certain exchange rate. Forex traders most frequently use it to count the right amount of change regarding profits and losses.

Once a trader gets to know the value’s change assists traders in the market to either get in or manage orders to be in full control over their Forex trading strategy.

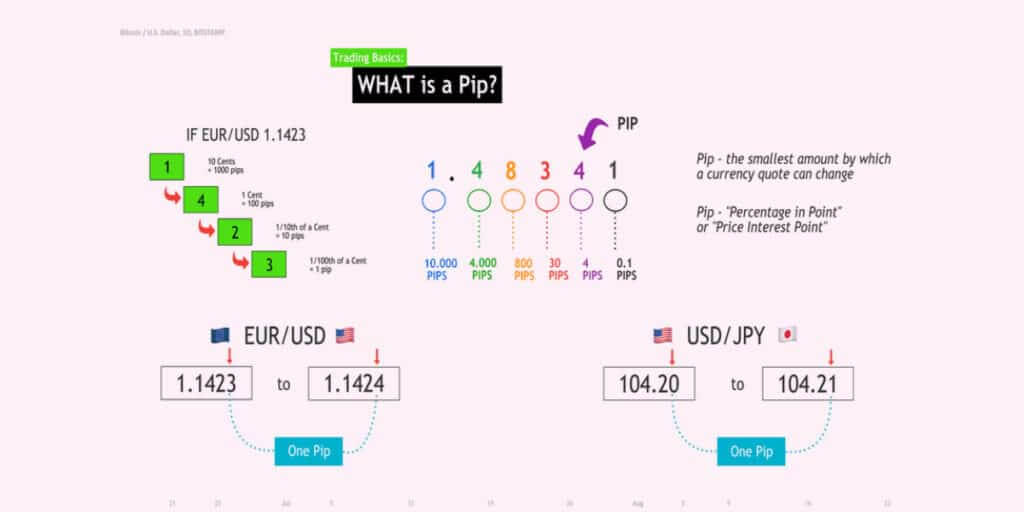

Since a Pip is responsible for measuring the amount of change for a certain Forex pair, it is crucial to comprehend that traders can calculate the Pip utilizing the last decimal point.

The decimal point in Pips

We must consider that numerous major Forex pairs are priced to four decimal places. Thus, the slightest change in it will be of the last decimal point that equals 1/100 of 1%, or one bottom line.

For instance, one Forex trader can state that he has managed to make thirty pips in the trade, which means that thirty pips profit him.

What is the real amount of cash will always be reliable to the value of the Pip.

How to decide Pip’s value?

Before learning how to count pips on the tradingview, it is essential to learn the proper way of deciding a Pip’s value.

To determine the value of the Pip most effectively requires Forex traders to understand that the economic value of every Pip heavily relies on the following factors:

- Trade’s size

- Particular currency pair that’s traded

- Exact trade size

- Exchange rate

Considering all of those from above, it is crucial to keep in mind that even one Pip is able to have a crucial role and influence on the open position’s value.

How to calculate pip value?

In order to calculate the exact amount of Pip’s value before getting to know how to count pips on tradingview, it’s necessary to follow these steps:

- Divide one Pip that’s often 0.0001 by the present market value of the selected Foreign exchange pair.

- Multiply that result by the lot size that refers to the base units’ number you’re trading.

- Once you get the USD as your quote currency, the pip value remains the same. For instance, if the size of a lot equals 100,000, the Pip will be 10 USD.

In many cases, you won’t be required to determine the Pip value yourself since your chosen provider or Foreign exchange provider will do it instead of you. However, it’s crucial for traders who want to use this process and apprises without it.

What is a tradingview in Forex?

A tradingview in Forex represents a specific social network for investors and traders on Foreign exchange markets, Stocks, and Futures markets. If you visit the TradingView platform/website, you’ll acquire only informative information. Keep in mind that it’s not supposed to be the place for research, advice, or recommendations of any kind.

Also, experts say this platform isn’t a place to record their trading prices. So, once you’re familiar with the basics of determining the value of the Pip, it’s time to learn exactly how to count pips on tradingview. Let’s get to know all there is about it, shall we?

Step-by-step guide on how to count pips on tradingview

In order to calculate pips on tradingview, it’s important first to open tradingview and utilize the tool “measure.” Once you manage to drop and drag that tool, it is essential to determine pips differences. To do so, the next step will be marking 2 price levels.

How to count pips on tradingview with the highest and lowest price levels?

If you’re motivated to learn how to count pips on tradingview utilizing the highest and lowest price levels via U.S. session on the EURUSD chart. Suppose the situation is the following one:

- The highest high price level equals 1.0859

- The lowest low price level equals 1.0802.

In this situation, the measure tool will show exactly 57 pips, representing a certain difference between 1.0802 and 1.0859. As with any other online platform for Forex trading, for calculating pips of numerous assets, here is what it’s essential to know:

If you’re interested in calculating the pip difference regarding a Foreign exchange pair, it’s crucial to calculate the decimal places in which the last one is called the “pip difference.” Here is another example:

- Of 1.012 EURUSD’s currency pair exchange rate includes 4 decimal places where every Pip equals 0.0001.

- One pip difference is, in this case, from 1.1012 and 1.1013.

Nonetheless, there are certain currency pairs, such as USDJPY, whose pip value equals 0.01. One pip difference can also be in the range of 108.20 to 108.21.

Profitability and pips – what is essential to know

Suppose you’re into risk management, technical analysis, position sizing, etc… In that case, knowing that the exchange rate movement of one particular Forex currency pair decides if a trader ultimately makes a profit or loss.

Suppose one Forex trader decides to purchase the EUR/USD and profits if the EURO rises in value in proportion to the U.S. dollar. The trader purchased the euro at a rate of 1.1835 and sold it at 1.1901, and the trade would yield 66 pips (1.1901 – 1.1835).

Let’s contemplate a trader who acquires the Japanese Yen by vending the USD/JPY pair at 112.06. If the trader terminates the position at 112.09, they will lose 3 pips. However, they would generate a profit of 5 pips if they closed the trade at 112.01.

Though the disparity seems trivial, the profits and losses can rapidly accumulate in the multi-trillion dollar foreign exchange market. For instance, on a $10 million position that concludes at 112.01, the trader would receive ¥500,000, which equals $4,463.89 in U.S. dollars (¥500,000/112.01).

The main purpose of Pips utilization

For any motivated Forex trader who’s familiar with the terms such as, Pipette, decimal places, spread, bid price, ask price, and the significance of Long position, short position, profit, and loss (P&L), it’s crucial to understand the main purpose of using Pips long term.

Besides knowing how to count pips on tradingview, it is also important to know that Pips is an integral part of the exchange rate market quote of one particular currency pair.

Pips denote the alteration in the quotation and the worth of a position in the market that one might have entered. For instance, let’s assume that you purchased a currency pair for 1.1356 and then disposed of it at 1.1360, resulting in a gain of 4 pips on your transaction.

Afterward, you will need to determine the worth of each Pip and multiply it by your lot size to estimate the monetary gain.

Does the Japanese Yen Forex Rate Utilize Pips?

Pips are used by the Japanese Yen Forex rate very frequently. Nonetheless, the Yen is a special case. The yen quote usually has two decimal places beyond the decimal point, implying that a pip of one unit is equal to 0.01, unlike other currency pairs, where it is 0.0001.

How to count pips in MetaTrader 4?

There is also a possibility for counting pips in MT4 that numerous ambitious Forex traders are eager to learn and learn more about. In order to measure in the MT4 platform, it is essential to utilize the tool called “Crosshair” from that platform.

Press that button which you can din in the chart’s left upper corner. Once you do so, you’re able to measure the right distance between two different prices on the MetaTrader 4 chart. To successfully calculate pips on an MT4 desktop or MT4 app, it’s essential to remember that one Pip for huge pairs equals 0.0001.

Also, regarding YEN pairs, one Pip is 0.01. Regarding different MT3 assets, it’s crucial to go to MT4 to observe value increment throughout live trading.

Adding a pip counter on MetaTrader 4

In case you’re expecting a pip counter indicator, you may count your pips in MetaTrader 4 for almost every open position. Thus, you’re able to add a free indicator to your chart. Once you’ve downloaded it, it’s essential to add the so-called “pip_counter.ex4” in the folder “indicator.” The next step would be to drag and drop on your chart.

Bottom Line

The Pip refers to the minimum price alteration the market can undergo, and its size varies across several markets. For a successful counting of Pips in the Tradingview, it’s crucial to find a tool “measure.” Once you drag and drop that tool, you’re able to mark 2 price levels and then measure pips differences.

FAQ

What are pips in the Forex industry?

Pips in the Foreign exchange industry refer to a specific price move in a certain exchange rate. Forex traders most frequently use it to count the right amount of change regarding profits and losses.

Once a trader gets to know the value’s change assists traders in the market to either get in or manage orders to be in full control over their Forex trading strategy.

Since a Pip is responsible for measuring the amount of change for a certain Forex pair, it is crucial to comprehend that traders can calculate the Pip utilizing the last decimal point.

How to calculate pip value?

To calculate the exact amount of Pip’s value before getting to know how to count pips on tradingview, it’s necessary to follow these steps:

- Divide one Pip that’s often 0.0001 by the present market value of the selected Foreign exchange pair.

- Multiply that result by the lot size that refers to the base units’ number you’re trading.

- Once you get the USD as your quote currency, the pip value remains the same. For instance, if the size of a lot equals 100,000, the Pip will be 10 USD.

How to count pips on tradingview?

In order to calculate pips on tradingview, it’s important first to open tradingview and utilize the tool “measure.” Once you manage to drop and drag that tool, it is essential to determine pips differences. To do so, the next step will be marking 2 price levels.

How to count pips on tradingview with the highest and lowest price levels?

Suppose you’re motivated to learn how to count pips on tradingview utilizing the highest and lowest price levels via the U.S. session on the EURUSD chart. Suppose the situation is the following one:

- The highest high price level equals 1.0859

- The lowest low price level equals 1.0802.

In this situation, the measure tool will show exactly 57 pips, representing a certain difference between 1.0802 and 1.0859. As with any other online platform for Forex trading, for calculating pips of numerous assets, here is what it’s essential to know:

If you’re interested in calculating the pip difference regarding a Foreign exchange pair, it’s crucial to calculate the decimal places in which the last one is called the “pip difference.”