How does El Salvador’s Bitcoin adoption affect cryptos?

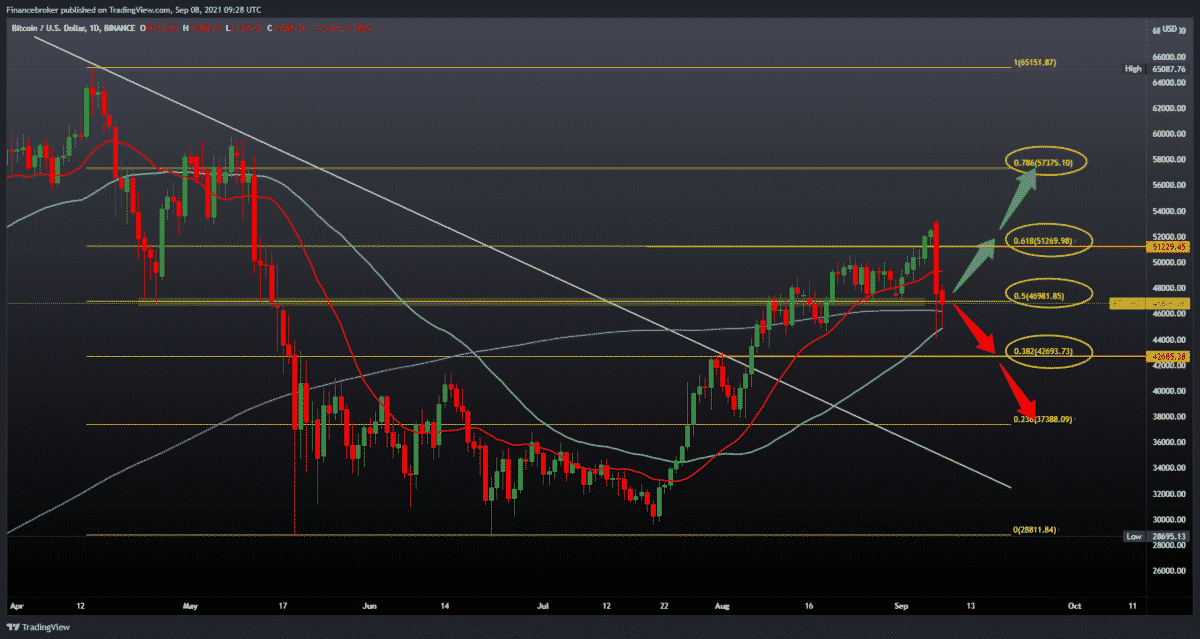

Looking at the chart on the daily time frame, we see that yesterday was disastrous for Bitcoin as the price fell about 13%, from $ 53,450 to $ 44,100. Currently, the price is consolidating around $ 46,770 at a 50.0% Fibonacci level. Looking at the moving average, we see that the price has dropped to the 50-day moving average. Our current support is at the 200-day moving average. The fall in prices showed a connection with the introduction of Bitcoin in El Salvador’s payment transactions. We need further negative consolidation for the bearish scenario. It directed the price again towards the 50-day moving average, and then 38.2% Fibonacci level to $ 42,693.

If we look at the bullish scenario, we see this price drop as the current instability. This acts as a possibility for investors to buy new quantities of Bitcoin. As well as, transfer them to their ownership. To continue, we first need a positive consolidation above 50.0% Fibonacci level. If possible, climb to the previous high to wipe out this decline and continue to the next Fibonacci level.

Ethereum chart analysis

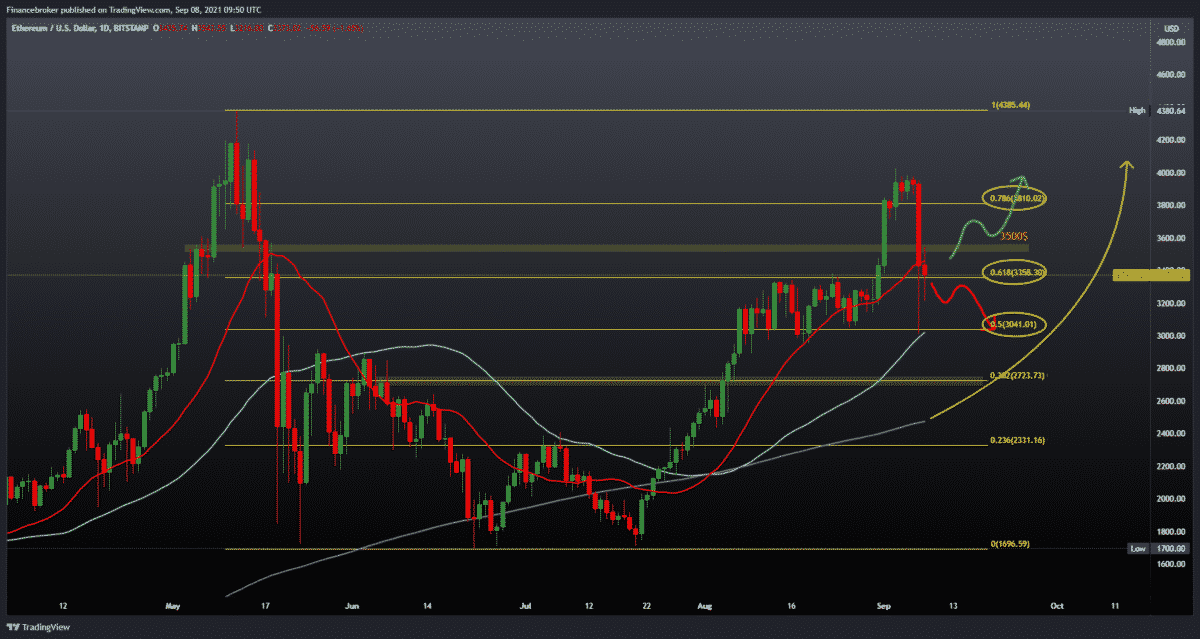

The fall in the price of Ethereum was followed by the fall in the price of Bitcoin. So if we look at the chart on the daily time frame, we see that the price fell from $ 4,000 to $ 3,000 yesterday. Moreover, 25% of its value became lost in one day. After hitting a 50-day moving average and 50.0% Fibonacci level, it pulls back to 61.8% Fibonacci levels at $ 3360.

To continue on the bullish side, we need a new positive consolidation above the 61.8% level. As well as support for the 20-day moving average to expect the price to recover and continue again above $ 4000. We need a continuation of this drop below the 61.8% level and a new test of the 50-day moving average for the bearish scenario. The 200-day moving average is in the $ 2600 zone.

Dogecoin chart analysis

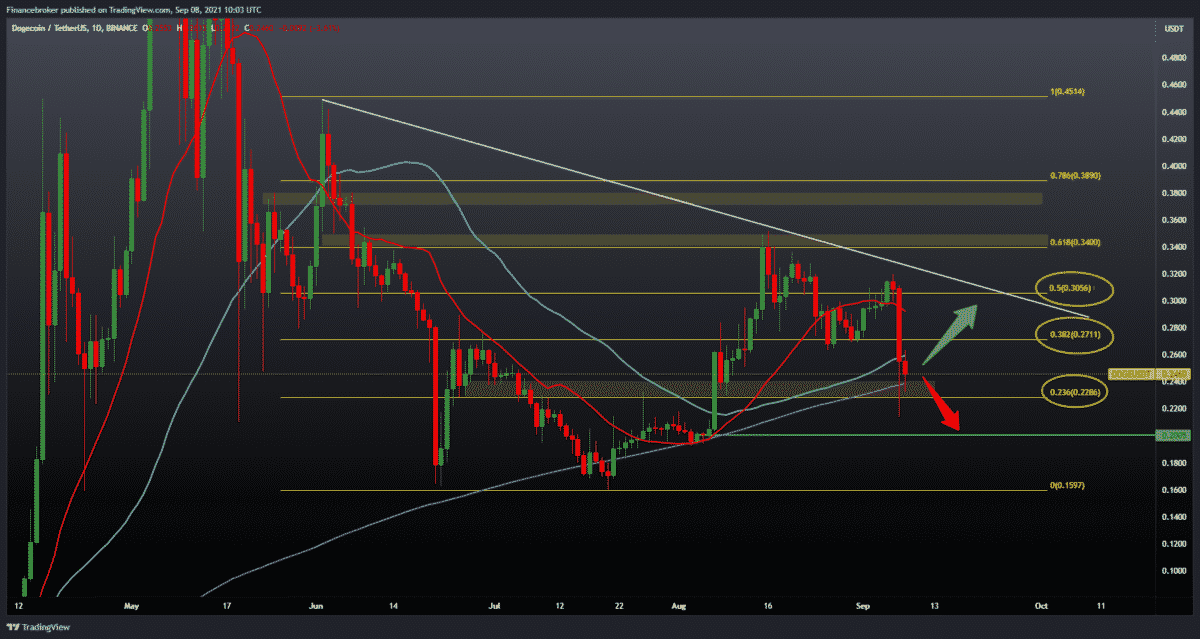

Looking at the chart on the daily time frame, we see that the price had a drastic drop. But it stopped at the 200-day moving average. From 0.32000 to 0.21000 and a retreat above the 200-day moving average. To continue on the bearish side, first of all, it is important that the price rises above 38.2%

Fibonacci level to 0.27100 because our previous resistances were at 61.8% level, and then at 50.0% level. If we look at the continuation on the bearish side, we ask for support at 0.20000 psychological level, and if it subsides, then we go down to the previous low to 0.15970.

Market overview

The chairman of the Nigerian Commission on Economic and Financial Crime (EFCC), Abdulrasheed Bawa, singled out the increase of cryptocurrencies as something that now poses a “far greater threat to the world economy.” Therefore, in order to deal with such dangers or threats, Bawa advocates a “collective and collaborative approach by governments around the world.”

According to Vanguard’s report, the president of the EFCC made these remarks while speaking at a symposium organized by the Center for International Documentation on Organized and Economic Crime (CIDOEC). Meanwhile, at the same meeting organized to discuss the costs of economic crime and who should submit this bill, Bawa explained why countries need to co-operate on the issue.

He said: [Economic crimes] affect the vital structures of global economies, causing significant damage to the global financial system and depriving developing countries of the resources they need for sustainable development.

Bawa also warned that developed countries, just like their less developed counterparts, are not immune to plagues that are exacerbated by “the spread of cybercrime that threatens the stability of global financial institutions.” To return home, Bawa uses the example of how criminals now choose “transactions or receiving illegal money [such as ransom] for cyberattacks in cryptocurrencies.”

Conclusion

On Tuesday, one observer called it “the beginning of a new world” because El Salvador officially became the first country to accept bitcoin as a legal tender.

The eagerly awaited move is a major test of the enduring power of cryptocurrency. It has hinted at what could be expected in other countries, namely Panama. As more and more economies adjust to the suddenly hot global movement of cryptocurrencies.

This is a turning point in the evolution of digital currency. It marks the beginning of a new world. We can expect more nations, especially those with developing economies, to follow El Salvador’s historical leadership, said Nigel Green, founder of deVere Group, a financial consulting firm.

In an interview with Finance Live last week, Wood said the crypto would introduce “a new global monetary system. It is a rules-based monetary policy, which is fully decentralized. Therefore it is not subject to the whims of policymakers.”

She added that the crypto is “protection from the whims of policymakers, especially in emerging markets.”

Despite El Salvador’s move and Wood’s bullish approval, the cryptocurrency could not surpass the reputation of a highly variable asset. The duality’s best summary is what one Salvadoran entrepreneur told the Wall Street Journal: “My mother believes that bitcoin is a devil’s thing, but bitcoin has many advantages.”

Faster than you could say “Chivo,” bitcoin discovered its devilish side. It fell below $ 50,000. It also fell over 17% within days long positions were massively liquidated. El Salvador’s electronic wallet also suffered errors during the first day that temporarily disabled the technology.

-

Support

-

Platform

-

Spread

-

Trading Instrument