Gold Reversal? Have No Fear!

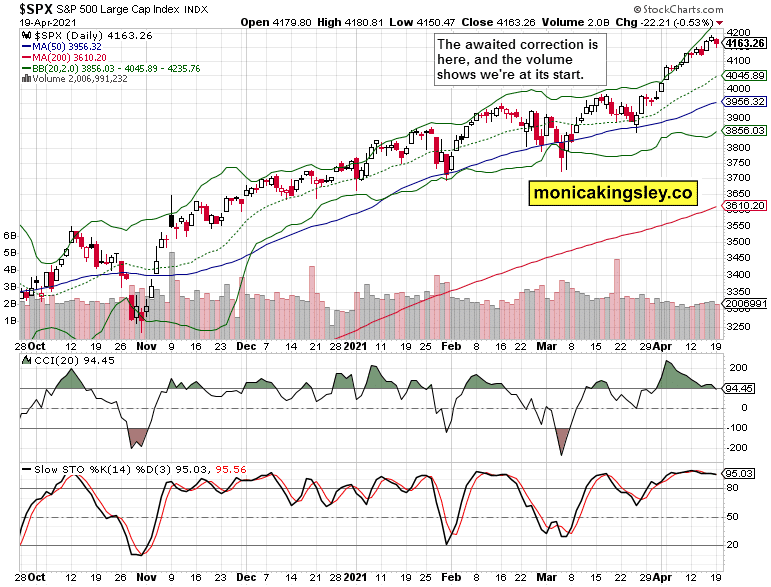

S&P 500 closed in the red, vindicating my bearish sentiment going into Monday‘s session. And as I have tweeted during the day, the selling doesn‘t appear to be over. Friday‘s:

(…) selling wave before the close looks to indicate hesitation ahead. Even though VIX is attacking the 16th level and the put/call ratio ticked higher, the bulls are a little disturbed thus far.

While VIX rose yesterday, it finished only a little above 17 – the tide in stocks hasn‘t turned to fear even temporarily in the least, and the current consolidation would still be one to be bought.

That‘s the result of ample liquidity in the system, which is denting the rotations. Yields moved higher yesterday, and defensive, including tech or Down Jones Industrial Average, rightly felt the pressure more than value stocks.

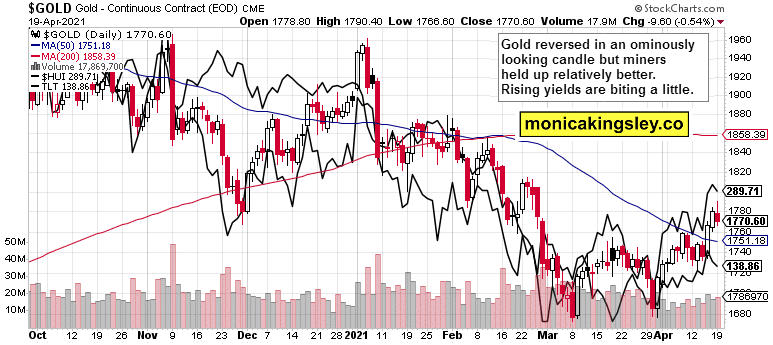

Gold

Gold got caught in the daily selling, but again the miners and commodities reveal how little has changed. Oil and copper keep doing very fine, and the precious metals upleg appears undergoing a daily correction only – one that doesn‘t change the larger trend, which is higher (and for the dollar, by the way, it‘s pointing down – I‘m not placing much weight upon the USD link arguing that gold is acting weak to the weakening dollar, and thus has to fall). I look at the ratios, yields, and other commodities for stronger clues.

And the matter of fact is that inflation expectations have yet again turned higher, confirming my earlier calls about transitioning to a higher inflation environment made either recently or more than a month ago. Remember that the Fed wants inflation above all, and made so amply clear:

(…) Now, it‘s up to gold and silver to catch up on what they missed since the early Aug 2020. Inflation is running hotter, and the Fed is tolerant of it, amply supplying liquidity. The gold bottom is in, and much brighter days ahead.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

Stocks are visibly in a vulnerable position as not enough new buyers have stepped in. The volume print attests to having to go some more on the downside before a local bottom emerges.

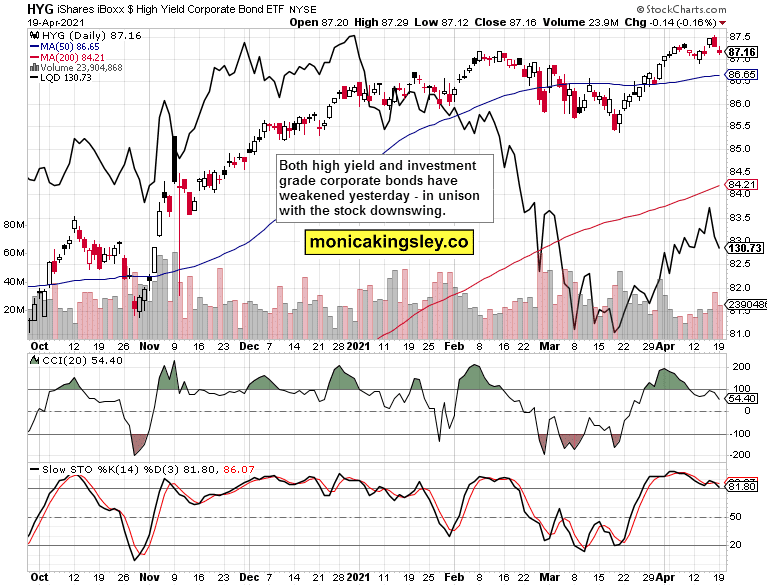

Credit Markets

Both high yield corporate bonds (HYG ETF) and investment grade ones (LQD ETF) weakened, and more so than the TLT did – that‘s what a risk-off environment looks like. Thus far, no change on the horizon – this overdue, little correction can keep going on.

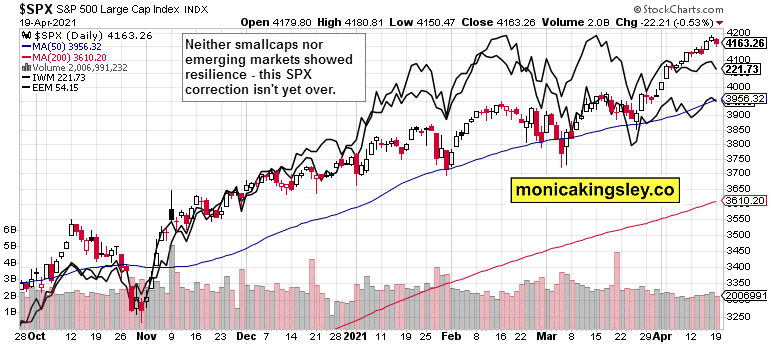

Smallcaps and Emerging Markets

Both small caps and emerging markets are revealing the concerted selling yesterday – unless these turn higher next, the S&P 500 has further to go to the downside still.

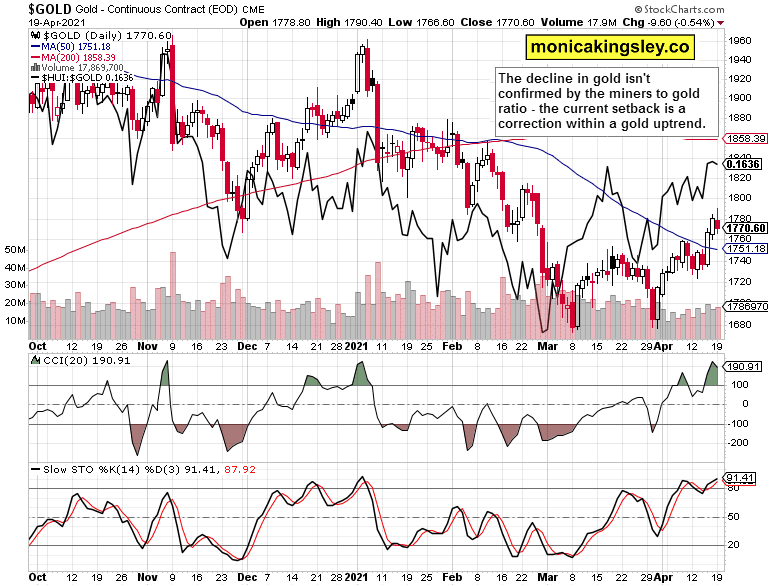

Gold in the Limelight

Gold‘s daily reversal may look ominous but really isn‘t – it‘s merely a temporary setback. The miners have held up relatively well, and I consider the yellow metal‘s selloff as a reaction to the retreat in nominal yields and first red day in the S&P 500 in quite a while. I‘m standing by the call of decoupling from nominal yields getting more pronounced, and by increasingly lower dollar values powering precious metals higher, especially in the second half of this year – the USD/JPY pair offers clearly clues for the king of metals even now.

Look how stubborn the miners to gold ratio is – no, this precious metals upleg isn‘t ending here, no way, it‘s merely getting started, and the panicked bears doubling down this early from the imperfect second bottom is telling you as much about the state of the market as the ongoing silver squeeze driving relentlessly PSLV stockpile higher, bypassing the SLV.

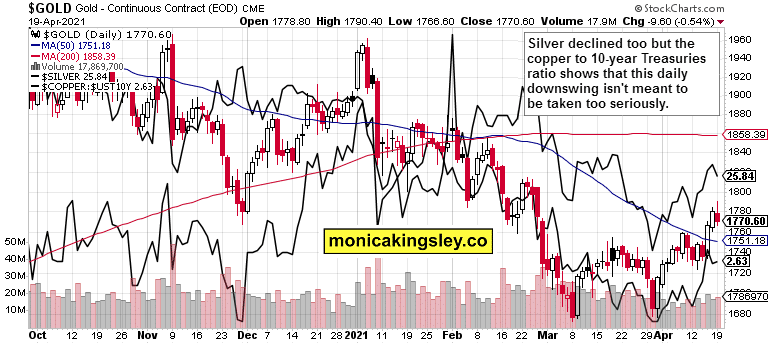

Silver and Copper

Silver retreated in tandem with gold, but again the fierce copper (copper to 10-year Treasury yields ratio) reveals that this isn‘t a move to be trusted. The trend in precious metals remains higher.

Summary

The S&P 500 consolidation is here and is a shallow one, just as anticipated. The risk-off moves were evident across the board yesterday and might very well not be over just yet (when looked at from a larger than daily perspective).

Gold and miners are undergoing a shallow correction as well, but nothing more than that. Before too long, precious metals will shake off the setback, and revert to breaking above another resistance, the $1,800s. Since we broke above the two levels I discussed recently (the $1,760s and closing above $1,775 on solid internals), the lows can be comfortably declared as in across the precious metals board, and I look for miners to keep leading the upleg.

Thank you for reading today‘s free analysis, which is available in full at my personal site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on availability and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes. It should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor.

Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument