18 May chart overview for gold and silver

Gold is falling, meanwhile Silver is stable

- During the Asian session, the price of gold confirmed yesterday’s losses.

- The price of silver is stable today and is around 21.50 dollars.

- The emergence of increased buying of U.S. dollars.

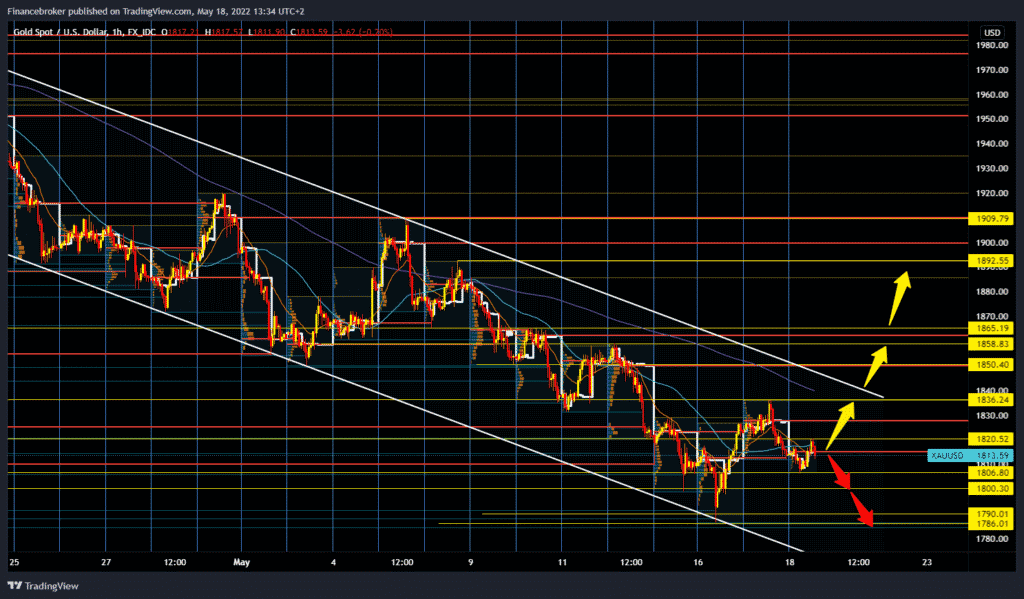

Gold chart analysis

During the Asian session, the price of gold confirmed yesterday’s losses. Better data on retail sales in the United States in April and a better health situation in China influenced the withdrawal of the price of gold. Jerome Powell, the chairman of the US Federal Reserve, yesterday also emphasized the continuation of the decisive fight against inflation. In addition, it was announced this morning that price inflation in the UK in April was slightly lower than expected, which somewhat reduced expectations of the extremely aggressive monetary policy of the Bank of England in the coming period. The price of gold is trading at around 1814.5 dollars per fine ounce, which is a small drop of 0.02% since the beginning of trading tonight. If the price manages to rise above 1840 dollars, only then can we expect a more concrete recovery of the price. And as long as we are in this falling channel, we are in bearish consolidation. We are looking for potential support for the price of gold at the following levels: $ 1,800, $ 1,790, and $ 1,786.

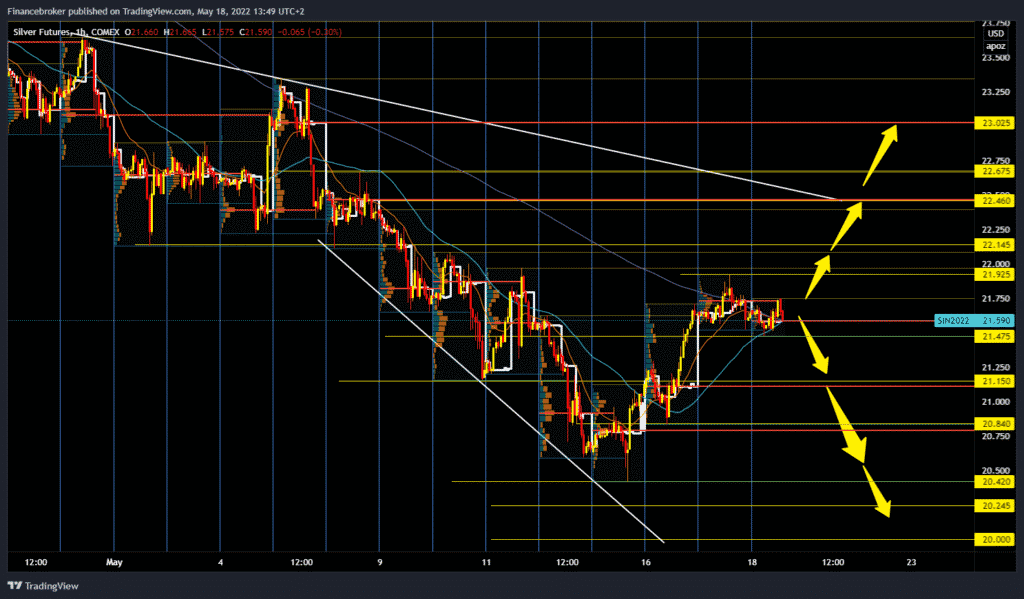

Silver chart analysis

The price of silver is stable today and is around 21.50 dollars. So far, we have not managed to climb to yesterday’s maximum of $ 21.92. Today’s resistance is MA200 moving average, and price support is the MA50 moving average. In the last two hours, the price has been in bearish withdrawal from 21.75 to 21.61 dollars. For the bullish option, we need a break above $ 22.00 to make the price easier to continue on the bullish side. Our potential targets are $ 21.15, $ 22.45, $ 22.67. For the bearish option, we need a price drop below $ 21.47. Potential lower targets are $ 21.25, $ 21.00, $ 20.85.

Market overview

The emergence of increased buying of U.S. dollars – backed by prospects for a more aggressive tightening of policy by the Fed – has proven to be a key factor undermining gold denominated in dollars. Markets seem convinced that the Fed will need to take more drastic measures to bring inflation under control. Bets were boosted by optimistic U.S. retail data and sharp comments from Fed President Jerome Powell on Tuesday. Speaking at an event on the Wall Street Journal, Powell said he would support raising interest rates until prices begin to fall to a healthy level.