Gold Drops and Silver is on The Same Level Again

- The price of gold dropped from $1732 to $1696 yesterday.

- During the Asian trading session, the price of silver remained above the $19.25 level.

- Above-expected US inflation pushed bets on a 0.75% Fed rate hike to 95%.

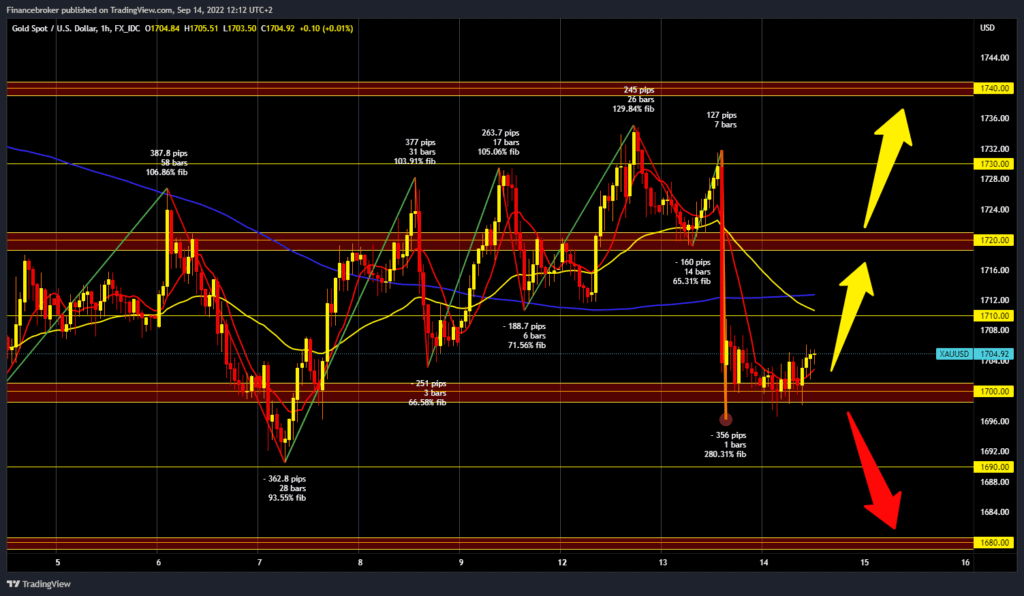

Gold chart analysis

The price of gold dropped from $1732 to $1696 yesterday. The US inflation report strengthened the dollar index, which affected the price of gold. During the Asian trading session, the price of gold managed to maintain the $1700 level, and now we see a slight recovery to the $1705 level. To continue the bullish option, we need a positive consolidation. The first target is the $1710-$1712 resistance zone; additional resistance in that zone is in the MA50 and MA200 moving averages. A break above the gold price could take us up to the $1720 level. Potential higher targets are $1730 and $1735 levels. We need a negative consolidation and a break below the $1700 support level for a bearish option. In the continuation, we need to stay below and then the price could continue to descend towards the following support levels. A potential lower target is the $1690 level.

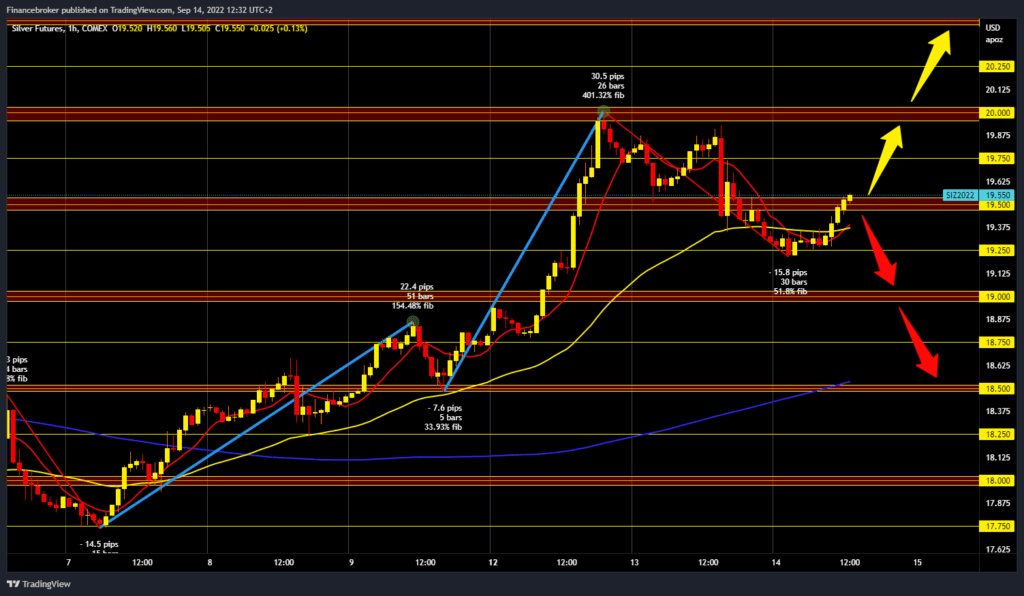

Silver chart analysis

During the Asian trading session, the price of silver remained above the $19.25 level. Then followed a bullish impulse, and the price of silver rose to the $19.50 level. We have support in the MA20 and MA50 moving averages, and based on them, we could expect a further continuation of the recovery. We need a break above the $19.50 level to continue the bullish trend further. Potential higher targets are $19.75 and $20.00 levels. We need a new negative consolidation and price pullback to this morning’s low at the $19.25 support level for a bearish option. A silver price break below would form a new two-day lower low at $19.00. If the price fails to hold at that support level, the potential lower targets are $18.75 and $18.50.

Market Overview

Above-expected US inflation pushed bets on a 0.75% Fed rate hike to 95%. Talks about a rise of 1.00% have been put back on the table. Further, the data postponed speculation about a Fed rate cut next year. Such a view can worsen the situation for dollar-denominated commodities.