Gold and Silver: What to Expect?

- During the Asian session, the price of gold dropped to $1720.

- During the Asian trading session, the price of silver finds support at the $19.50 level.

- The US Bureau of Labor Statistics reported on Tuesday that CPI inflation fell to 8.3% on an annualized basis in August from 8.5% in the previous month.

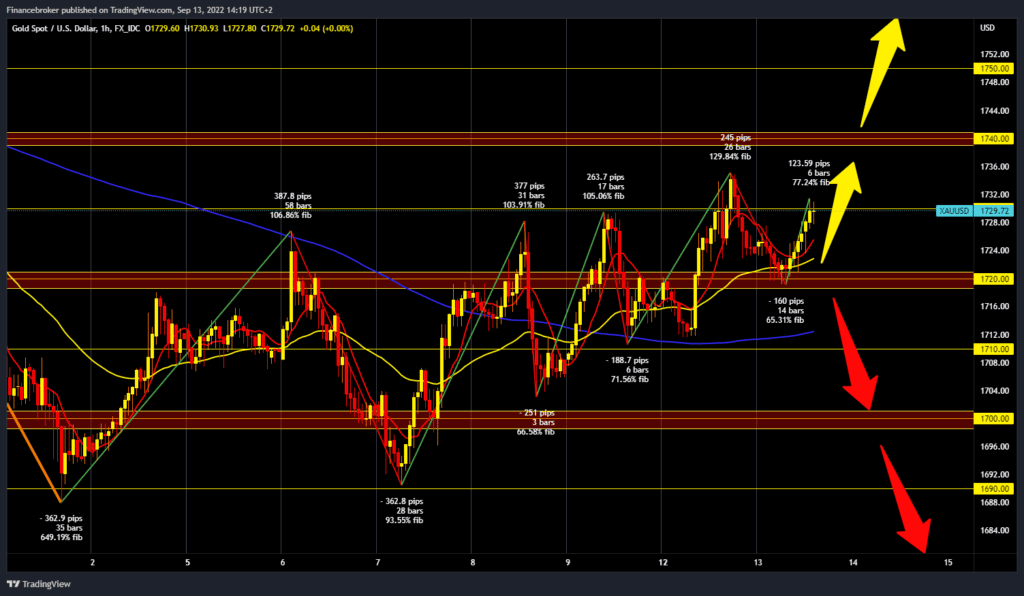

Gold chart analysis

During the Asian session, the price of gold dropped to $1720, where it found support in the MA20 and MA50 moving averages and started a new bullish impulse. We are already at $1730, and we could test yesterday’s high at the $1735 level. If we managed to stay at that level, the price of gold would probably continue up to $1740. We need a negative consolidation and a new price pullback to the $1720 level for a bearish option. A drop below could continue to pressure the price and pull it further down to the $1710 level. Additional support at that point is in the MA200 moving average. Potential lower targets are the $1700 and $1690 September lows.

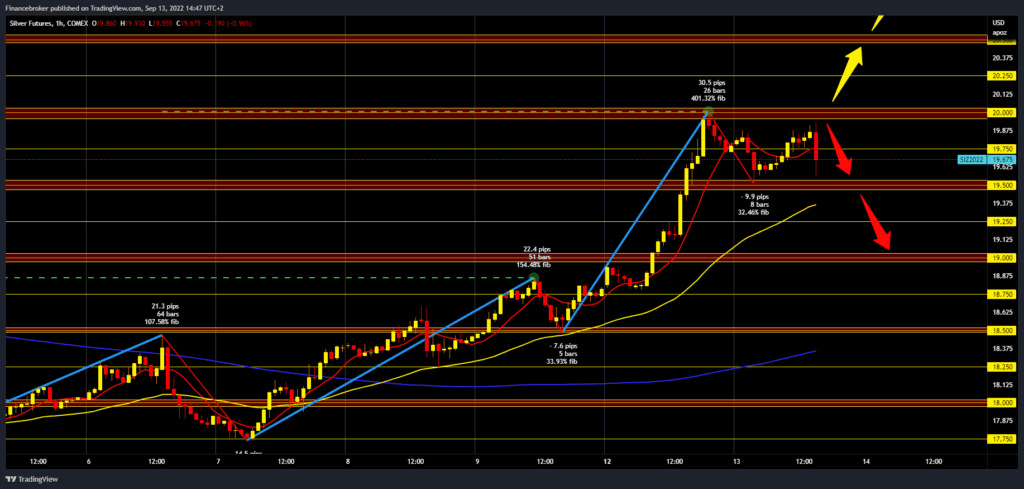

Silver chart analysis

During the Asian trading session, the price of silver finds support at the $19.50 level and continues at the $19.75 level. In the European session, we see a break above and continue towards the $20.00 level. Yesterday we managed to climb up to $20.00, but we didn’t manage to stay there, and now we have a new chance. To continue the bullish option, we need a break above and to maintain at that level. Potential higher targets are $20.25 and $20.50 levels. We need negative consolidation and a pullback to the $19.50 level for a bearish option. Additional support in that zone is in the MA50 moving average. Potential lower targets are $19.25 and $19.00 levels.

Market Overview

The US Bureau of Labor Statistics reported on Tuesday that CPI inflation fell to 8.3% on an annualized basis in August from 8.5% in the previous month. The reading was above forecasts, pointing to a decline to 8.1%, meaning inflation did not fall enough for the Fed to back off from aggressive interest rate hikes.