Gold and Silver: Two-year low

- The price of gold fell by $50.00 yesterday, from $1810 to the $1760 level.

- Early this morning, the price of silver fell to its two-year low at $18.70, and the last time we reached that level was in July 2020.

- After a recent strong bullish run to a new two-decade high touched on Tuesday at 107.15.

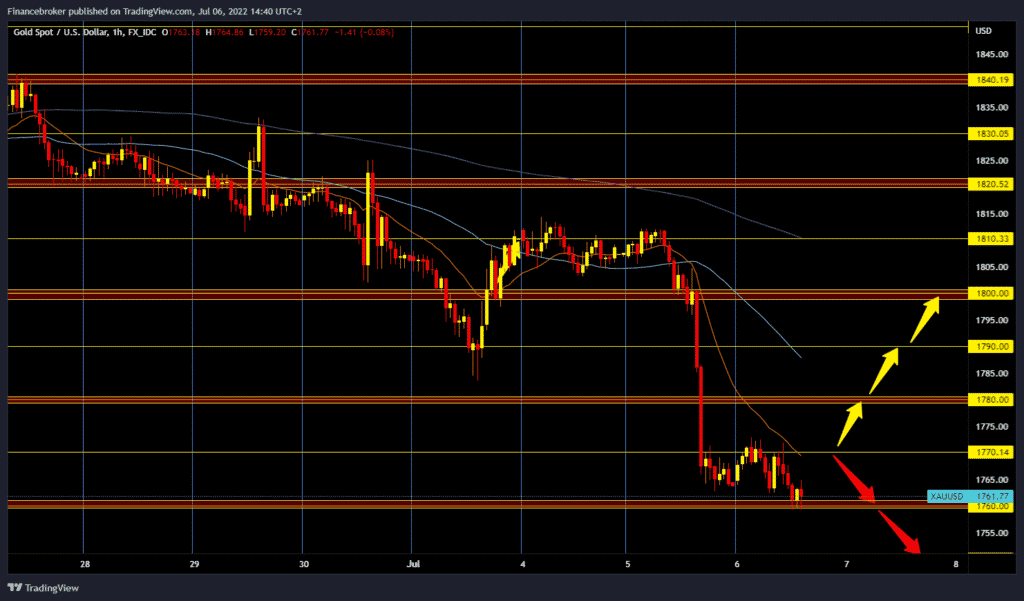

Gold chart analysis

The price of gold fell by $50.00 yesterday, from $1810 to the $1760 level. During the Asian trading session, we saw a recovery to the $1770 level. But we did not stay there for long, and the price went down again to the previous low of $1760. We need a continuation of negative consolidation and a breakout below for a bearish option. Potential lower support targets are $1750 and $1740 levels. For a bullish option, we need a new positive consolidation and a jump to the $1780 resistance zone. After that, we must stay at that level so that gold forms a new higher low from which we can continue the bullish recovery. Potential higher targets are the $1790 and $1800 levels.

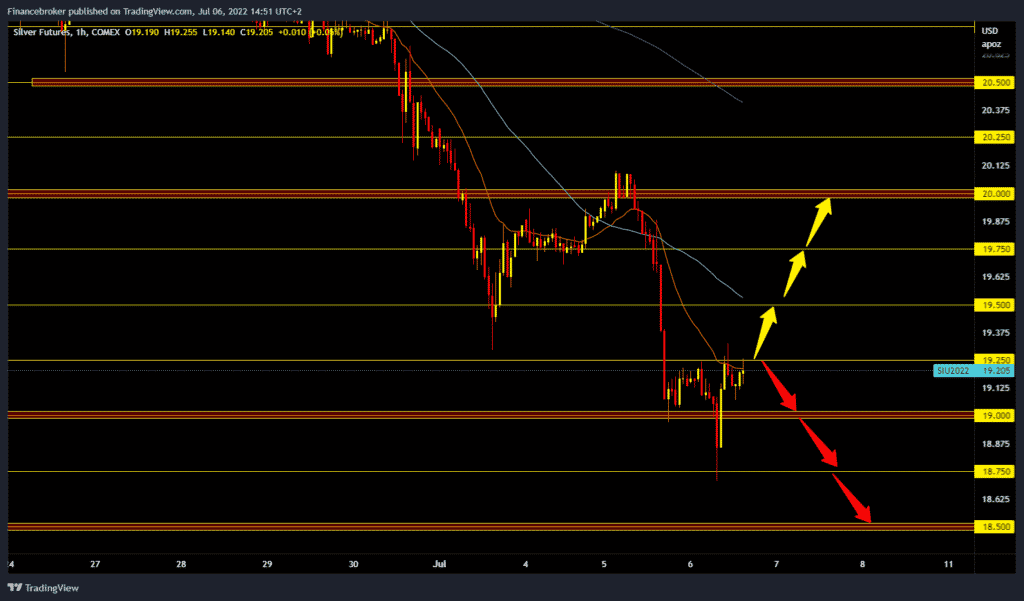

Silver chart analysis

Early this morning, the price of silver fell to its two-year low at $18.70, and the last time we reached that level was in July 2020. A retracement above $19.00 soon followed. The price of silver is now hovering around the $19.25 level, and it is possible that we will see a continuation of the recovery and a move as far as possible from the previous low. Potential higher targets are $19.50, $19.75 and $20.00 levels. For a bearish option, we need a new price drop below the $19.00 level. After that, we retest the $18.70 previous support. If it does not last, we can expect a continuation of the bearish trend. Potential lower targets are $18.50, $18.25 and $18.00.

Market overview

After a recent strong bullish run to a new two-decade high touched on Tuesday at 107.15, the US dollar witnessed modest profit-taking amid some repositioning trade ahead of the FOMC meeting minutes. This is a crucial factor that offered some support to gold at the current level.

Fed President Jerome Powell reiterated last week that the US central bank is focused on bringing inflation under control and added that the US economy is in a good position to lead a tighter policy. Investors may also refrain from aggressive betting and prefer to wait for news on the Fed’s policy tightening path.