Gold and Silver: The Price Is Under Great Pressure

- This morning the price of gold fell to the $1660 level.

- During the Asian trading session, the price of silver fell to the $19.25 level.

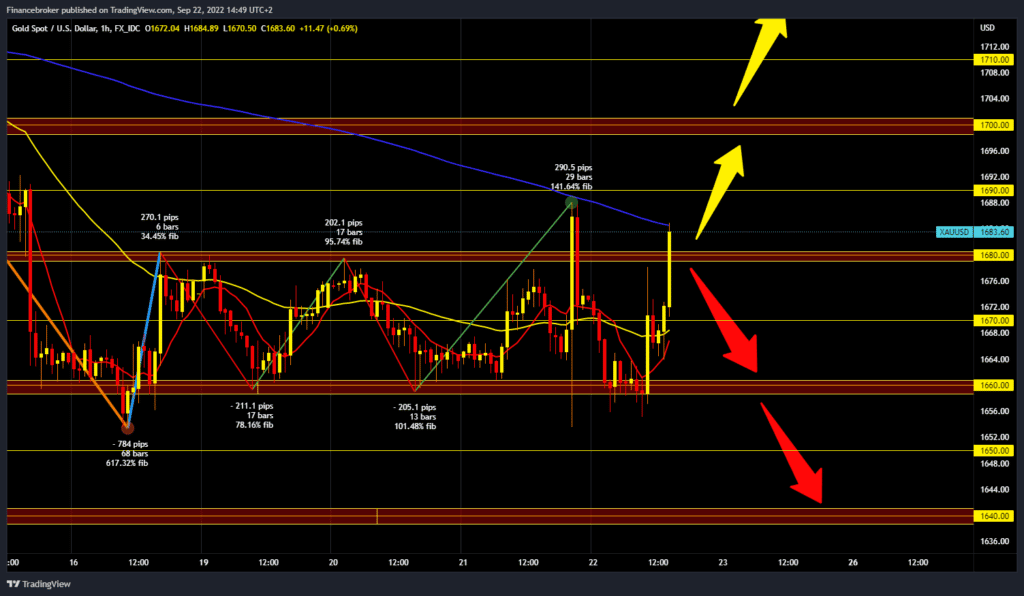

Gold chart analysis

The price of gold is under great pressure due to interest rate hikes by the FED, BOE and SNB. This morning the price of gold fell to the $1660 level, while now we see a bullish impulse and growth to the $1683 level. Possible resistance at this level is in the MA200 moving average. To continue the bullish option, we must first hold above the $1680 level. Then we need a new positive consolidation to continue the recovery. Potential higher targets are the $1690 and $1700 levels. We need a new negative consolidation and a return below the $1680 level for a bearish option. After that, we can expect the price to continue falling. Potential lower targets are $1670 and $1660 levels.

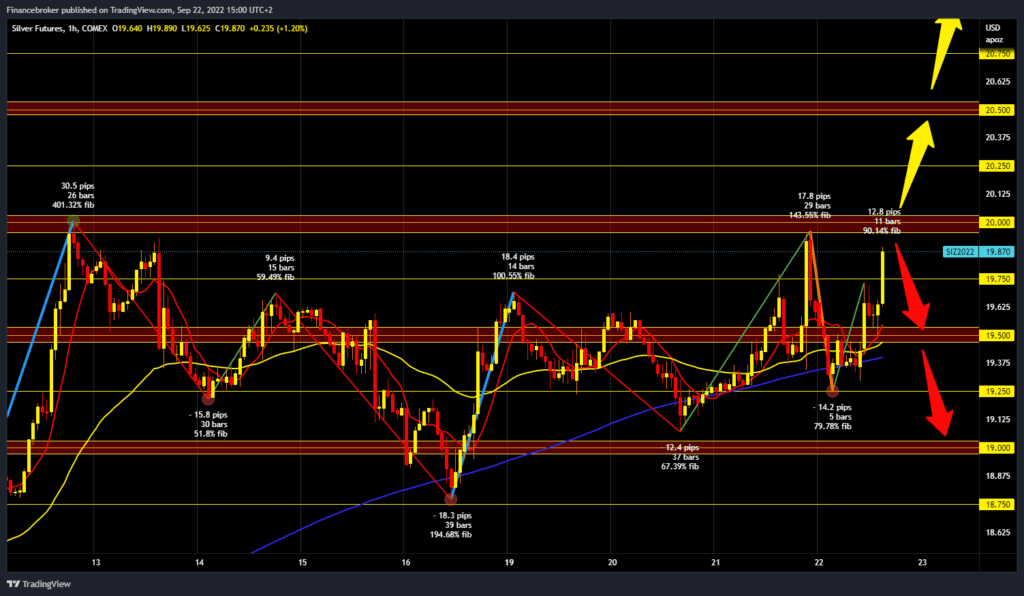

Silver chart analysis

During the Asian trading session, the price of silver fell to the $19.25 level, after which we see a consolidation above and a bullish impulse that has now taken us to the $19.85 level. And now, we could soon test the $20.00 resistance level. If we were to see break prices above, then it is necessary to maintain above in order to start the continuation of the bullish trend. Potential higher targets are $20.25 and $20.50 levels. We need a new negative consolidation and price return to the $19.50 support level for a bearish option. Additional support at that level is in the moving averages. A break in silver prices below would increase bearish pressure, and potential lower targets are $19.25 and $19.00 support levels.