Gold and Silver: The end of the five-day bullish trend

- Yesterday, the five-day bullish trend of the gold price was stopped at $1788.

- The price of silver was stopped again yesterday at $20.50.

- According to Bloomberg, US House Speaker Nancy Pelosi is vowing not to abandon Taiwan amid Chinese pressure, while Taiwan’s president is willing to retaliate against Beijing’s military moves, if any.

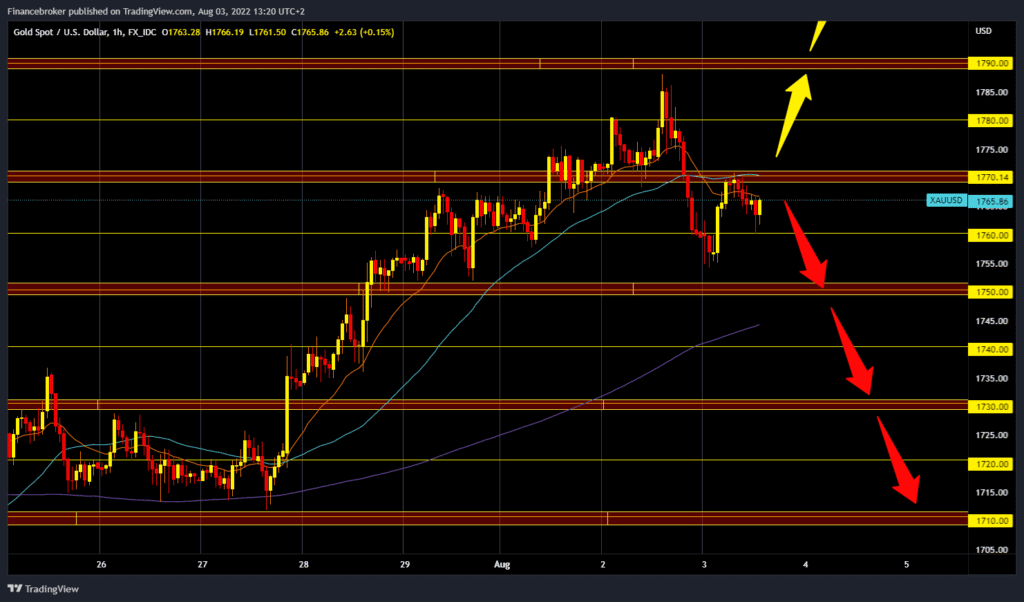

Gold chart analysis

Yesterday, the five-day bullish trend of the gold price was stopped at $1788. Shortly after reaching the maximum, the price retreated to the $1753 level. During the Asian session, the price recovered to the $1770 level, where we again encountered an obstacle and saw a new pullback today. Currently, the price of gold is at $1763, representing a price increase of 0.20% since the beginning of trading last night. If the price forms a new higher low at this point, the recovery could continue. For a bullish option, we need a return above the $1770 level and a hold above that level. With a new bullish consolidation, we continue towards the $1780 and $1790 resistance zones again. For a bearish option, we need a drop in the price of gold to the $1750 level. A price break below would form a new lower low and thus shift the center of gravity of the movement to the bearish side. Potential lower targets are $1740 and $1730 levels.

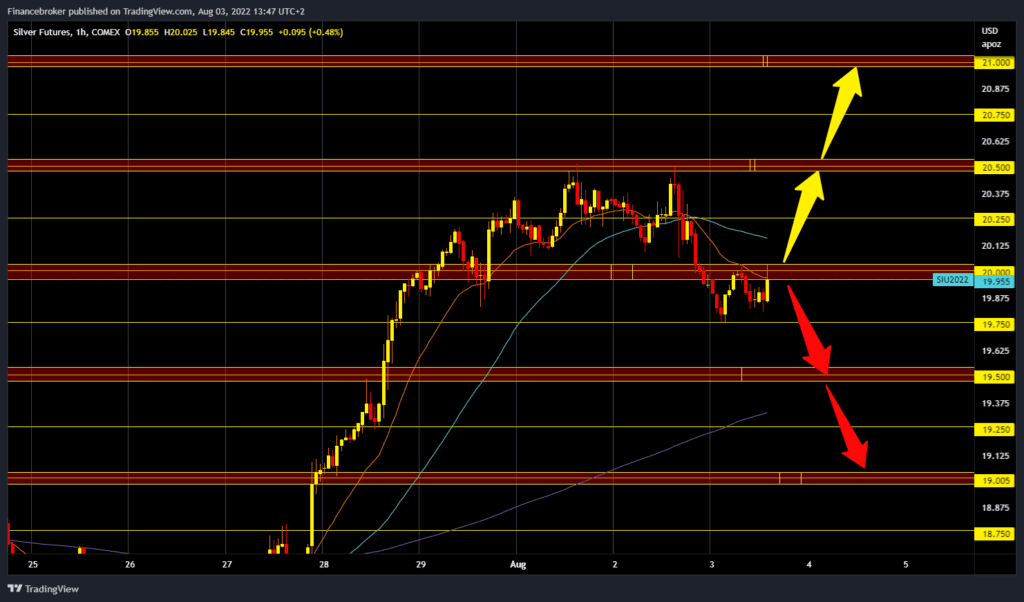

Silver chart analysis

The price of silver was stopped again yesterday at $20.50. On Monday was the first attempt to break above. After the failure, the price started to pull back. It dropped very quickly below $20.25 and then below $20.00 and stopped at $19.75 this morning. Then there was another recovery to $20.00, and now we are trying to break above. If we succeed, we could once again test the resistance zone at $20.50. For a bearish option, we need a continuation of negative consolidation and a drop below $19.75. The next lower support zone is at $19.50. If it does not support us, we continue towards the $19.25 and $19.00 levels.

Market overview

According to Bloomberg, US House Speaker Nancy Pelosi is vowing not to abandon Taiwan amid Chinese pressure, while Taiwan’s president is willing to retaliate against Beijing’s military moves, if any. Elsewhere, St. Louis Federal Reserve President James Bullard and Cleveland Fed President Loretta Mester spoke on concerns about a US recession, supporting talk of a 50-basis point (bps) rate hike in September.

Given the indecisiveness of the market, gold traders should wait for the US factory orders for June and the ISM Services PMI for July. There will also be important headlines on China, Taiwan, and the Fed.