Gold and Silver: Ten-day bearish trend

- The price of gold continues its ten-day bearish trend, and today a new lower low was formed at the $1808 level.

- During the Asian session, the price of silver stumbled and fell from $20.75 to $20.35.

- Eurozone inflation data for June will be published tomorrow.

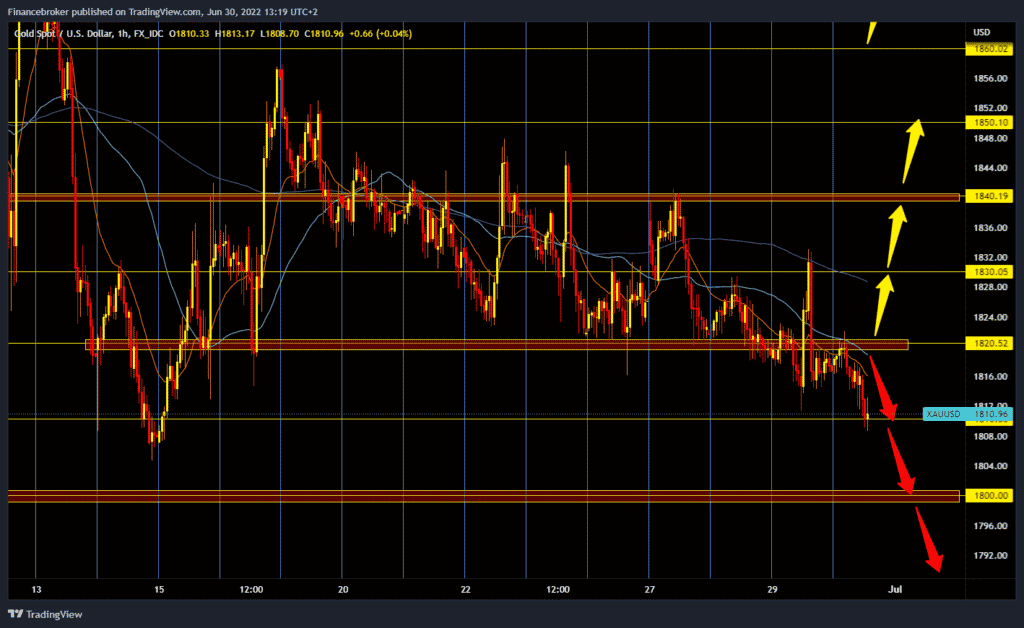

Gold chart analysis

The price of gold continues its ten-day bearish trend, and today a new lower low was formed at the $1808 level. The dollar continued to strengthen and climbed well above the 105.00 level, which negatively affects all goods denominated in dollars. For a bearish option, we need a continuation of this negative consolidation and a price drop to $1800, potential psychological support. The June price minimum was $1,804. For a bullish option, we need a new positive consolidation and a return above the $1820 level. After that, the price of gold could form solid support at that level and continue the recovery. Potential higher resistance targets for us are the $1830 and $1840 levels.

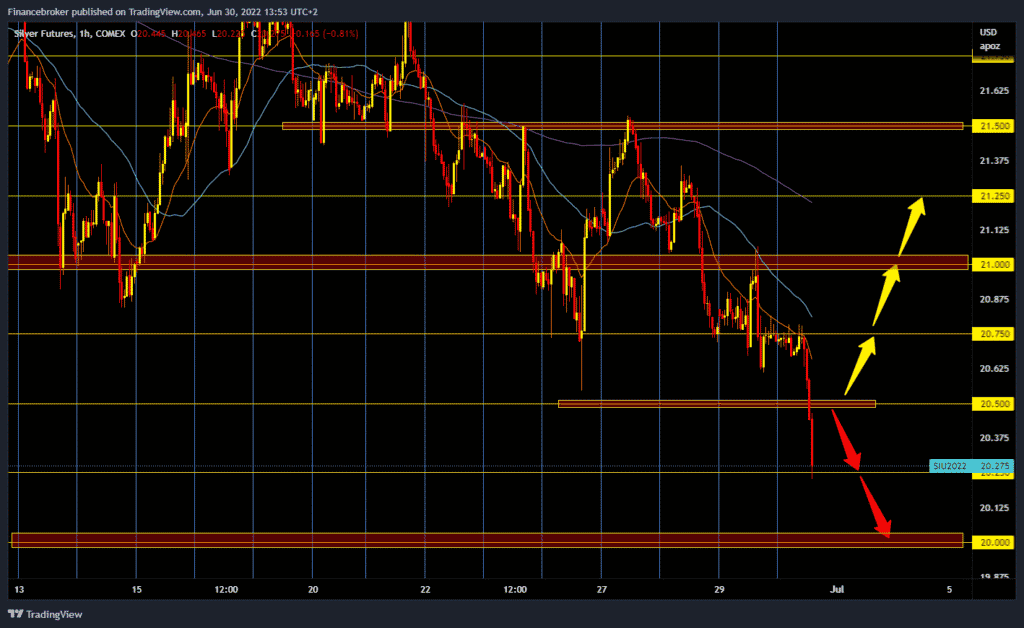

Silver chart analysis

During the Asian session, the price of silver stumbled and fell from $20.75 to $20.35. It failed to make a more concrete break above $20.75, and the pullback succeeded. Our first lower support is at the $20.25 level; if it does not provide concrete support, the price could fall to the $20.00 level. The last time we were at that place was in July 2020. For a bullish option, we need a new positive consolidation and a return above the previous support at the $20.50 level. After that, with a bullish impulse, the price could be found again above the $20.75 level. If we were to succeed, there would be a chance to test the $21.00 previous lower high.

Market overview

Eurozone inflation data for June will be published tomorrow. The European Central Bank could leave the euro under negative pressure, affecting gold. With a rate hike of just 25 basis points, the ECB risks falling further behind other central banks that have already raised their interest rates significantly. In this case, the euro would likely remain weak, further weighing on the price of gold.

Speaking at the ECB’s annual forum on Wednesday, Powell said the U.S. economy is well-positioned to pursue policy tightening and that the U.S. central bank remains focused on getting inflation under control. Adding to this, Cleveland Fed President Loretta Mester said policymakers need to act strongly to contain price pressures. Market sentiment remains fragile amid concerns that rapidly rising interest rates and tighter financial conditions would pose challenges to global economic growth.