Gold and Silver: Slightly Higher Than Expected

- Gold rallied after the US Labor Department reported a slightly higher than expected unemployment rate for August.

- The price of silver once again managed to climb above the $18.00 level.

- The US dollar jumped to a new 20-year high on Monday and is a key factor putting pressure on the price of gold.

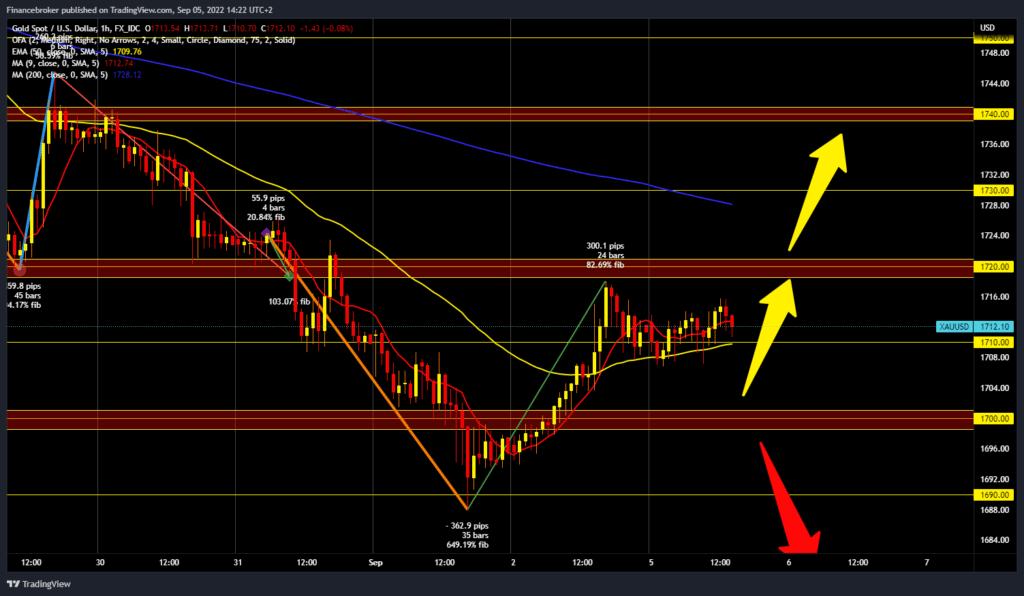

Gold chart analysis

The price of gold rallied after the US Labor Department reported a slightly higher than expected unemployment rate for August. For the beginning, we need a break above the previous high from Friday and test the $1720 level. Gold has support at the MA20 and MA50 moving averages. If we climb above the $1720 level, we would have a solid chance of continuing the bullish recovery. The next target is at the $1730 level. Additional resistance at that point is in the MA200 moving average. A potential higher target is at the $1740 level. We need a negative consolidation and a price drop below the $1710 level for a bearish option. The first next support is at the $1700 level; if it does not support us, we go down to $1690, last week’s low.

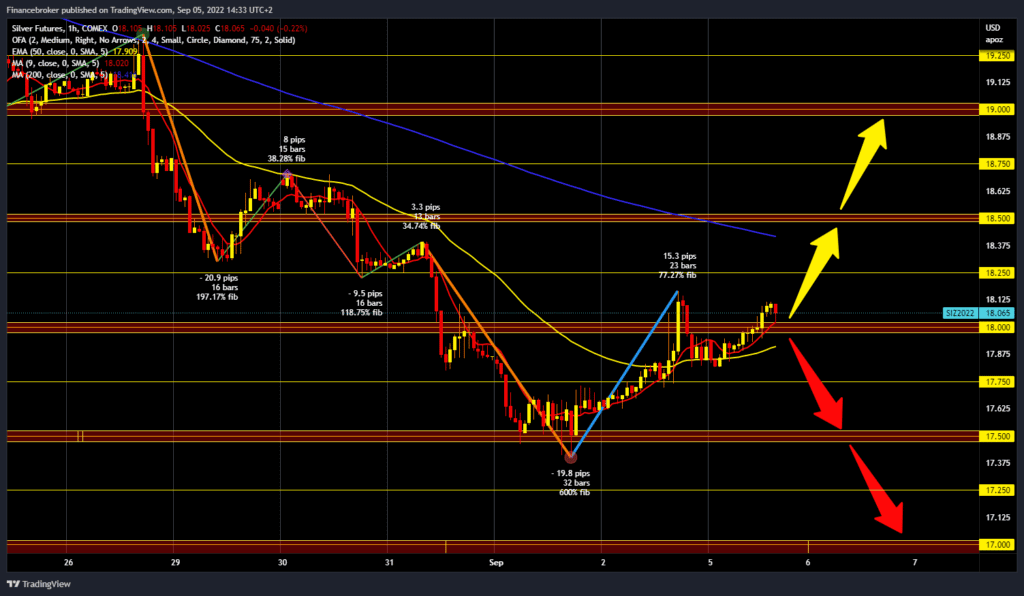

Silver chart analysis

The price of silver once again managed to climb above the $18.00 level. We need now to stay above if we want to continue on the bullish side. We have support in the MA20 and MA50 moving averages. Based on that, the price of silver could continue up to the $18.25 level. Below, the next target is at $18.50 with additional resistance in the MA200 moving average. For a bearish option, we need a negative consolidation and the first price pullback below the $18.00 support level. In the continuation, the price would be below the MA20 MA50 moving averages, further strengthening the bearish pressure. Potential lower targets are $17.75 and $17.50 levels.

Market Overview

The US dollar jumped to a new 20-year high on Monday and is a key factor putting pressure on the price of gold. Despite a mixed US jobs report on Friday, there is growing acceptance that the Fed will stick to its path of aggressive policy tightening. Bets are growing, and we will see a 0.75% rate hike at the next meeting. This has been confirmed by recent hawkish comments from several Fed officials, who have indicated that interest rates will continue to rise until inflation is closer to the 2% target.