Gold and Silver: Seven-day bearish trend

- During the Asian trading session, the price of gold fell from its high of $ 1879 this month as US inflation data increased bond yields and reduced investor interest in buying gold.

- The price of silver continues its seven-day bearish trend from $ 22.50.

- The reference 10-year yields are trading at their highest level since 2018.

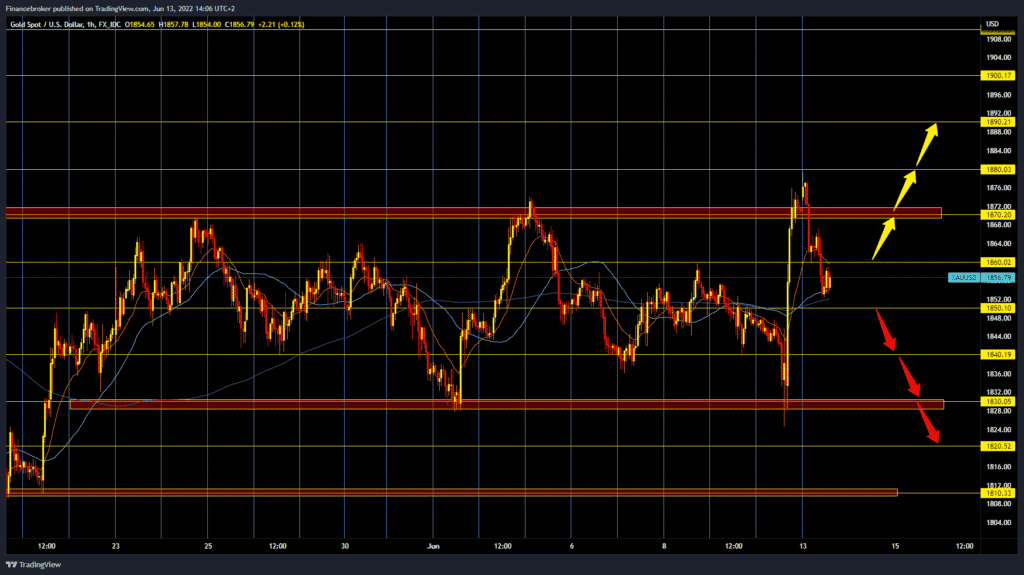

Gold chart analysis

During the Asian trading session, the price of gold fell from its high of $ 1879 this month as US inflation data increased bond yields and reduced investor interest in buying gold. The price is now at $ 1854 and slides further towards the $ 1850 level. One could see the break below and the continuation towards the lower support zone at $ 1830. We can expect the following consolidation below. A potential price break below would open the following targets at $ 1820 and $ 1810. For the bullish option, we need a new positive consolidation and a return above $ 1860. After that, we could expect the price to retest the resistance zone at $ 1,870 and maybe make a break above and visit this morning’s high at $ 1,880.

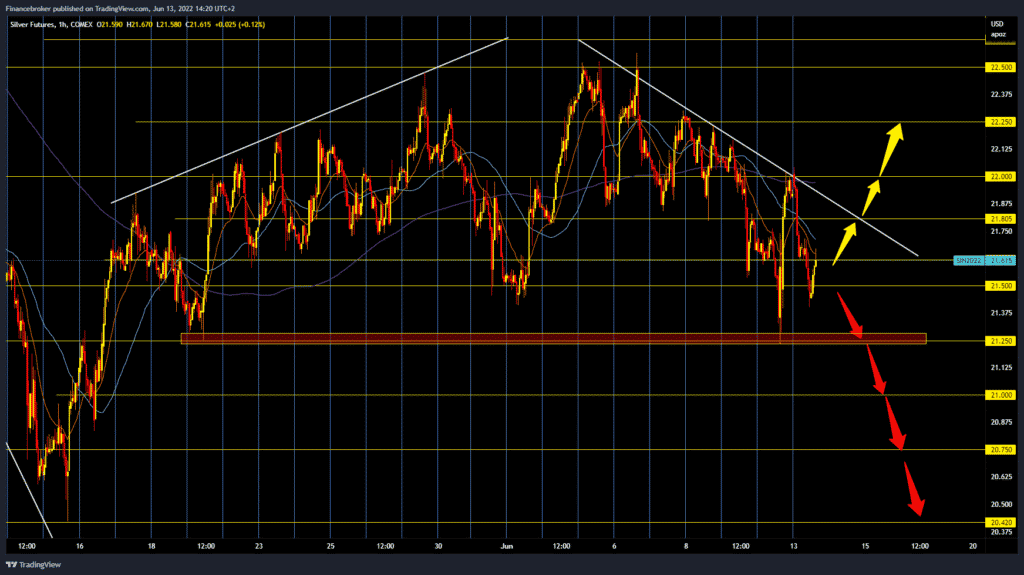

Silver chart analysis

The price of silver continues its seven-day bearish trend from $ 22.50. On Friday, the price formed a new lower low at $ 21.25 and then managed to recover to the $ 22.00 price and formed a new lower high there. During the Asian session, the price of silver makes a new pullback to $ 21.40, and there he finds today’s support, from which he starts a new bullish recovery at $ 21.65. To continue the bullish option, we need to break prices above the upper resistance line and the $ 22.00 level. After that, the price would have a solid momentum to continue. Potential bullish targets are $ 22.25, $ 22.50, and $ 22.56 June high.

Market overview

The reference 10-year yields are trading at their highest level since 2018, based on bets that the Fed will increase the rate by 75 basis points at least once in its next three meetings in order to curb sudden inflation. Zero-yield gold feels the heat of rising yields, which have raised the US dollar to a higher level. Aggressive expectations from the Fed’s tightening overshadowed growing fears of a recession while affecting the price of gold. Markets are now eagerly awaiting the Fed’s decision on Wednesday on guidelines on rate increases and their impact on related assets.