Gold and Silver: Rise or Fall

- During the Asian trading session, the price of gold consolidated after the withdrawal from Friday.

- The price of silver follows the rise in the price of gold, and this morning we had a jump in the price of silver from $ 21.87 to $ 22.47.

- Later in the week, the European Central Bank is expected to keep reference rates unchanged.

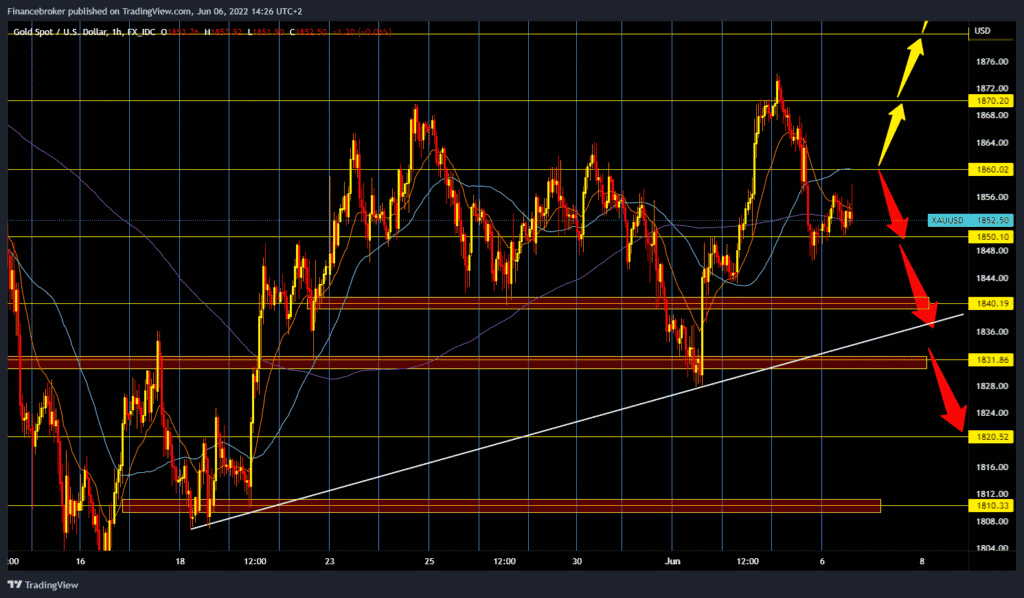

Gold chart analysis

During the Asian trading session, the price of gold consolidated after the withdrawal from Friday. A report from the American labor market for May showed a better picture of the American economy, which tripped over gold on Friday. The slowdown in yields on US government bonds and the weakening dollar gave gold room to grow last week. The price of gold is trading at around 1855 dollars per fine ounce, which represents a price increase of 0.22% since the beginning of trading tonight.

The latest news on price inflation in the United States is expected on Friday. We need a positive consolidation above the $ 1860 price for the bullish option. After that, we could expect a further continuation towards 1870 dollars, and then 1,874 dollars, last week’s maximum. FOR the bearish option, we need negative consolidation and pullback prices below $ 1,850. Continuing the negative consolidation, the price could be lowered first to 1840 dollars and maybe to 1830 dollars on the lower support line.

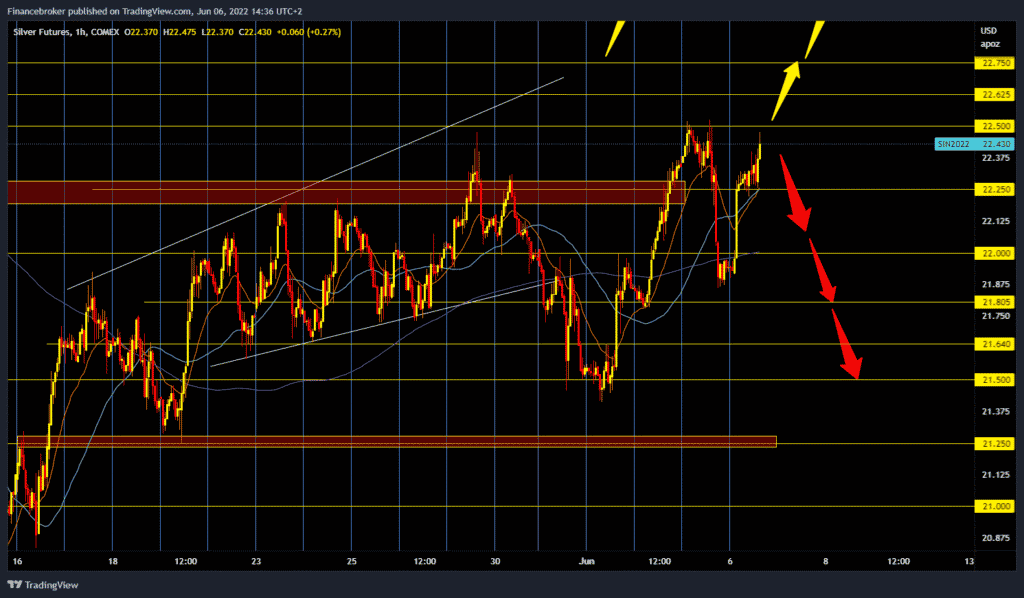

Silver chart analysis

The price of silver follows the rise in the price of gold, and this morning we had a jump in the price of silver from $ 21.87 to $ 22.47. The price currently remains in the upper resistance zone, and we could see a break above. First, we come across $ 22.50, then $ 22.62 and $ 22.75 level. For the bearish option, we need a new negative consolidation and a return below $ 22.25. Additional support at that level is in the MA20 and MA50 moving averages. Breaking the price of silver below them would increase bearish pressure, and the price would then drop to $ 22.00 in the support zone. Additional support at that level is in the MA200 moving average. If we don’t find support here either, the price could drop to $ 21.50, last week’s support zone.

Market overview

ECB meeting

Later in the week, the European Central Bank is expected to keep reference rates unchanged. The bank is expected to raise its benchmark interest rate by 25 basis points in July, and the Asset Purchase Program (APP) ends in July. According to Bloomberg, some policymakers want ECB President Christine Lagarde to convey a clear message that the borrowing costs of vulnerable countries will be limited and fragmentation will not be allowed.

This week, the most important data will be the reports on inflation in May from the USA on Friday. As NFP data confirm that labor market conditions remain challenging in the U.S., higher-than-expected consumer price index values are likely to trigger another step higher in U.S. yields.

The Asian recovery of light metals was spurred by a smaller decline in U.S. Treasury yields as the dust settled over an optimistic U.S. labor market report released on Friday. Rising oil prices due to rising prices in Saudi Arabia have also spurred gold to hedge against inflation.