Gold and Silver: Recover all losses

- Gold’s price recovered all losses from Friday after falling to $1784.

- On Friday, the price of silver broke the support at the $20.00 level and stopped at the $19.30 level.

- European Central Bank Governing Council member Madis Mueller told Bloomberg that it would be appropriate for the ECB to raise its benchmark interest rate by 25 basis points in July.

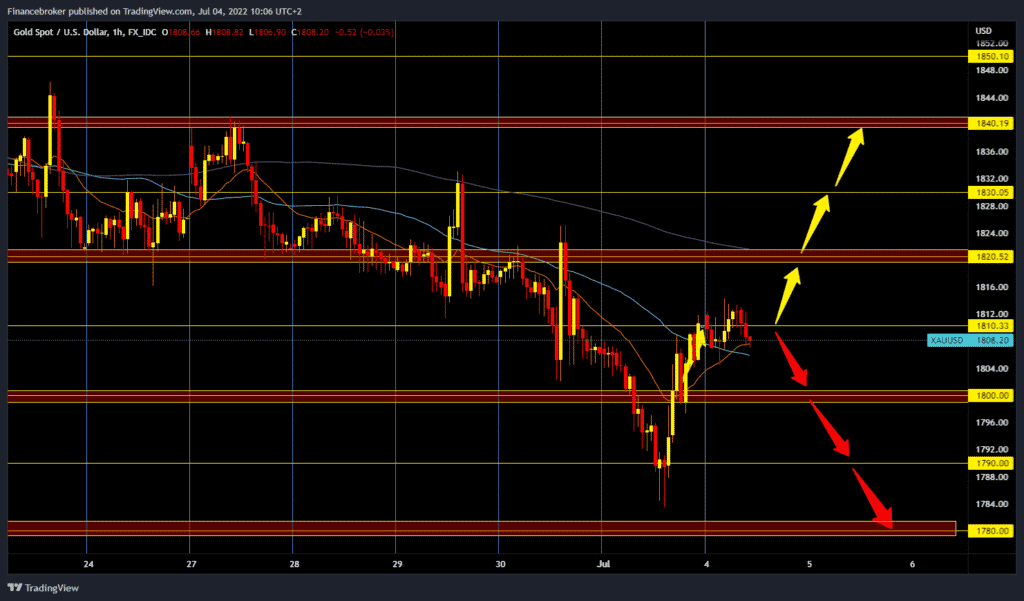

Gold chart analysis

Gold’s price recovered all losses from Friday after falling to $1784. During the Asian session, the price rose to the $1814 level, which is our daily resistance for now. In the zone around $1805, we have support in the MA20 and MA50 moving averages. We need a continuation of positive consolidation and support at the $1810 price for a bullish option. After that, we could see a recovery to $1820. Additional resistance at the $1820 level is the MA200 moving average. If the gold price manages to break above, then we would return to the previous movement zone of $1820-1840. For the bearish option, we need negative consolidation and pullback first to the $1800 level. A break below this support would likely take us to another test of the $1790 level. With increased bearish pressure, the price of gold could form a new lower low in the zone around $1780.

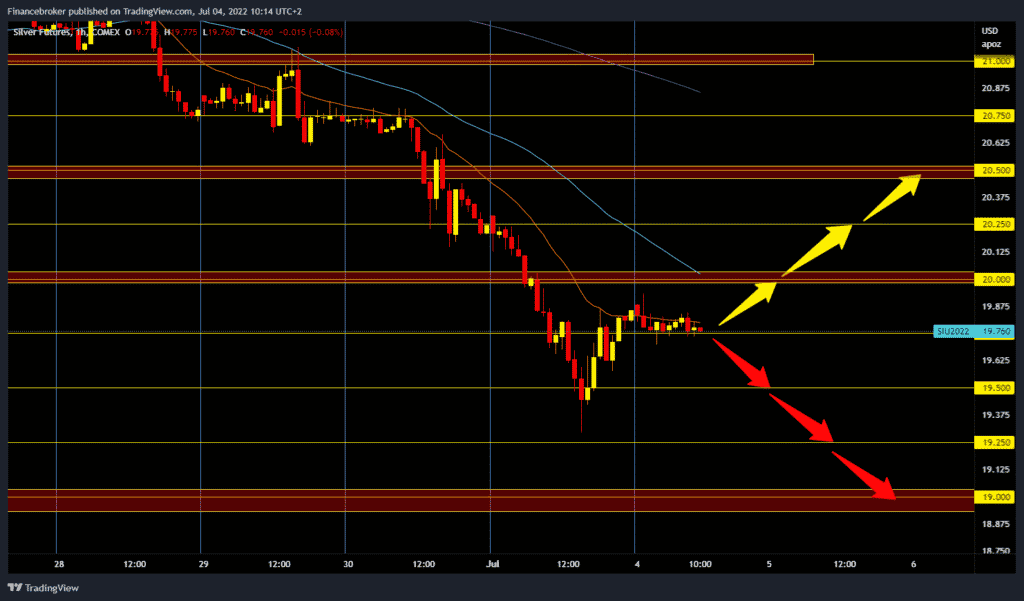

Silver chart analysis

On Friday, the price of silver broke the support at the $20.00 level and stopped at the $19.30 level. It recovered a good part of the loss very quickly but failed to get back above $20.00 again, stopping at $19.93. During the Asian session, the price mostly moved slightly above the $19.75 level. For a bullish option, we need a positive consolidation and a return above $20.00. After that, our next target is $20.25 and $20.50 as a bigger resistance zone. We need a continuation of negative consolidation and a return to the $19.50 support zone for a bearish option. If we fail to find support here, the price should continue to slide lower. Potential lower targets are $19.25 and $19.00 levels.

Market overview

European Central Bank Governing Council member Madis Mueller told Bloomberg that it would be appropriate for the ECB to raise its benchmark interest rate by 25 basis points in July. We should continue with a further increase of 50 basis points in September, Miller added, noting that the rate is in line with the views of most other ECB officials. Such statements can affect the trend of the gold price.

Rising expectations of aggressive interest rate hikes and a stronger dollar are headwinds for gold. However, weakness in capital markets and ongoing geopolitical uncertainty should support investor demand. Economists at ANZ Bank expect the yellow metal to find support at current levels and move towards $1,900.

Today is a day without economic news due to the national holiday in the US – Independence Day.