Gold and Silver Prices Drop Sharply – May 11, 2022

- Since the market opened, the gold lost $ 20 (or 1.18%) of its value by the end of the trading day yesterday.

- The price of silver fell to $ 21.15 yesterday, forming a new low this week.

- China’s consumer price index (CPI) rose above the market consensus of 1.8% to 2.1% year-on-year.

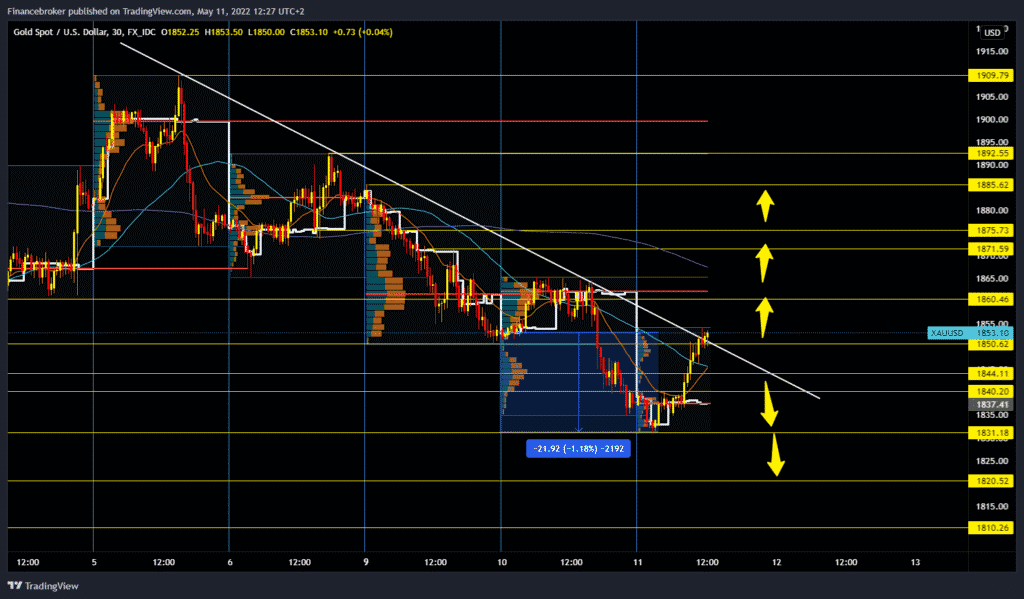

Gold chart analysis

Since the market opened, the gold lost $ 20 (or 1.18%) of its value by the end of the trading day yesterday. During this morning’s Asian session, the price of gold found support at the $ 1,831 level. A bullish impulse soon followed, raising gold above $ 1,850. This move made a break above this week’s declining trend line, boosting bullish optimism for a resumption of price recovery.

Our next target is the resistance zone of 1860-1865 dollars. A break above would open us up to a $ 1,885 level this week’s high. Our main target is last week’s high at $ 1909. We need a new negative consolidation and pullback prices below $ 1850 and a trend line for the bearish option. After that, we can expect a return to previous support at the $ 1831 price tag. Our lower targets are $ 1820, $ 1810, and $ 1800 level as psychological support.

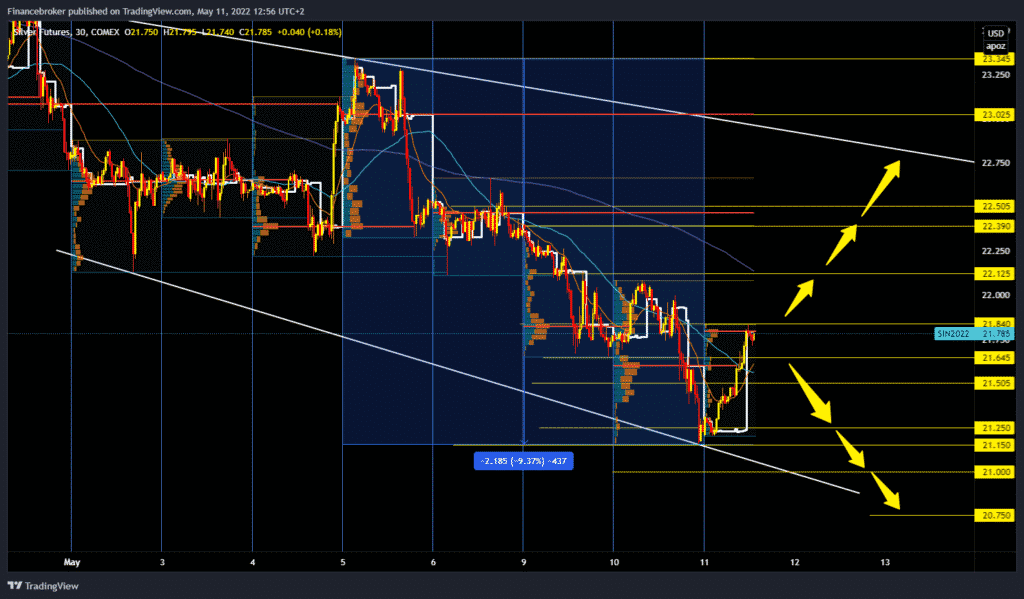

Silver chart overview

The price of silver fell to $ 21.15 yesterday, forming a new low this week. During the Asian session, silver began its recovery. After in the European session, we saw a recovery in the price of up to $ 21.84. At that level, we have today’s resistance and lower pullback prices to consolidate better.

Our next bullish target is yesterday’s resistance zone of $ 22.10-22.12. A price break above could raise the price to a higher price consolidation point at $ 22.50. The maximum target for this time frame is the upper trend line at the 22.75 level. For the bearish option, we need new negative consolidation and pullback prices to the previous support zone of $ 21.15-21.25. Lower support targets are $ 21.00 and $ 20.75 levels.

Market overview

China’s consumer price index (CPI)

China’s consumer price index (CPI) rose above the market consensus of 1.8% to 2.1% year-on-year, while the producer price index (PPI) exceeded expectations of 7.7% with annual figures of 8.0%. As China is one of the world’s largest consumers of gold, strong inflation, despite quarantine caused by the coronavirus, supports hopes for future demand for the yellow metal.

Comment during the Asian session of the president of the Fed in Atlanta, Rafael Bostik, is that the American economy is strong and the demand is great. At the same time, a neutral rate of 2.0-2.5% is also expected.

An additional challenge for gold buyers is China’s policy of “zero tolerance of kovids”, despite the efforts of the World Health Organization to alleviate the rigid restrictions on activities in Shanghai and Beijing. Quarantines in the world’s largest industrial player pose a serious threat to global growth, especially at a time when fears of inflation are high.

Stories about the war between Russia and Ukraine and its probable negative implications also give hope to gold sellers. According to the latest news, Europe needs to redirect its gas flow from Russia, which used to come through Ukraine.