Gold and Silver price fluctuated

- The price of gold advanced in the European session and is now at $ 1,830.

- The price of silver is already on the third day in bearish consolidation.

- The movement of US bond yields will affect the dynamics of USD prices and give a certain impetus to gold.

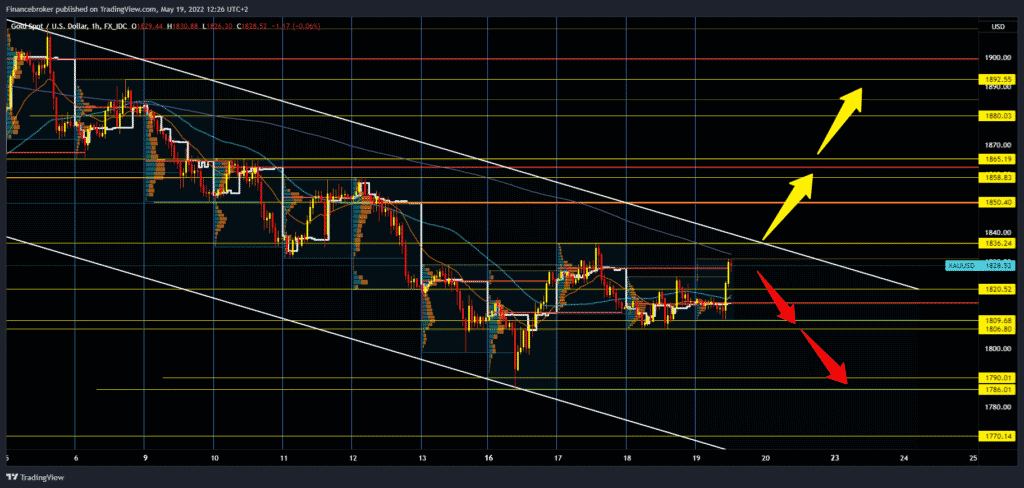

Gold chart analysis

During the Asian trade, the price of gold fluctuated around 1815 dollars and was well above the level of 1800 dollars. Price inflation in the UK and Canada indicates ever-increasing inflation, which is a long-term supporting factor for gold. It is also a signal of higher interest rates, and they can slow down the growth of the price of gold in the short term. After this morning’s consolidation, the price of gold advanced in the European session and is now at $ 1,830. It takes a little more to climb to yesterday’s high of $ 1,836. If the dollar continues to weaken, we can expect further growth in the dollar price.

First, we need a break above $ 1840 and the top line of the channel. Our potential bullish targets today are $ 1,850, $ 1,858 and $ 1,865 levels. We need a price withdrawal in this morning’s $ 1810-1815 support zone for the bearish option. A break in the gold prices below would reinforce the bearish impression, and we could see a continuation of the pullback to the next lower support. Potential bearish targets are $ 1,806, $ 1,800 and $ 1,790.

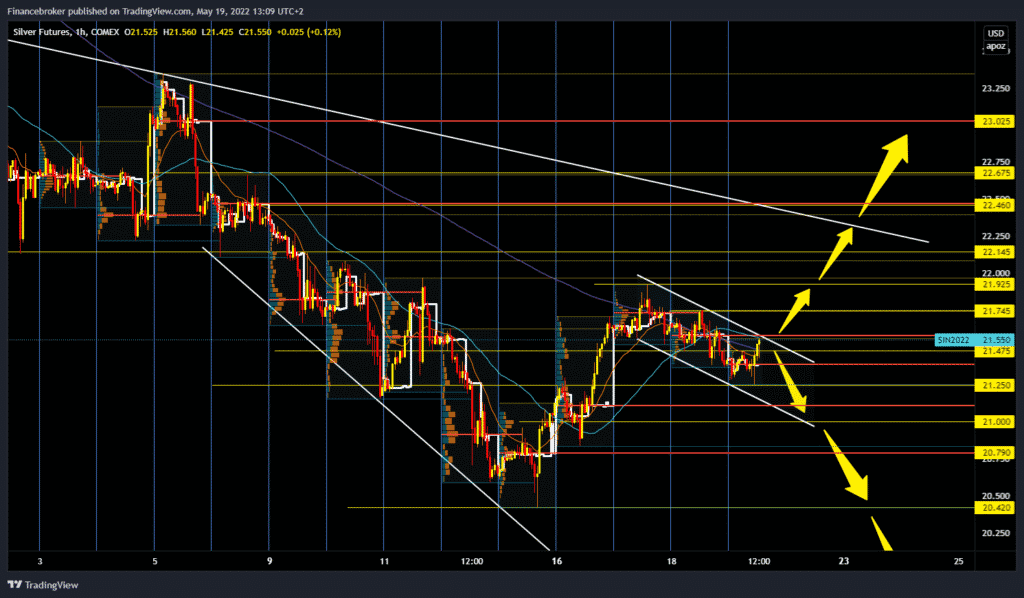

Silver chart analysis

The price of silver is already on the third day in bearish consolidation. The day before yesterday, a new lower high was established at $ 21.92, and since then, the price has been in withdrawal. This morning, silver found support at $ 21.25, and since then, we have had a smaller recovery at $ 21.45. We need a break above $ 21.60 and a jump to the $ 21,750 price to get out of this consolidation. Today’s potential bullish targets are $ 21.75, $ 21.92, and $ 22.14. For the bearish option, we need negative consolidation and the formation of a new lower low below the $ 21.25 price tag. After that, we can expect the bearish trend to continue and the price to continue to recede. Potential bearish targets are $ 21.10, $ 21.00, $ 20.80.

Market overview

Later, Market participants expect the US economic report, which includes the publication of the Philadelphia Fed Manufacturing Index, then the usual weekly initial claims for the unemployed and data on existing house sales. The movement of US bond yields will affect the dynamics of USD prices and give a certain impetus to gold. In addition, traders will use signs from a broader sense of market risk to take advantage of short-term opportunities to change the price of gold.