Gold and Silver: No success

- For the sixth day in a row, the price of gold is in retreat. On June 16, the price dropped to $ 1857.

- The failure of the silver price to make a break above $ 22.00 at the beginning of the week started the bearish trend, which this morning formed a new lower low at $ 20.75.

- A significant factor this week was the fall in oil and commodity prices, which eased fears of inflation and enabled the stock market to recover.

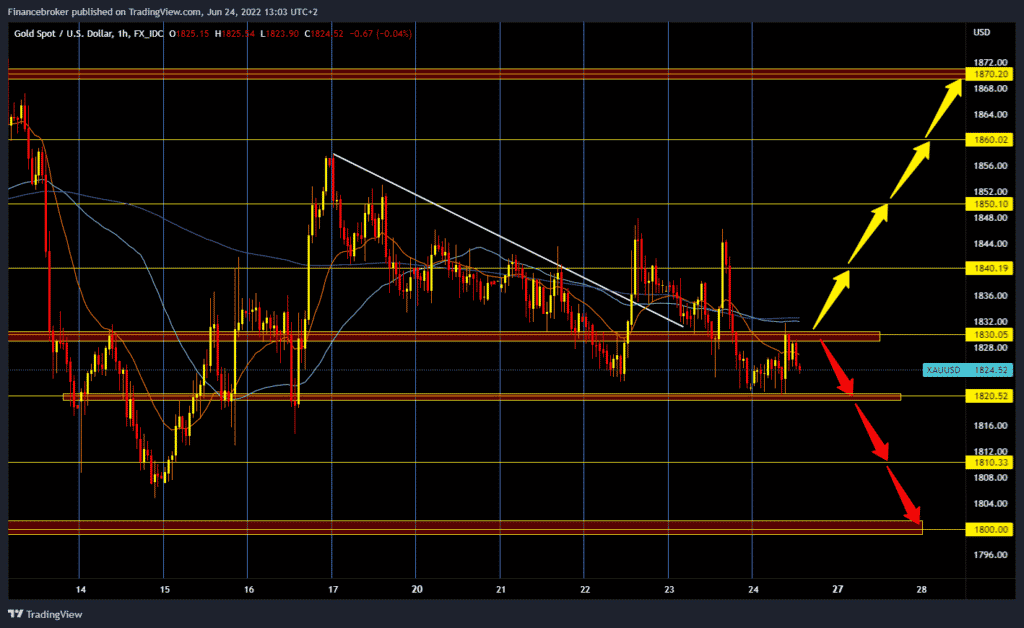

Gold chart analysis

For the sixth day in a row, the price of gold is in retreat. On June 16, the price dropped to $ 1857, and we have been in the bearish trend ever since. Gold tried to form new higher highs in the previous two days but without success. We stopped at $ 1845. Early this morning the cane fell to $ 1820 forming a new lower low, and based on that we can expect a bearish trend. The shorter recovery lasted until the $ 1830 level, and after that we see a new negative consolidation.

A break below the $ 1820 support zone could bring us down to the next support zone at $ 1810 from June 15. If the price dropped to $ 1800, we would then fall to the May support zone. For the bullish option, we need a new positive consolidation and first growth above $ 1830. After that, the price could recover to the $ 1840 level. If we manage to break above to see, then the space up to $ 1850 opens up for us. Last year’s high awaits us at $ 1857, and if we skip it too, we climb to the $ 1870 June resistance zone.

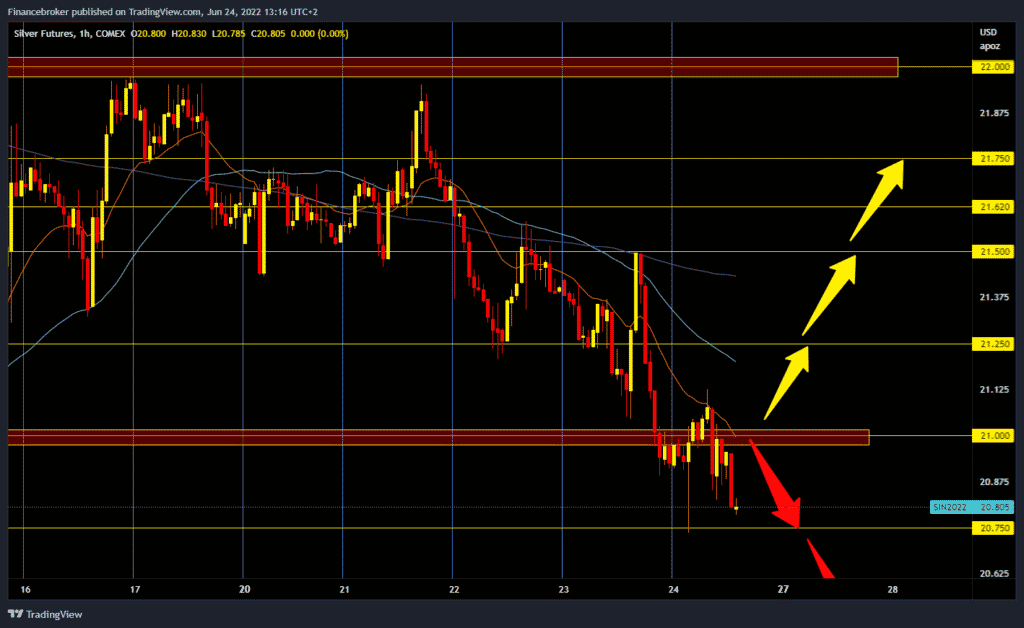

Silver chart analysis

The failure of the silver price to make a break above $ 22.00 at the beginning of the week started the bearish trend, which this morning formed a new lower low at $ 20.75. Early this morning, the price of silver broke the support to $ 21.00 and fell to $ 20.75. The pressure on the price is still very present on the chart, and we will likely see the continuation of the bearish trend towards the $ 20.50 level. A break below this level brings us down to the May support level at $ 20.42. For the bullish option, we need a new positive consolidation and a return above the $ 21.00 level. It is then necessary for the price to remain at that level, forming a new higher low from which a new bullish impulse would begin. Potential higher targets are $ 21.25 and $ 21.50 levels.

Market overview

A significant factor this week was the fall in oil and commodity prices, which eased fears of inflation and enabled the stock market to recover. This undermined the safe-haven offer, which boosted the dollar against major currencies.

The dollar, which has risen 9 % this year, has lost some of its lustrs since investors began betting that the Fed could slow the rate of rate tightening after another 75-point increase in July. They now see that rates will peak next March at around 3.5 % and fall by almost 20 basis points by July 2023.

For now, Fed President Jerome Powell has emphasized the central bank’s unconditional commitment to curbing inflation. Fed Governor Michelle Bowman also supported a 50-point increase for the “next few” meetings after July.