Gold and Silver: New lower low again?

- During the Asian trading session, the price of gold recovered slightly from yesterday’s decline.

- The price of silver yesterday formed a new lower low at $18.70, followed by a bullish consolidation and recovery.

- Markets appear confident that the Fed will maintain its aggressive tightening policy in the fight against high inflation.

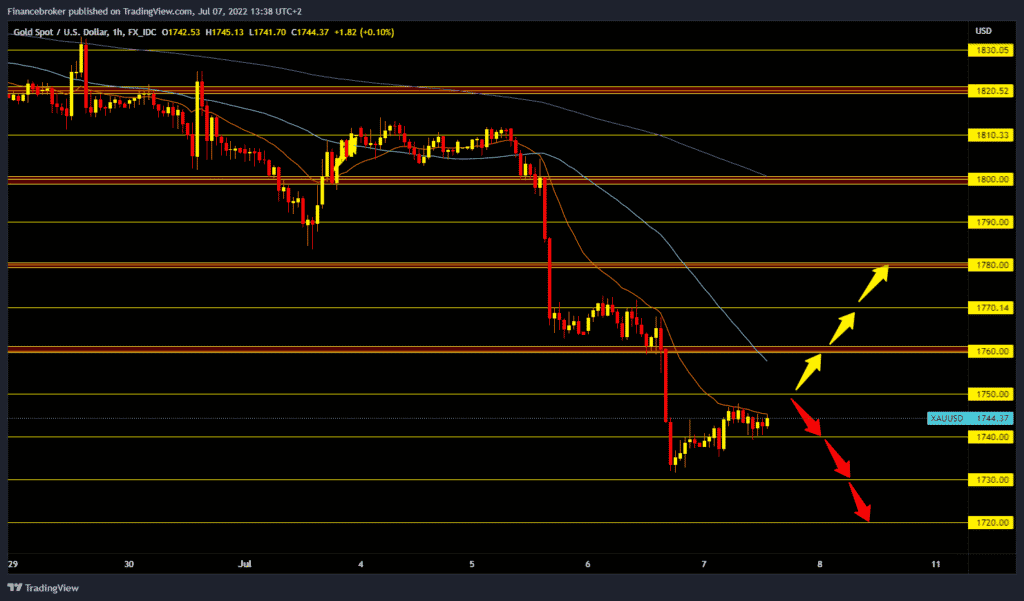

Gold chart analysis

During the Asian trading session, the price of gold recovered slightly from yesterday’s decline. Notes from the last meeting of the US Federal Reserve showed the US central bank’s determination to pursue a restrictive monetary policy, which further shook gold. Last Thursday, India, the world’s second-largest consumer of gold, announced an increase in customs tariffs that dragged the price below 1800. Rising inflation is pushing interest rates higher with calls for faster hikes. The gold price is around $1,743 per fine ounce, representing a price increase of 0.126% since the start of trading last night. If the pressure on the gold price continues, it could slip to a retest of the $1730 support zone. Our potential lower support zone is $1720. For a bullish option, we need a better positive consolidation and a return above $1750. After that, we could try to climb up to the $1760 level. Additional resistance at that level is the MA50 moving average. Potential higher targets are $1770 and $1780 levels.

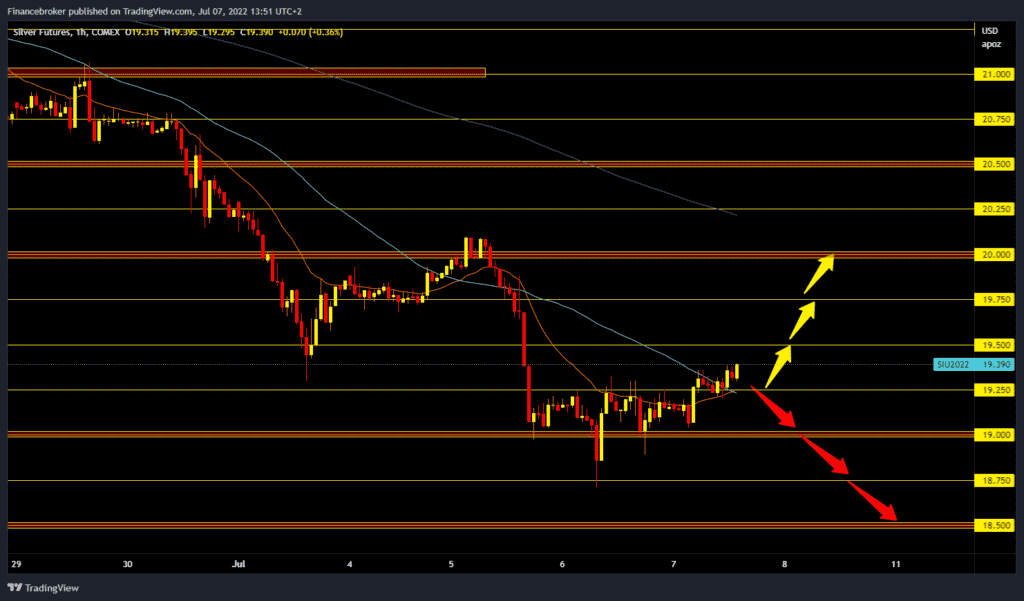

Silver chart analysis

The price of silver yesterday formed a new lower low at $18.70, followed by a bullish consolidation and recovery. Today, that recovery continues, and today’s maximum was at the $19.38 level. At $19.25, the silver price is supported in the MA20 and MA50 moving averages. Based on that, we expect the price to continue to recover. Potential higher targets are $19.50, $19.75 and $20.00 levels. We need a price pullback below the 19.25 level for a bearish option. After that, the pullback could continue to the $19.00 support zone. And if we break support, the price will continue to drop. Potential lower targets are $18.75 and $18.50 levels.

Market overview

Markets appear confident that the Fed will maintain its aggressive tightening policy in the fight against high inflation. Bets were reaffirmed in the unsurprisingly hawkish minutes of the June 14-15 FOMC meeting, where policymakers stressed the need to fight inflation even if it results in an economic slowdown.

Policymakers have indicated that another rate hike of 50 or 75 basis points is likely at the July meeting. This, along with some subsequent recovery in US Treasury yields, should act as a tailwind for the dollar. Additionally, the positive risk tone could further help limit any significant upside for safe-haven gold.

Market participants are now anxiously awaiting the week’s initial US jobless claims, due later in the early session in North America. This, along with scheduled speeches by Fed Governor Christopher Waller and St. Louis Fed President James Bullard, will affect USD price dynamics and produce near-term gold opportunities.