Gold and Silver: Gold’s Price Attempt to Climb $1670 Failed

- Yesterday’s attempt by the price of gold to climb above $1670 was unsuccessful.

- This week’s silver price growth stopped yesterday at the $19.60 level.

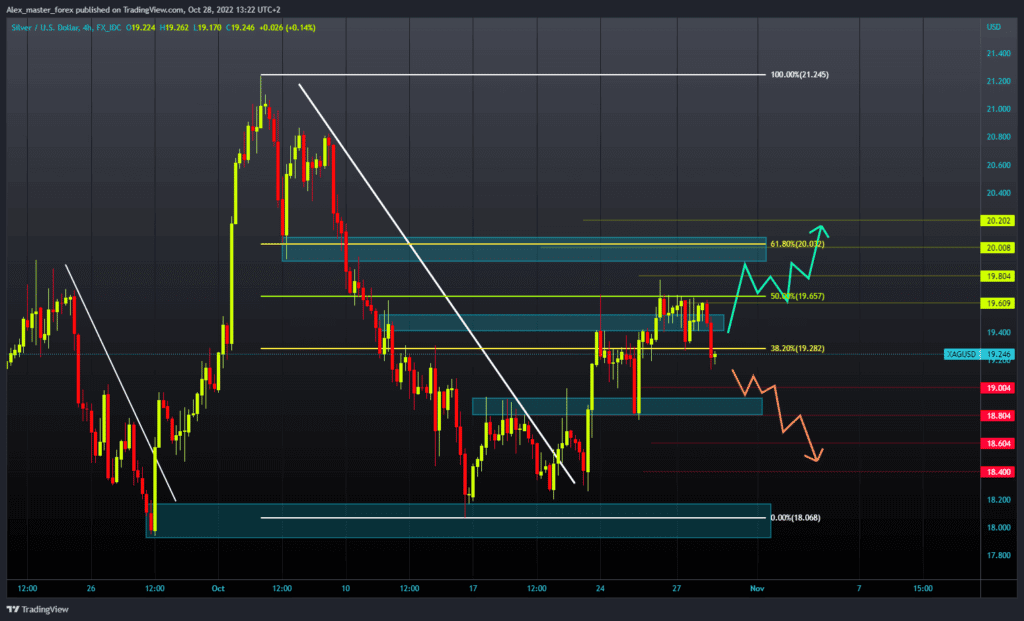

Gold chart analysis

Yesterday’s attempt by the price of gold to climb above $1670 was unsuccessful. A new price pullback occurred, and a lower high was formed at the $1667 level. Since then, the price of gold has been in a bearish trend, falling to the $1,645 level. Now we are trying to find support there and stop this price pullback.

For a bullish option, we need a positive consolidation and a return above the $1650 level first. After that, we should see a further recovery to $1660, then the $1670 resistance zone. A break above and staying there would signify that we could continue toward the $1700 level.

For a bearish option, we need a negative consolidation and a drop below the previous low at the $1640 level. Then we could expect further price pullback. Potential lower targets are $1630 and $1620 levels.

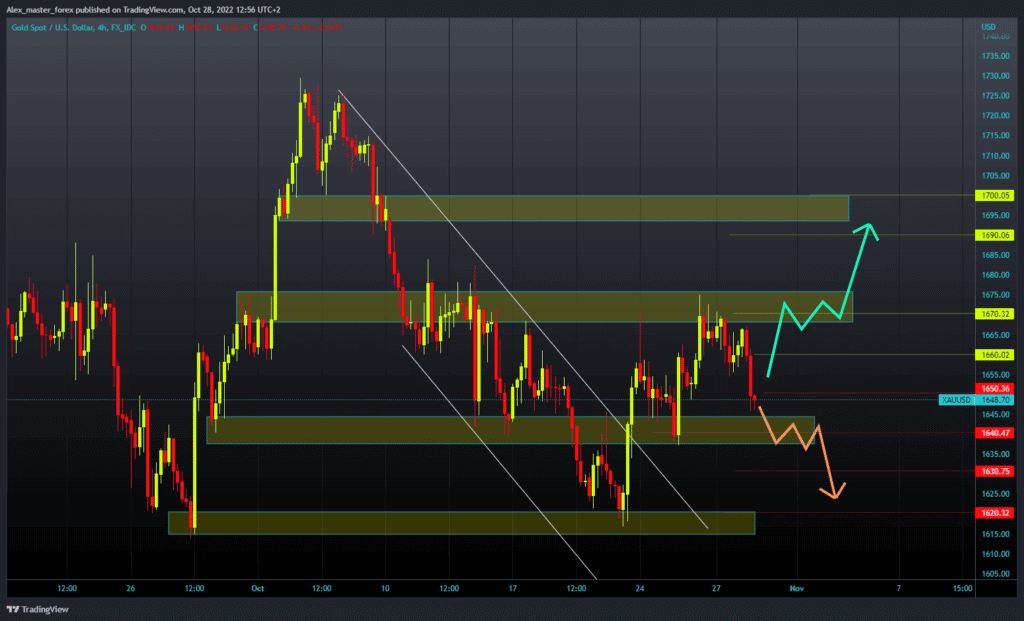

Silver chart analysis

This week’s silver price growth stopped yesterday at the $19.60 level. During the Asian session, the price of silver continued to pull back to the $19.20 level. We are now trying to find support here, and if we fail to do so, the price will continue its decline.

For a bearish option, we need a continuation of the negative consolidation and a drop to the $19.00 level. Increased flow at that point could lead to a breakout below and test of the previous low at the $18.80 level.

Potential lower targets are the $18.60 and $18.40 levels. We need a positive consolidation and a return to the $19.60 resistance level for a bullish option. A break above would be very helpful, as would staying at that level. In the future, we could expect a new bullish impulse and further recovery of the price of silver. Potential higher targets are the $19.80 and $20.00 levels.