Gold and Silver: Bullish trend

- The price of gold continues this week’s bullish trend after falling to the $1730 level.

- This week the price of silver found support at the $18.75 level.

- financial markets are relatively quiet at the moment as investors await the US durable goods orders report, which is expected to post a modest 0.6% advance in July.

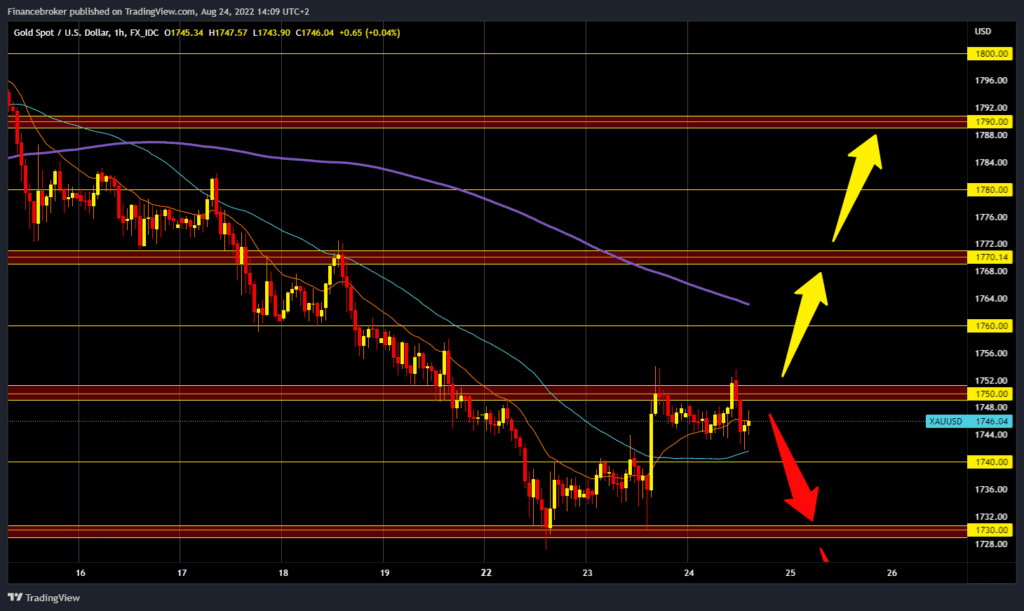

Gold chart analysis

The price of gold continues this week’s bullish trend after falling to the $1730 level. Yesterday, the price of gold managed to climb above the $1750 level. During the Asian trading session, the price of gold was stable and found support above the $1740 level. Today we saw another break above the $1750 level. We need a continuation of positive consolidation and a break above the $1750 level for a bullish option. Then the price of gold needs to hold above in order to try to continue towards the following higher targets. Potential higher targets are $1760 and $1770 levels. We need a negative consolidation and a drop below the $1740 level for a bearish option. Then we could retest the $1730 support zone. If a break below occurs, the potential lower targets are $1720 and $1710 levels.

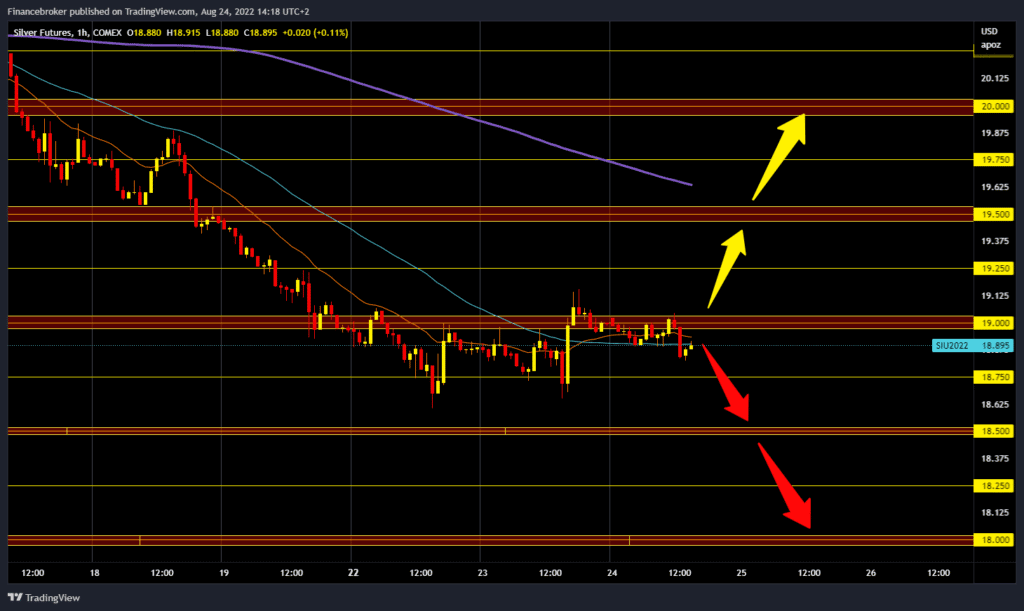

Silver chart analysis

This week the price of silver found support at the $18.75 level. During the Asian trading session, the price of silver hovered around the $19.00 level. We now see a short pullback to the $18.85 level and find immediate support there. For a bullish option, we need a continuation of positive consolidation and a price jump above the $19.00 level. If we succeed in this, we will get additional support in the MA20 and MA50 moving averages. Potential higher targets are the $19.25 and $19.50 levels. We need negative consolidation and a price drop below the $18.75 level for a bearish option. Increased bearish pressure could lower the price of silver to the $18.50 support level. Potential lower targets are $18.25 and $18.00 levels.

Market Overview

financial markets are relatively quiet at the moment as investors await the US durable goods orders report, which is expected to post a modest 0.6% advance in July. Such a tepid report is likely to exacerbate recessionary concerns. Economic fears in China, the world’s largest consumer of commodities, are affecting gold price movements. Chinese authorities are trying to form the bottom of the economic slowdown fueled by the deepening real estate crisis.