Gold and Silver: Break the barrier

- The price of gold yesterday tried to break the barrier to 1860 dollars, but without success, because we saw another pullback to the support zone at $ 1850.

- For the third day in a row, the price of silver on the chart forms a new lower high and directs the pressure on the $ 21.80 support zone.

- ECB report and impact on the price of gold.

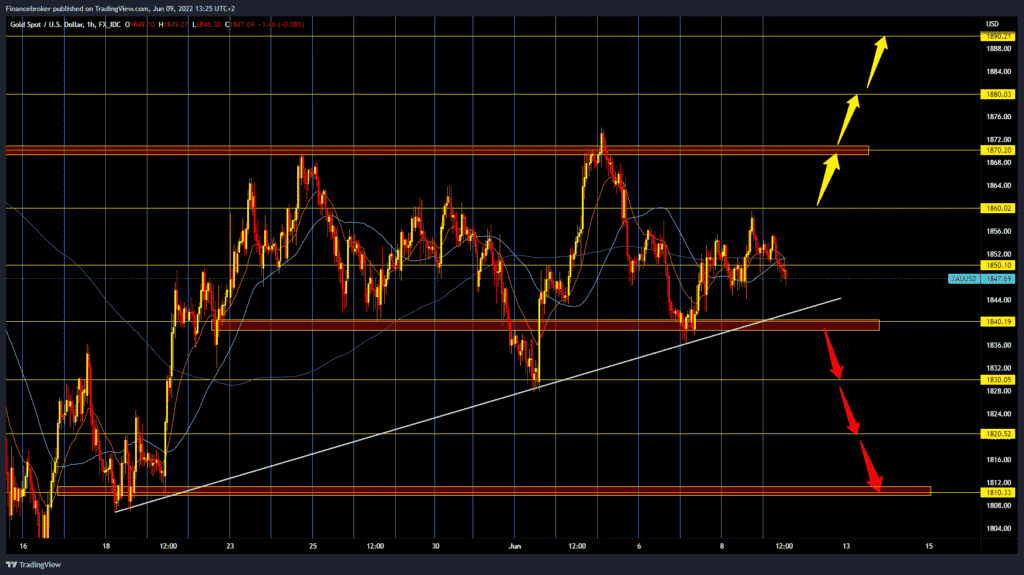

Gold chart analysis

The price of gold yesterday tried to break the barrier to 1860 dollars, but without success, because we saw another pullback to the support zone at $ 1850. Today, gold prices continue to retreat and are already halfway to the $ 1840 level. In the past few days, we have had solid support at that level. Additional support for me could be the bottom trend line. A break below the money line would be a sign to us that the price of gold could make a bigger retreat towards lower support zones. Potential lower targets are $ 1830, $ 1820 and $ 1810 price. We need a return above the $ 1860 level for the bullish option. After that, the price should retest the $ 1870 level. A break above would open space for us to the next resistance zones at $ 1880 and $ 1890 levels.

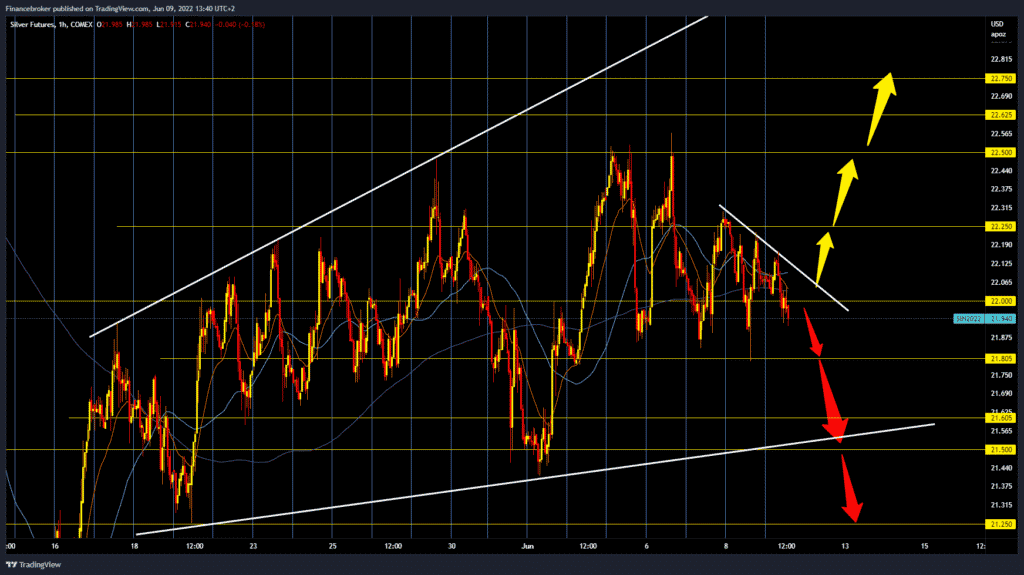

Silver chart analysis

For the third day in a row, the price of silver on the chart forms a new lower high and directs the pressure on the $ 21.80 support zone. And today is possible to we can see a break and fall to the lower support line at $ 21.50-21.60. At the top of the chart, we can connect the three top peaks and draw a trend line. A price break above this line could be a sign of a potential price recovery above $ 22.00. With further bullish consolidation, our first target is $ 22.25 left, followed by the $ 22.50 June resistance zone.

Market overview

ECB report and impact on the price of gold

Gold is on standby ahead of the European Central Bank meeting. We believe that the ECB will decide today to end the purchase of bonds at the beginning of the third quarter. In addition, it will probably signal quite clearly that interest rates will be raised at the next meeting in July and that the deposit rate will no longer be negative until the end of September. That would mean the next rate increase would come in September. ”

“We believe that it is questionable whether any announcement will be made about the long-term prospects of interest rates because there is still no consensus on this issue in the Governing Council of the ECB.

According to a survey of nearly 60 central banks conducted by the World Gold Council (VGC), about a quarter of central banks plan to replenish their gold reserves in the next twelve months. Moreover, most respondents expect the share of gold in foreign exchange reserves to increase in the next few years. The WGC says gold is popular with central banks as a safe haven and storehouse of value. Moreover, gold is expected to perform better in times of crisis. However, central banks have been buying significantly less gold lately.