Gold and Silver: Bearish week

- The price of gold fell to the $1790 level.

- During the Asian trading session, the price of silver retreated from the $20.75 level.

- The release of disappointing macroeconomic data from China led investors to believe that a slowdown in the economy could significantly affect the outlook for demand for gold as a safe haven.

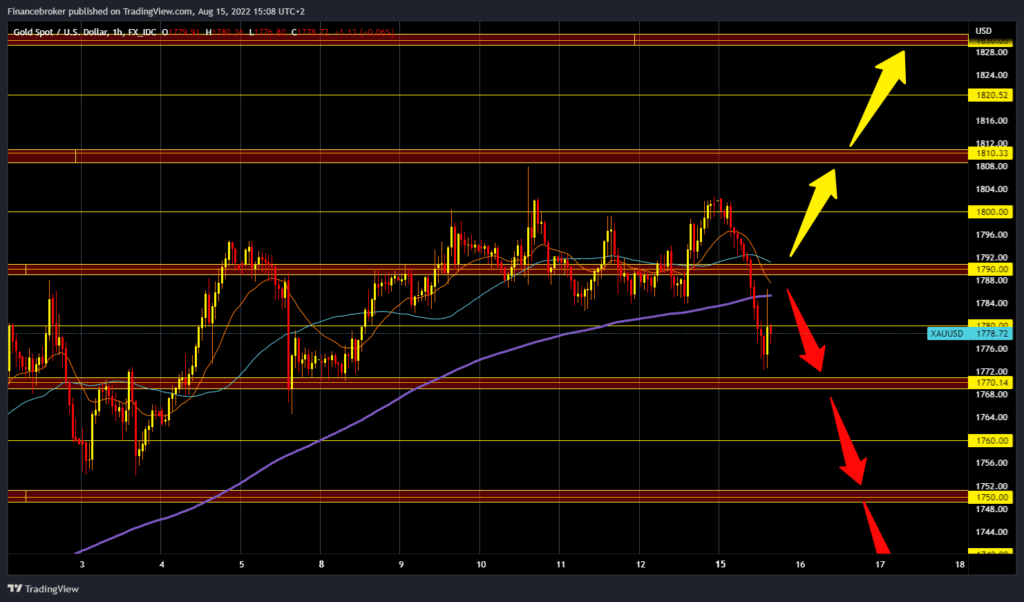

Gold chart analysis

The price of gold retreated from the $1800 level, and during the Asian trading session, the price fell to the $1790 level. In the European session, we see the continuation of the retreat of the gold price to the $1772 level. Chances are increasing that this week will be very bearish for the price of gold. We need a continuation of the negative consolidation and a further pullback below the $1770 level for a bearish option. Below, the potential targets are the $1760 and $1750 levels. For a bullish option, we need a new positive consolidation and return in the price above the $1790 level. After that, we could try to climb up to the $1800 resistance zone. Potential higher targets are $1810 and $1820 levels.

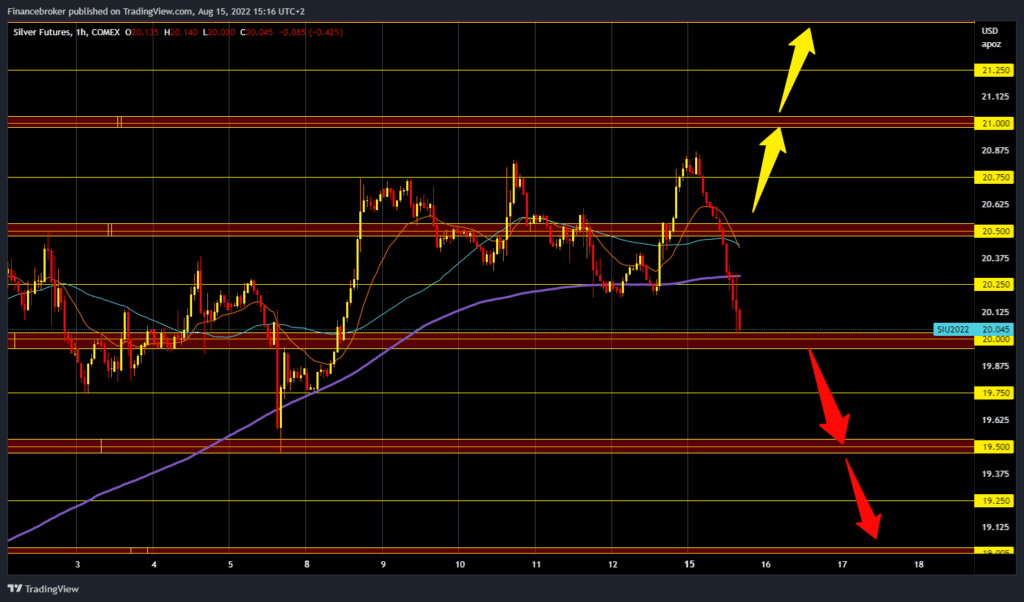

Silver chart analysis

During the Asian trading session, the price of silver retreated from the $20.75 level. The price has already fallen to the $20.00 level and is now looking for potential support here. The support of the MA200 moving average at the $20.5 level was also broken. If we do not find support at the current level, the price of silver could continue the current trend and fall below the $20.00 level. Potential lower targets are $19.57 and $19.50 levels. We need a new positive consolidation and a new bullish impulse for a bullish option. The first target and obstacle is at the $20,25 level due to the MA200 moving average. A break above would help the silver price to release bearish pressure and continue its recovery. After that, we reach the $20.50 level of last week’s consolidation. Potential higher targets are $20.57 and $21.00 levels.

Market Overview

The release of disappointing macroeconomic data from China led investors to believe that a slowdown in the economy could significantly affect the outlook for demand for gold as a safe haven. The increase in risk caused the dollar to strengthen on Friday, and such a trend continued today, the first day of the new week.