Global Stocks lower on Covid-19 concerns

Highlights:

- USA:

Wall Street settled mixed on Friday with the S&P 500 hitting a new record. - ASIA:

The Nikkei lost a slight 0.06% because of the poor performance of technology stocks.

Chinese stocks traded in mixed territory. Trading was delayed on Hang Seng due to a storm, settling with a loss at the end of the session.

Kospi ended almost flat, yielding 0.03%, while the South Korea benchmark bond yield registered advances. - EUROPE:

European shares trade with losses, dragged by travel and banking stocks. Uncertainty about coronavirus is contributing to a slight downturn in the market. - AUSTRALIA:

ASX ended almost flat, with a decrease of 0.0096%, prompted by a Covid-19 lockdown causing losses in travel and tourism stocks.

The S&P 500 ended with a record on Wall Street

Wall Street closed the last day of the week on mixed ground. However, the S&P 500 registered another record, ending its best week since February.

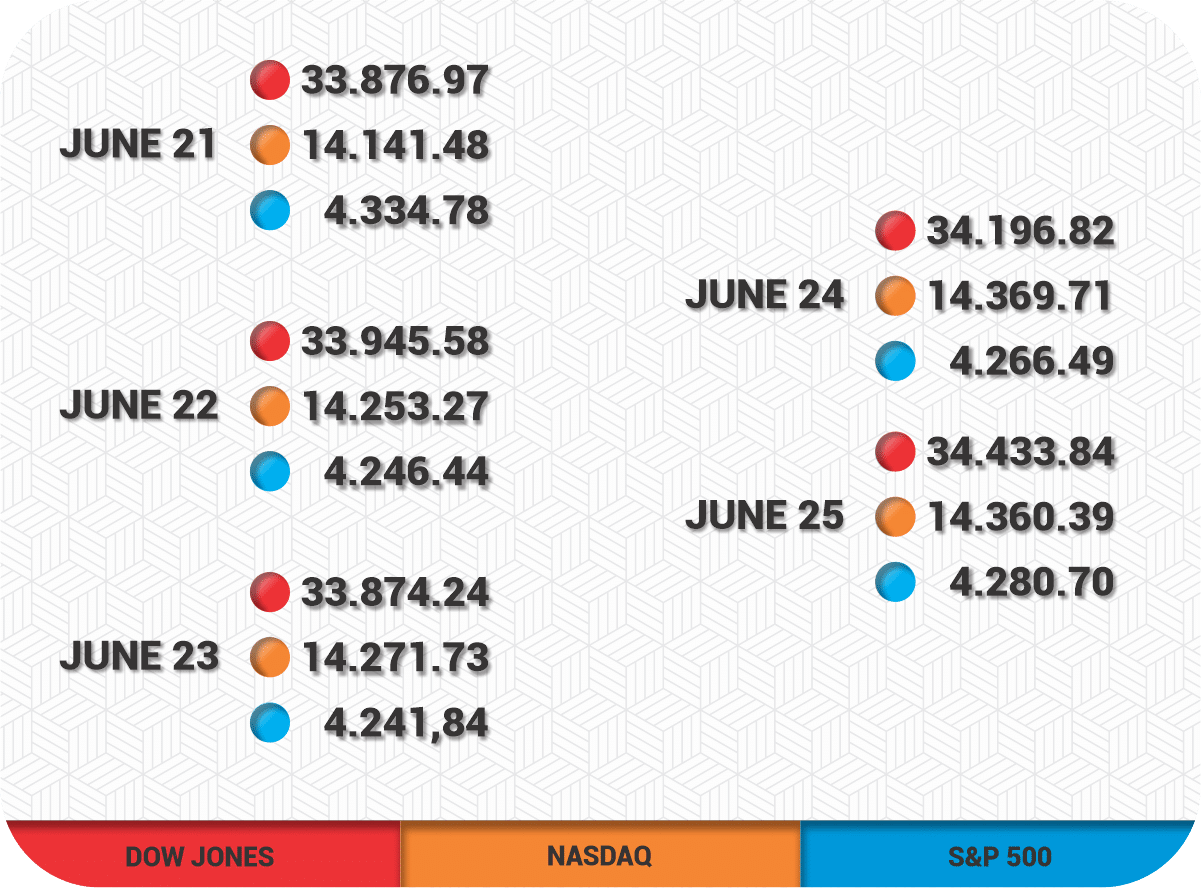

At the close of the NYSE session, the selective S&P 500 rose by 0.33% or 14.21 points, to 4,280.70. Meanwhile, the Dow Jones Industrials advanced by 0.69% or 237.02 points, to 34,433.84.

The Nasdaq Composite Index, which brings together the main technology companies, dropped 0.06% 9.32 points, to 14,360.39.

In the last five sessions of last week, the Dow Jones accumulated a profit of 3.5%. The S&P 500 added 2.7%, and the Nasdaq increased by 2.4%. Last week’s optimism resulted from signs of economic recovery in the US after the coronavirus crisis.

In the first quarter of the year, the country’s economy expanded by 1.6%. According to the latest government estimate, the price index for personal consumption increased by 3.4% in May. It has been the most significant increase since 1992, reflecting inflationary pressures.

Jerome Powell, the Fed president, insisted that those pressures are temporary, and investors are beginning to digest his statement.

Nike shares soared by 15%

At the opening of Wall Street on Friday, Nike shares shot up by 15%. The multinational sportswear company stocks settled with a rise of 15.53% or 20.75 points at 154.35.

In the fiscal year 2021, which ended on May 31, the company earned a net profit of 5.727 million dollars. It was a 127% increase compared to the previous year’s estimates when Nike had to close almost all the shops globally to prevent infections.

During the Q4, the company highlighted record sales in North America, its most crucial region.

Nike has begun the fiscal year 2022 with optimism, expecting to obtain sales of 50,000 million dollars.

Technology stocks dragged Nikkei by 0.06%

Topix, including the firms with the highest capitalization, advanced by 0.15% or 3.02 points to 1,965.67.

The Tokyo stock market started the session with an increase. However, it soon fell into negative territory, weighed by the fall in technology stocks. Still, the losses were balanced by an appetite to purchase undervalued stocks, such as steel firms.

Analysts stated that investors are awaiting fresh data, such as US manufacturing and payrolls.

The best performers on the Nikkei 225 were Seven & I Holdings Co., increasing by 4.47% or 225.0 points to 5258.0. Meanwhile, Hitachi Zosen Corp. gained 4.10% or 29.0 points to 737.0. JFE Holdings, Inc. advanced by 2.87% or 38.0 points to 1360.0.

As for the worst performers on the Nikkei, Ricoh Co., Ltd. dropped by 4.42% or 57.0 points to 1233.0. Konami Corp. declined by 2.97% or 210.0 points to 6850.0. Meanwhile, Toyota Tsusho Corp. yielded 2.21% or 120.0 points to 5300.0.

The Softbank group brought together the highest volume of operations of the day and it declined by 0.07%. Fast Retailing, an owner of Uniqlo, added 2.40% to 84,700.

Rising stocks outnumbered falling ones by 2408 to 1134. At the same time, 232 shares ended unchanged.

The trading volume amounted to 1.97 trillion yen.

Kospi closed a 4-day winning streak due to fears of a Covid-19 rebound

Kospi ended almost flat, with a decrease of 0.95 points, or 0.03%, to close at 3,301.89.

Meanwhile, the Kosdaq technology stock increased by 0.61% or 6.21 points to 1,018.34.

Investors chose to reap profits because of concerns about a new coronavirus outbreak.

The biggest losers of the sessions were the technology and auto sectors. In contrast, financial assets and insurance companies led the rises.

Samsung electronics increased by 0.38%. Sk Hynix, the country’s second-largest chip manufacturer, dropped by 1.95%.

Navar, South Korea’s main internet provider, lost 0.49%. Besides, Samsung Biologics, a pharmaceutical giant, sank by 0.71%.

Hyundai Motor also decreased by 0.82%, and LG Chem, a chemical firm, posted a loss of 0.95%.

The benchmark 10-year yield advanced by 4.1 basis points to 2.141%. The won ended 0.23% lower per dollar, at 1,130.3.

Chinese shares settled mixed

Chinese stocks closed in the mixed territory on Monday. The Shanghai Composite declined by 0.03 or 1.19 points to 3,606.37.

Chinese stocks closed in the mixed territory on Monday. The Shanghai Composite declined by 0.03 or 1.19 points to 3,606.37.

The Shenzhen Component Index increased by 0.98% or 146.32 to 15,150.17.

The blue-chip CSI300 index added 0.2%, to 5,251.76.

Hong Kong’s financial markets closed earlier due to a strong storm which forced Hang Seng to suspend its morning session activities. Trading opened again in the afternoon, with the Hang Seng index retreating by 0.1%. However, it settled with a loss of 0.068% or 19.92 to 29,268.30.

European stocks sink on anxiety caused by inflation and Covid-19

The Pan-European STOXX 600 posted a drop of 0.2% by 0813 GMT. At the same time, travel-related stocks lost between 1.9% and 3.2%.

The travel and leisure index sank to a one-month low following declines in Asia.

As for Banks and mining stocks, they lost between 0.1% and 0.7%. The banking sector has been the biggest loser of the month after travel industry equities.

EuroStoxx 50 was down by 0.41%.

Uncertainty about the coronavirus is contributing to the slight downturn in the market. Several countries have seen a surge in new Covid-19 cases, particularly in Asia and Australia. It is forcing local authorities to impose new restriction measures.

Australian shares almost closed flat amid the Covid-19 lockdown

The S&P/ASX 200 almost closed flat with a decline of 0.0096% or 0.70 points to 7,307.30.

The country imposed some restrictions amid increasing Covid-19 cases. It has caused heavy losses in travel and tourism stocks. Qantas Airways, Webjet Ltd, and Flight Centre Travel Group sank by around 5% each at one-month lows.

Over the weekend, the country reported one of the highest numbers for coronavirus cases, which turned the markets towards trends seen during the pandemic’s early stages.

Sydney began a two-week lockdown on Saturday, prompting a rally in the stay-at-home stocks. As a result, online retailers’ shares surged, and e-commerce names such as Temple & Webster and Kogan.com advanced by more than 10% each.

Panic-buying at supermarkets supported Woolworths to climb by 3% and Coles to add 1.8%.

Local tech stocks dropped by 2.8%, while energy shares advanced by 0.2%, following the upward trend in oil prices. Woodside Petroleum rose by 1.04%, while Santos grew by 1.4%.

The mining sub-index posted an increase supported by higher iron ore prices. BHP Group gained 1.3%, and Fortescue Metals Group jumped by 1%.

-

Support

-

Platform

-

Spread

-

Trading Instrument