Global Stocks Erased from Record Highs

Highlights:

- USA

The Dow Jones lost 323 points, or 0.92%. The S&P 500 slipped by 20 points, or 0.46%, to end the session at 4,402. Meanwhile, the Nasdaq added 19 points, or 0.13%, to 14,780. - ASIA

Thanks to technology shares, the Nikkei climbed by 0.52%.

In contrast, the Kospi closed with a loss of 0.13%, and the Hang Seng lost 0.84% or 221.86 points. - EUROPE

Stoxx 600 hit a new all time record.

Wall street settled mixed on disappointing employment data

Wall Street closed mixed this Wednesday, depressed by disappointing job creation in the private sector in July in the United States.

The Dow Jones lost 323 points, or 0.92%, to 34,792. The S&P 500 slipped by 20 points, or 0.46%, to end the session at 4,402.

The Nasdaq added 19 points, or 0.13%, to 14,780.

According to analysts, markets have digested mixed economic data, including a disappointing jobs report that brought concerns about peak growth and earnings to the fore. According to the monthly survey by the firm ADP, job creations in the private sector in July came out less than half of what was expected, only 330,000.

Fed Vice-President Richard Clarida commented that he could support a reduction in asset purchases as early as this year and, therefore, a reduction in monetary support if the economy allows it. This has also cooled investors sentiment.

The energy sector sank after a sharp decline in WTI prices

Nine of eleven sectors of the S&P 500 settled in the red. The energy sector slumped the most by 2.93% in the wake of falling crude prices.

The industrial sector lost 1.37%, and the essential goods also dropped by a notable 1.26%. Meanwhile, the only sectors closing in green were communications, adding 0.23% and technology, gaining 0.19%.

Amgen posted the most significant decrease in the 30 listed on the Dow Jones, shedding 6.46%. A slump in the company’s shares was related to a reduction in business forecasts for the whole of 2021. It was followed by Chevron slipping by 2.22%. Meanwhile, Walgreens yielded 2%, Dow Inc lost 1.94%, and Caterpillar dipped by 1.89%).

Only shares posting advances were Salesforce climbing by 1.31% and Nike adding 0.36%.

Outside of the group, Robinhood soared by 50% today after a sluggish debut on Thursday. The financial services company has doubled its market value so far this week.

General Motors slumped by 8.8% due to worse-than-expected quarterly results.

Nikkei extends gains for the third day in a row

The Nikkei climbed by 0.52% or 144.04 points to 27,728.12. Meanwhile, the broader Topix index added 7.55 points or 0.39%, at 1,928.98.

Technology stocks profited today thanks to the advance of the Nasdaq on Wall Street driven by robust business results presented on Wednesday after the close.

However, trading was more stagnant in the evening section due to fears related to the rate of Covid-19 infections in Japan. Also, many operators chose to maintain positions while waiting for US employment data to be published on Friday.

Earnings led the shipping, metallurgical and precision instruments sectors.

Shipping company Mitsui OSK lines closed today with a remarkable rise of 6.65%. Meanwhile, its competitor Nippon Yusen soared by 12.69%.

In turn, the manufacturer of photographic equipment Nikon enjoyed a rise of 0.86%. The steelmaker Nippon Steel and Sumitomo Metal advanced by 3.41%.

Sony climbed by 2.57%, and the chipmaker Tokyo Electron gained 2.2%.

On the other hand, the textile group Fast Retailing slipped by 0.7% today. Meanwhile, the world’s largest car producer, Toyota Motor, shed 0.16%.

As for other heavyweights in Tokyo, the Japanese video games giant Nintendo increased by 1.74%.

The session’s trading volume amounted to 2.206 trillion yen.

KOSPI dropped for the first time in four days

The KOSPI closed in the red due to concerns over an economic slowdown.

On the other hand, the KOSDAQ closed higher by renewing the high of the year.

The KOSPI closed with a loss of 0.13% or 4.24 points at 3,276.13.

Foreigners and institutions showed strong buying momentum at the beginning of the market. However, the index failed to maintain its upward trend as foreigners reduced their buying volume.

Most pharmaceutical stocks showed strength as global pharmaceutical companies such as Novavax were affected.

Samsung Biologics rose by 1%, and Green Cross gained 3.67%, supporting the stock price of the KOSPI.

Meanwhile, the KOSDAQ index closed with a rise of 1.11% or 11.61 points at 1,059.54, setting a new high for the year.

The paper, wood, and internet industries showed a strong uptrend, supporting the KOSDAQ index.

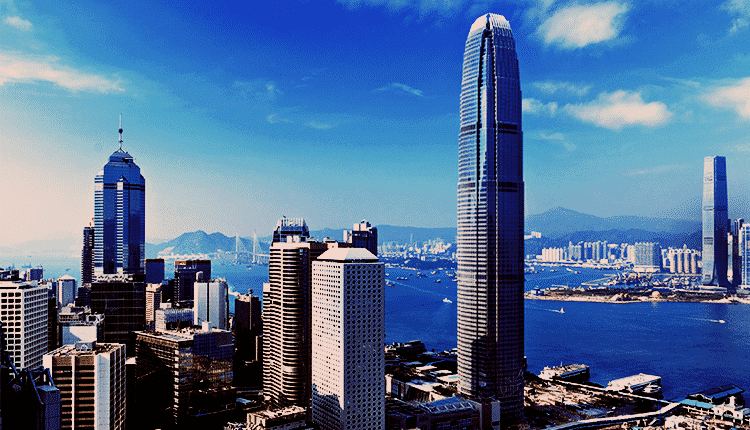

Hang Seng dipped on regulatory worries and the Covid-19 outbreak

All the sub-indices closed in negative territory. Finance lost 0.13%, Commerce and Industry dropped by 1.14%, Services shed 1.61%, and Real Estate sank by 1.64%.

The worst performers of the day were CG Services slipping by 4.75% and Hang Lung Properties, yielding 3.94%.

In the financial area, the HSBC bank advanced by 0.35%. However, it was not enough to offset the falls of the state-owned companies. ICBC declined by 0.69% and Banco de Comunicaciones lost 0.87%.

Tencent, which has been seeing volatility these days, fell by 3.9% today.

Among the other two large digital trading conglomerates, Meituan followed the same trend and lost 1.12%. In contrast, Alibaba advanced slightly by 0.1%.

Among the Chinese state oil companies, Cnooc was the only one posting increases. The firm added 0.51% while Sinopec shed 0.55% and Petrochina lost 2.43%.

The business volume of the session amounted to 161,750 million Hong Kong dollars.

European stocks hit new highs

The Stoxx 600 index hit an all-time high on Thursday, advancing by 0.3%. Solid profits of Novo Nordisk and Siemens overbalanced weakness in miners and banking shares.

Danish company Novo Nordisk surged by 4.1% after increasing its full-year outlook. It posted better-than-expected quarterly earnings on substantial sales and demand for its new obesity drug.

German industrial firm Siemens soared by 3.6% as it raised its profit forecast for the third time this year.

European equities are on the way for their most robust weekly performance in three months. Despite a surge in Covid-19 cases and worries about inflationary pressures, there were upbeat quarterly earnings and relaxed monetary policy supported markets. Still, Frederique Carrier from RBC Wealth Management believes that correction is not ruled out amid the Delta variant outbreak, and the markets are pretty vulnerable.

Still, as long as there is no recession in sight, they stand to recover.

Investors now have an eye on a policy decision from the Bank of England later in the day.

-

Support

-

Platform

-

Spread

-

Trading Instrument