GBP/USD forecast for January 11

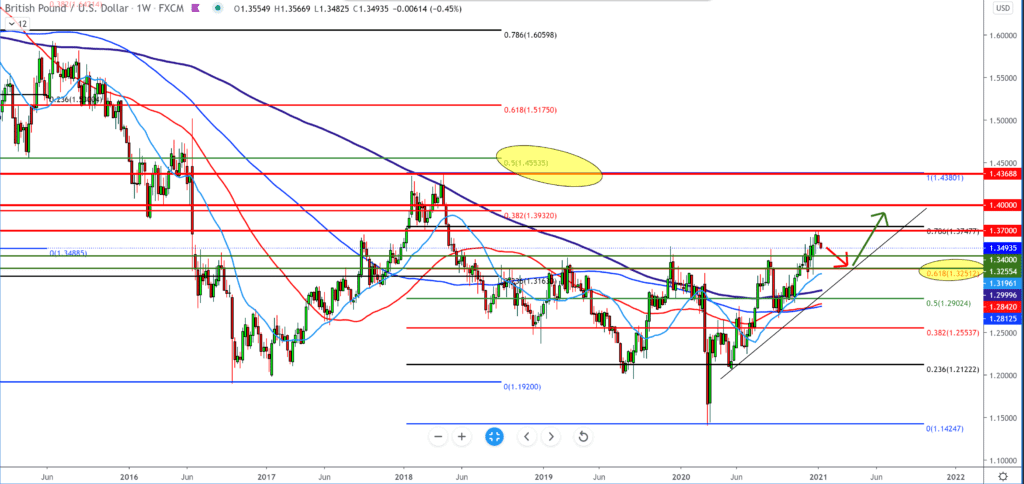

Looking at the chart on the weekly time frame, we see that the pair has reached the Fibonacci level of 78.6%, and for now, this represents a good resistance to higher levels. We can expect a pullback to a Fibonacci level of 61.8% at 1.32500, all within the correction to better support. The announcement that the whole of Great Britain will be locked due to the increased number of newly infected with coronavirus and a new strain of the new virus. All of this together affects the pound, which is now under pressure, and we will probably see it on the lower new ones on the chart.

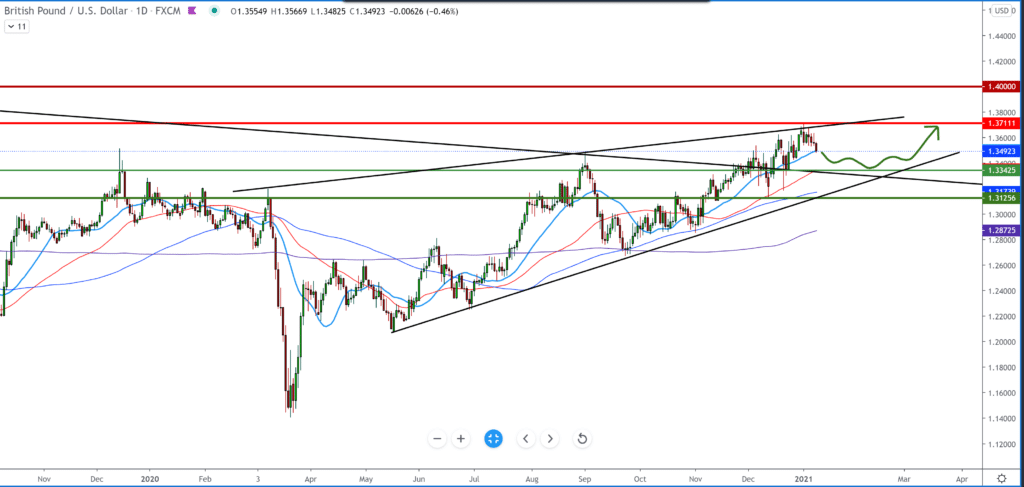

On the daily time frame, we see the pair moving in the ascending channel, where it touched the channel’s upper edge for the third time and bounced off it making a pullback. Now the moving average MA20 (light blue line) is being tested. The dollar has strengthened in the last few days, which has also affected this currency pair. Our target can be the 1.3300-1.35000 bottom line of the ascending channel if we see a correction.

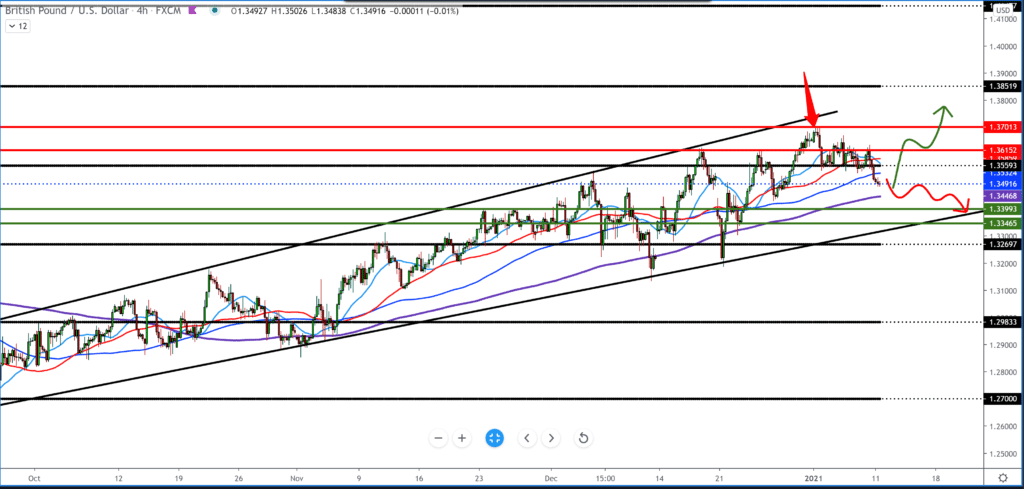

In the four-hour time frame, we see how the correction moves. The break was made below the moving averages of MA20, MA50, and MA100, and it is now very likely that the pair will continue to descend further down. We can ask for the first support below at 1.34480; if it fails to keep the pound, we are waiting for it at 1.33500.

The U.S. dollar increased its profits along with rising U.S. bond yields. The treasury’s return began to gather after the Democrats won effective control over the Senate, enabling them to bring a large package of incentives. The bond sale has been extended as the Federal Reserve seems to tolerate rising long-term interest rates – seeing it as a sign of hope for a recovery later in the year. London hospitals are in a desperate situation – medical services are asking the public to follow the rules in the midst of growing fatigue from the pandemic. Variants of the virus have caused a faster spread of the disease, and recent measures have not yet moved the case. In any case, the economy is undoubtedly struggling and sterling times. Support may come from the government – Treasurer Rishi Sunak is due to speak in parliament later in the day to discuss the state of the economy and potentially provide more fiscal relief. Overall, the focus is on vaccine/virus news and yields in the U.S. – depending on the Fed.

-

Support

-

Platform

-

Spread

-

Trading Instrument