GBP/USD forecast for December 07, 2020

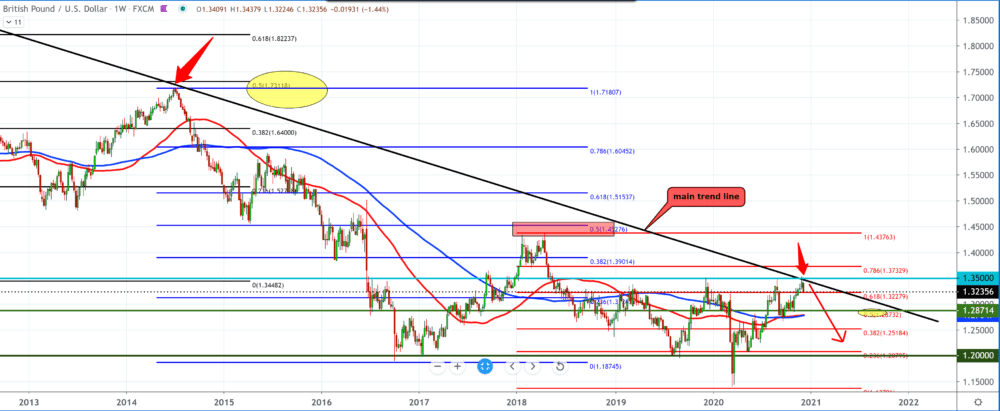

Looking at the chart on the weekly time frame, we can see that the GBP/USD pair is declining from the upper main trend line to 1.35000. To get potential trading targets, we can use Fibonacci levels as possible supports or consolidation zones to continue the trend. Moving averages of MA50 and MA100 are far below at 1.27500-1.28000, where we can find potential support. The week has just begun, and if this candlestick closes like this as it looks now, the bearish scenario continuation is very likely by the end of the year.

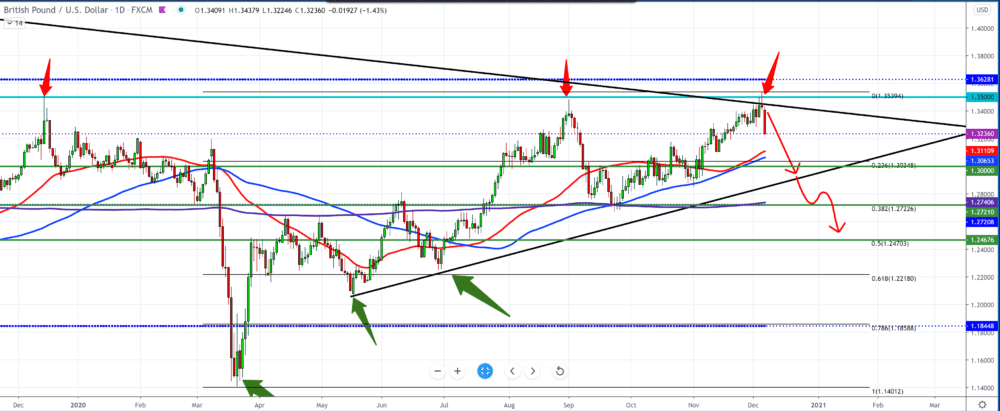

On the daily time frame, we also see a price confirmation of 1.35000 and confirm the main trend line’s upper resistance. The couple refused to do so and headed down, which was helped by the statement that the European Union was preparing for Brexit without an agreement, which harmed the pound.

When we adjust the Fibonacci, we see that our first support level of 23.6% coincides with the moving averages of MA50 and MA100, and here we can look for potential support for the pound. Below that, at the Fibonacci level of 38.2%, we have a match with MA200.

EU chief Brexit negotiator Michel Barnier briefed the Union’s national ambassadors and said differences on three key outstanding issues remain open. On the other hand, The Sun reported that the United Kingdom’s prime minister, Boris Johnson, is ready to withdraw from the Brexit negotiations in response to the new EU demands.

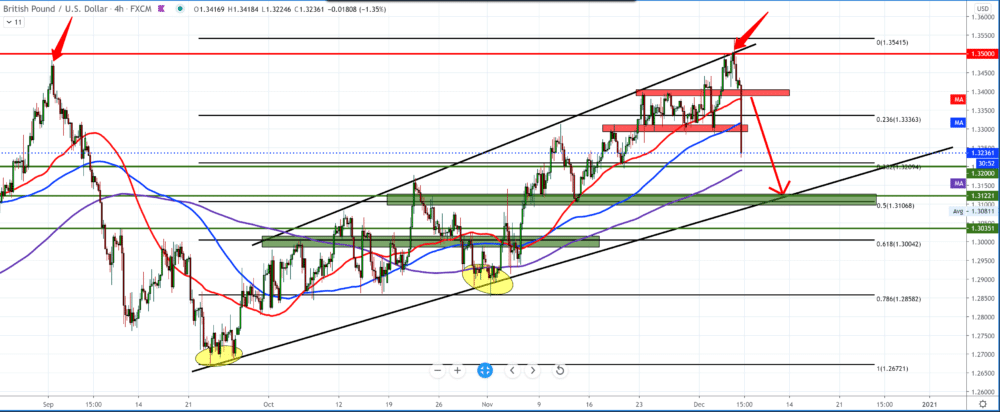

On the four-hour time frame, We see confirmation of all of the above on the larger time frame. We have a rising channel that has resistance at the top at 1.35000 and that after the negative news and the pound, we have a huge drop for now almost 300 pips.

The break is a moving average of MA50 and MA100; higher support for the pound can be on the Fibonacci 50.0% with MA200. The bearish scenario is very likely and will put pressure on the pound until the Breagzit deal is resolved, as well as the announcement that the UK will be lockdown until 10 January.

-

Support

-

Platform

-

Spread

-

Trading Instrument