GBP/USD forecast for December 01, 2020

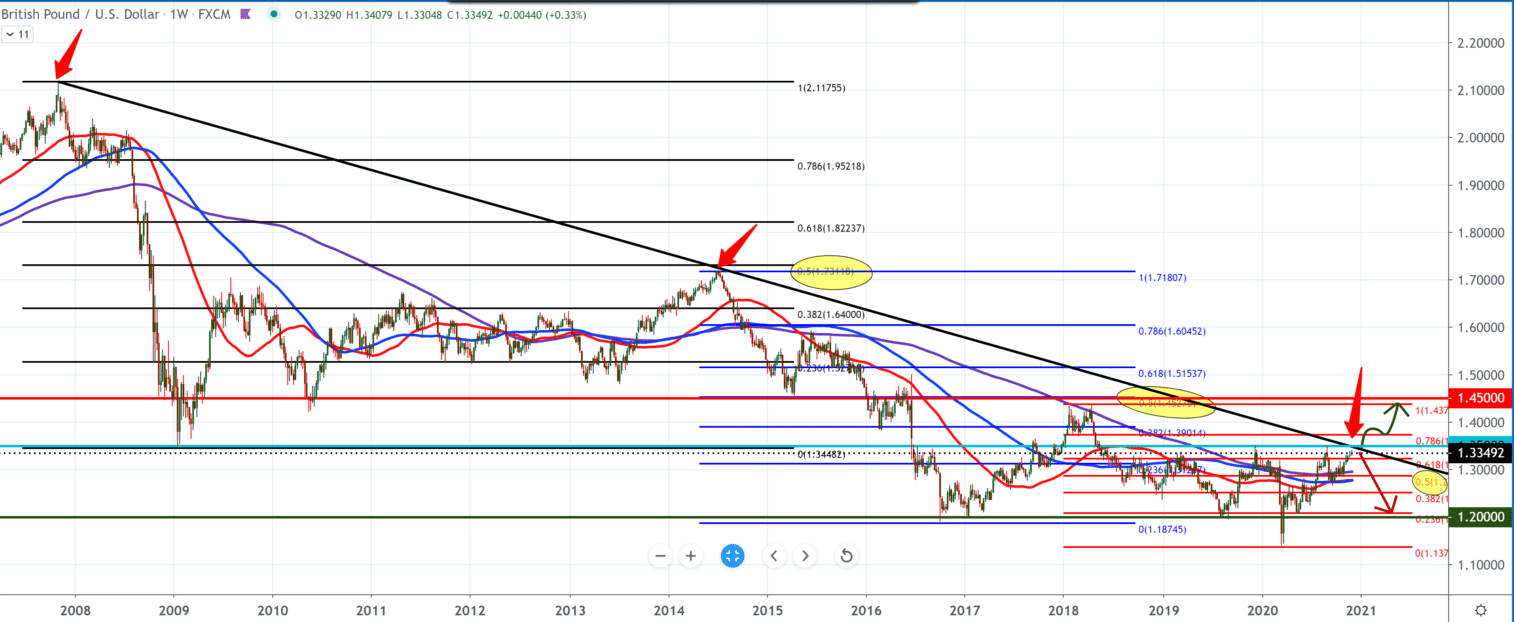

Looking at the chart on the weekly time frame, we will notice that we have a trend line at the top when we connect the previous peaks. By placing Fibonacci at certain levels, we will see that the GBP/USD pair moves according to a certain pattern with a pullback to a Fibonacci level of 50.0%. Fibonacci setting on the chart, a red color we see that the 50.0% set level is supported along with moving averages MA200, MA100, MA50, but on the upper side we have a big trend line which is long-term resistance.

That trend line and place of potential testing around 1.35000 coincides with the Brexit deal’s expiration on 31 December. Bullish scenario but with certain limits. If Brexit is agreed a bullish scenario is then very likely.

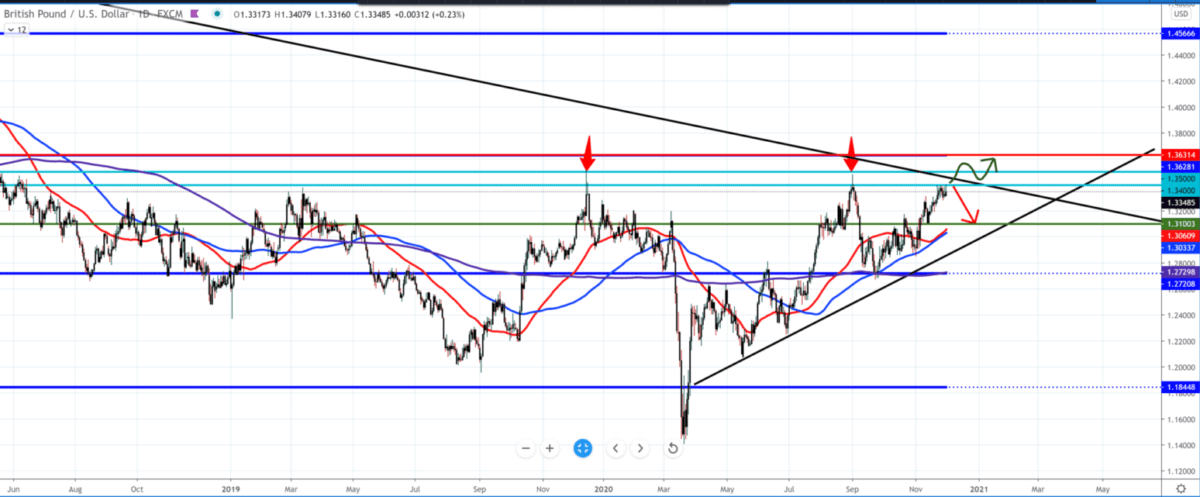

On the daily time frame, we see that it is now under pressure just below 1.34000 and that there is a likelihood of a larger pullback to the moving sections MA50 and MA100 to find support up to 1.31000. If we have any positive news about Brexit, we can expect the bullish moment to continue.

Neither the UK nor the European Union is ready to withdraw on key issues such as fisheries, equality, and governance. In contrast, British Prime Minister Boris Johnson reiterated that the British are refraining from changing sides, preparing companies to leave without an agreement.

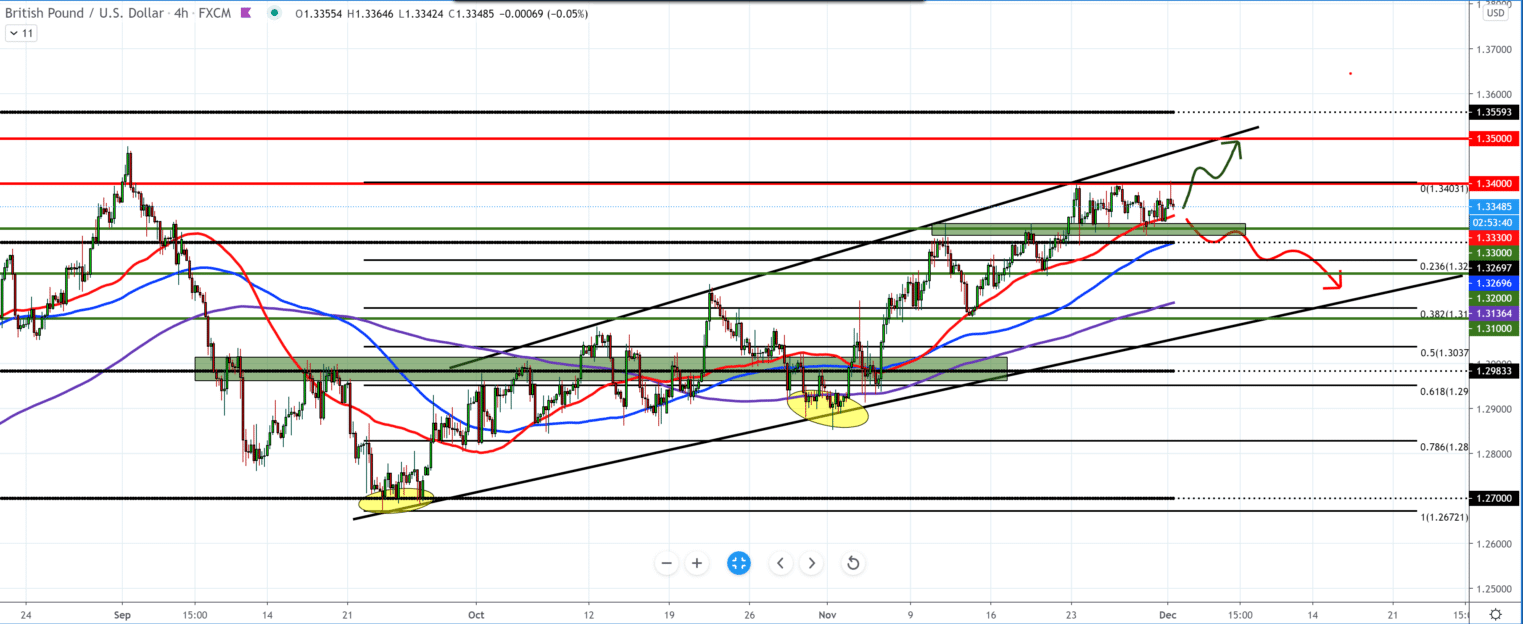

The four-hour time frame tells us that investors are patient and waiting for some concrete move regarding Brexit, Britain is a lockdown, but the vaccine is a balance of that and a risk-off for investors but with restraint.

As support GBP on the chart is the moving average MA50, if we see the break MA50 from below, we are waiting for MA100. This morning for the pound, we had news. The PMI manufacturing was positive for November and kept the pound at the current level. In the afternoon for the dollar, we will have news from Fed spokesman Jerome Powell on the potential impact on the market.

After that, another important news from the Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector, according to forecasts, a weaker report is expected. Consolidation on a four-hour time frame without any indication of a potential trend for this currency pair.

-

Support

-

Platform

-

Spread

-

Trading Instrument