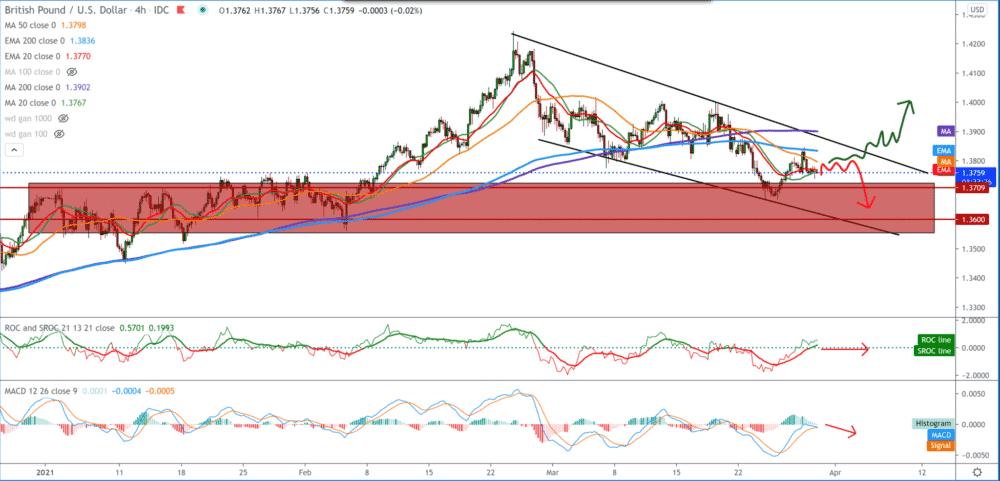

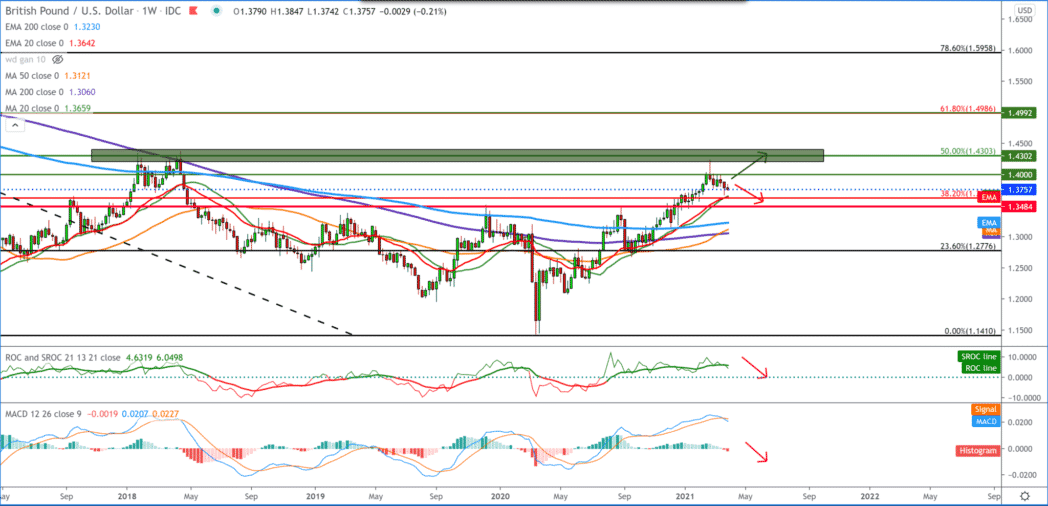

GBP/USD analysis for March 30, 2021

Looking at the GBP/USD pair graph on the four-hour time frame, we see a declining consolidation within the parallel channel frame, with the current pressure of the larger moving averages MA200 and EMA200. All this indicates that we will have a continuation of the bearish trend to some better support. Below us, a zone of the previous consolidation awaits, which has become a bullish trend. It could also be a support and potential retest to the top line of this zone around 1.37000. Rising US bond yields are strengthening the dollar, pushing other currencies into the background.

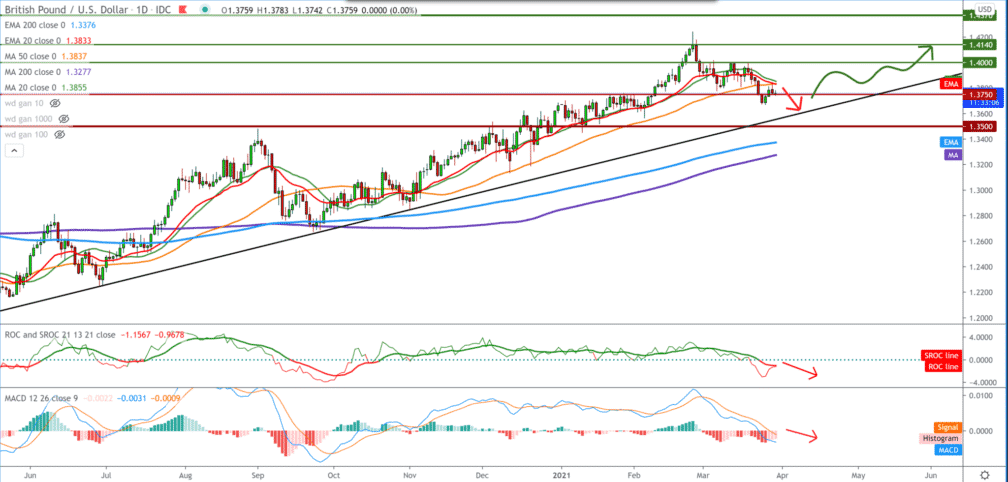

We see that the MA20, EMA20, and MA50 have moved to the bearish side on the daily time frame, giving us a sales signal at least to the bottom trend line or the MA200, EMA200 longer-term support on the GBP/USD pair chart. The UK’s good economic performance is not of much help as the dollar is too strong with rising yields on US bonds. The rapid vaccination of Americans and the opening of certain US states are also good indications that America is rapidly emerging from the crisis. In the UK and Europe, which is lagging in vaccinating citizens and increasing the number of newly infected with the coronavirus. Some EU officials predict that the lockdown will last after the Easter holidays.

From economic news for the GBP/USD currency pair, we can single out the following:

Mortgage borrowing in the UK increased in February to its highest level since 2016, as the government extended the annual customs tax until the end of June, data from the Bank of England showed on Monday. According to the BoE, net mortgage borrowing was £ 6.2 billion, the strongest since March 2016. That was also more than the expected level of £ 5 billion. Although the UK is expected to break the blockade in the coming months, the outlook for finances over the next year remains weak and deteriorating slightly from the fourth quarter of 2020.

-

Support

-

Platform

-

Spread

-

Trading Instrument