GBP/USD analysis for April 21, 2021

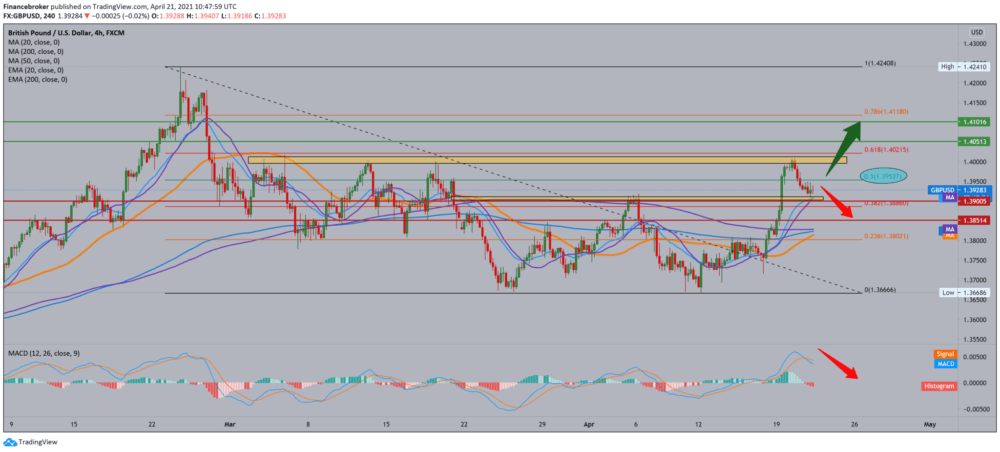

Looking at the chart on the four-hour time frame, we see that after arriving in the zone around 1.40000, the GBP/USD pair makes a pullback with Fibonacci 61.8% level, falling further below 50.0% with the goal of finding support at 38.2% level at 1.38850. At that level, we are also waiting for the moving averages MA20 and EMA20, which can give a certain boost and lead customers to buy the pound and return it to the bullish trend again. The MACD indicator is in the early phase of the bearish trend, and based on it; we can expect a further continuation of the decline of this pair down to better support.

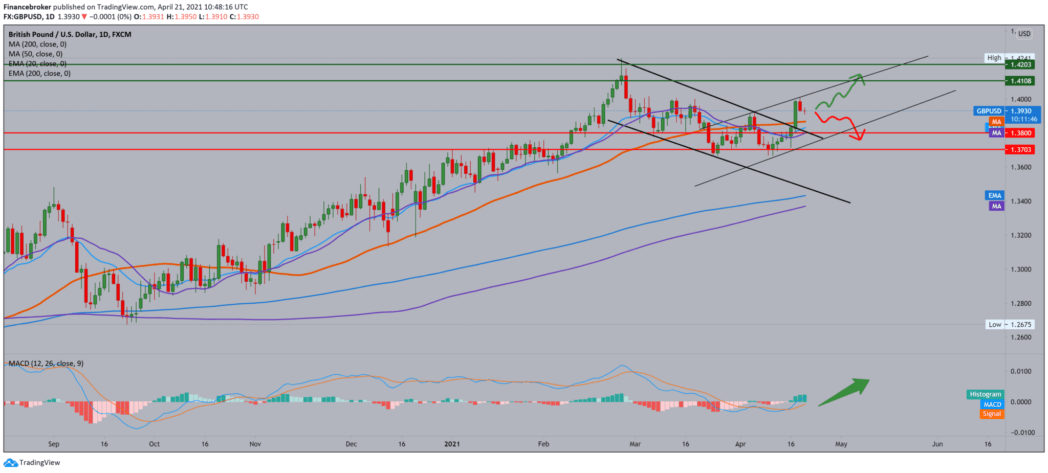

On the daily time frame, we see that the GBP/USD pair was in a pullback yesterday and that today the price has stabilized at the current 1,39300. The GBP/USD pair supports moving averages from the bottom, but we can expect further pullback so that the GBP/USD pair can find better support and find better momentum for the next bullish impulse. The MACD indicator has been in a bullish trend since the beginning of April, giving us support for further continuation, perhaps above 1.40000.

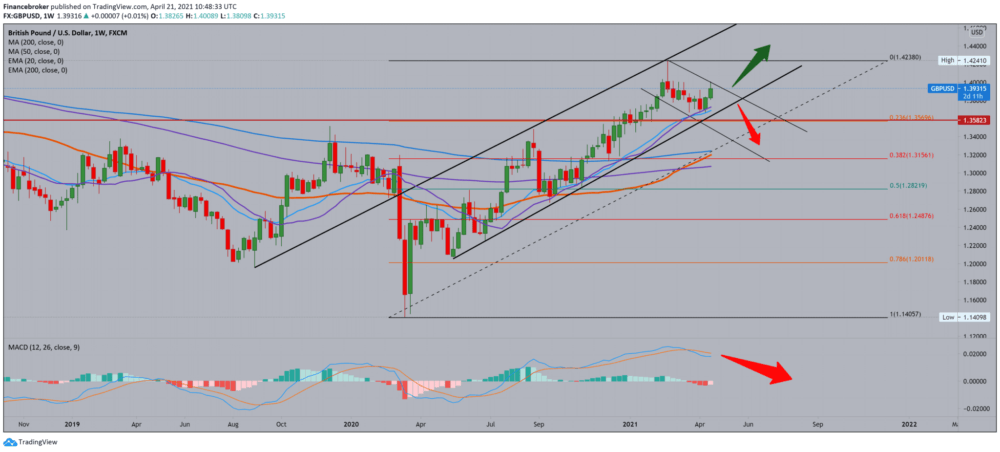

On a weekly time frame, we see that the GBP/USD pair is in a large growing channel, with good support on the channel’s bottom line, which coincides with MA20 and MA20. The current obstacle to the continuation of the bullish trend may be our psychological level at 1.40000. So we can expect to test the bottom line of support for both MA20 and EMA20 once again. Looking at Fibonacci, our support is 23.6% level at 1.35700. The MACD indicator on this time frame is also a bearish trend, showing that the pound has weakened and that the bearish is currently in the lead. Based on this, we can expect the MACD indicators to approach the middle and zero lines.

On a weekly time frame, we see that the GBP/USD pair is in a large growing channel, with good support on the channel’s bottom line, which coincides with MA20 and MA20. The current obstacle to the continuation of the bullish trend may be our psychological level at 1.40000. So we can expect to test the bottom line of support for both MA20 and EMA20 once again. Looking at Fibonacci, our support is 23.6% level at 1.35700. The MACD indicator on this time frame is also a bearish trend, showing that the pound has weakened and that the bearish is currently in the lead. Based on this, we can expect the MACD indicators to approach the middle and zero lines.

-

Support

-

Platform

-

Spread

-

Trading Instrument