GBP/NZD Forecast for March 12, 2021

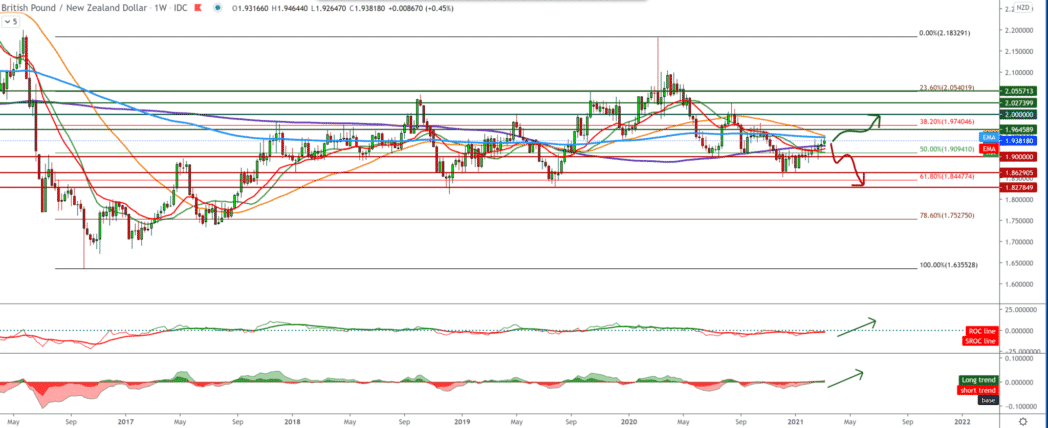

Looking at the chart on the weekly time frame, we see that the GBP/NZD pair has been in a bullish trend since December 2020 and has managed to break above the MA200, but we are testing the EMA200 at 1.95000 can potentially resist our higher targets on the chart. If we fail to do so, we go back down to 1.90000, asking for support in MA20 and EMA20. By setting the Fibonacci retracement level, we see the first rejection of 61.8% level and then the crossing over 50.0%, targeting 38.2% level as the next target.

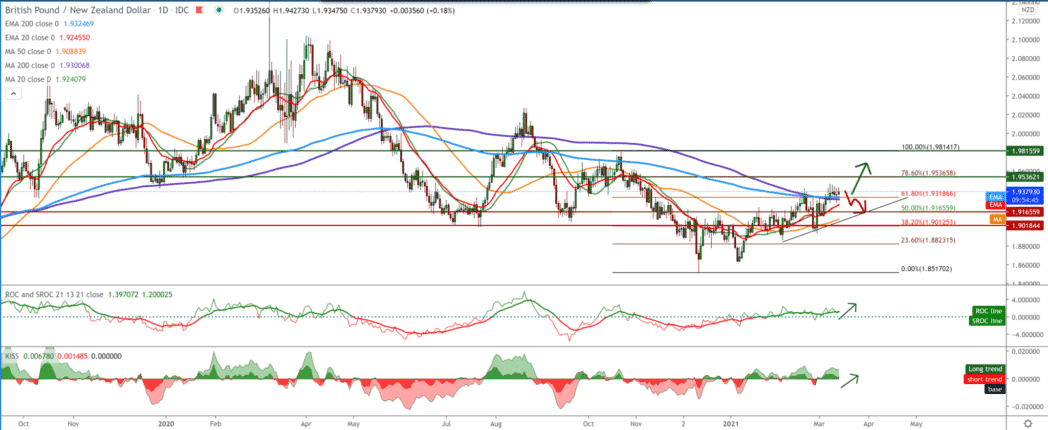

On the daily time frame, we see that the GBP/NZD pair made a break above all moving averages but that they encountered a minor obstacle. The GBP/NZD pair slowed down and failed to pass the psychological level to 1.95000. The bullish trend is still in effect, but a potential pullback awaits us for the GBP/NZD pair to find better support, and the MA50 seems to be the best indicator for the bullish trend to continue at 1.91500. By setting the FIbonaci retracement level we see that the pair has broken 61.8% level to 1.93150 and is now consolidating slightly above. If the pair manages to consolidate better, we can expect it to climb to 78.6% fibonacci level to 1.95300.

In the four-hour time frame, we see that the GBP/NZD pair moves in one growing channel with the support of all moving averages. We can expect the GBP/NZD pair to move within this channel in the coming period, so if the GBP weakens, we will see a pullback to the channel’s bottom line, where support with the MA200 and EMA200 awaits us. And if the GBP continues to strengthen, we will soon see a pair above 1.95000, making a new higher high on the chart.

From the news for the GBP/NZD pair, we can single out the following: British inflation expectations for next year have remained unchanged. The Bank of England’s quarterly Attitudes Survey on Inflation showed on Friday. Inflation for the next year was recorded at 2.7 percent, unchanged compared to the November survey. Simultaneously, inflation expectations for the twelve months thereafter rose slightly to 2.2 percent from 2.1 percent. Five-year inflation expectations remained unchanged at 2.9 percent.

The British economy contracted at the beginning of the year due to restrictions on pandemic control. Still, the pace of decline was slower than economists expected, data from the National Statistics Office revealed on Friday. Another ONS report showed that the January monthly decline in imports and exports was the largest monthly decline since records began in January 1997.

Gross domestic product fell 2.9 percent on a monthly basis, reversing the growth of 1.2 percent in December. However, this was slower than economists had predicted for the 4.9 percent reduction. Despite a significant blow to January GDP, the economy looks poised for a decent recovery in activity during the second quarter, said James Smith, an ING economist.

The housing market in New Zealand is likely to undergo a pronounced correction, the International Monetary Fund warned on Friday. Concluding discussions on Article IV, IMF staff said growing speculative demand for housing, coupled with historically low-interest rates and structural housing shortages, amplifies the housing cycle and raises concerns about financial stability and affordability. Unsustainable house prices relative to income, tightening credit standards, or a sharp rise in mortgage rates could trigger a possible, pronounced correction.

-

Support

-

Platform

-

Spread

-

Trading Instrument