GBP/NZD forecast for January 4

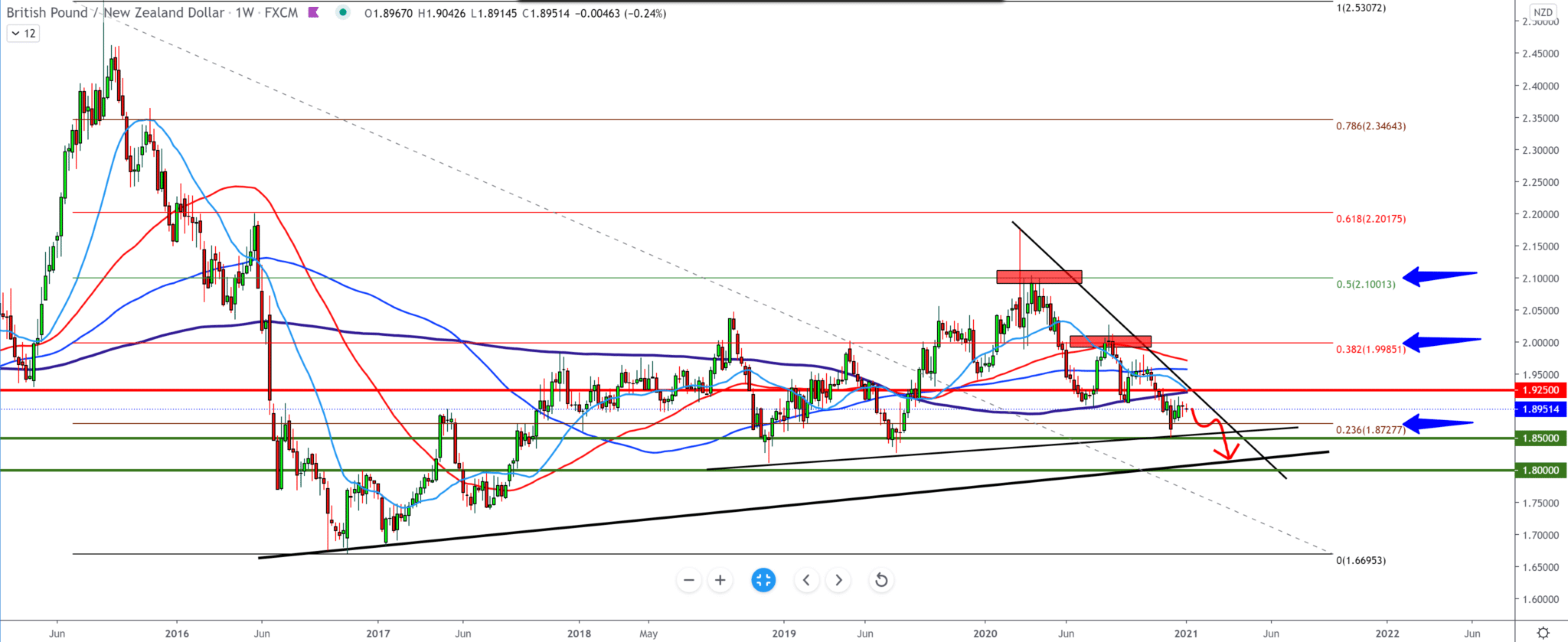

Looking at the chart on the weekly time frame, we will notice that the pair is under high pressure below 1.92000 and below all moving averages. The pressure on the pound continues this year; Brexit has been agreed upon, but now it needs to be applied on the ground, but it will take time to do so. Technically, the Fibonacci indicator shows us that we have a withdrawal at certain levels. We first had a pullback with 50.0% Fibonacci levels and then with 38.2%. Looking at moving averages, we can see that if this continues, the pair will fall to 1.87000, testing Fibonacci level 23.6%.

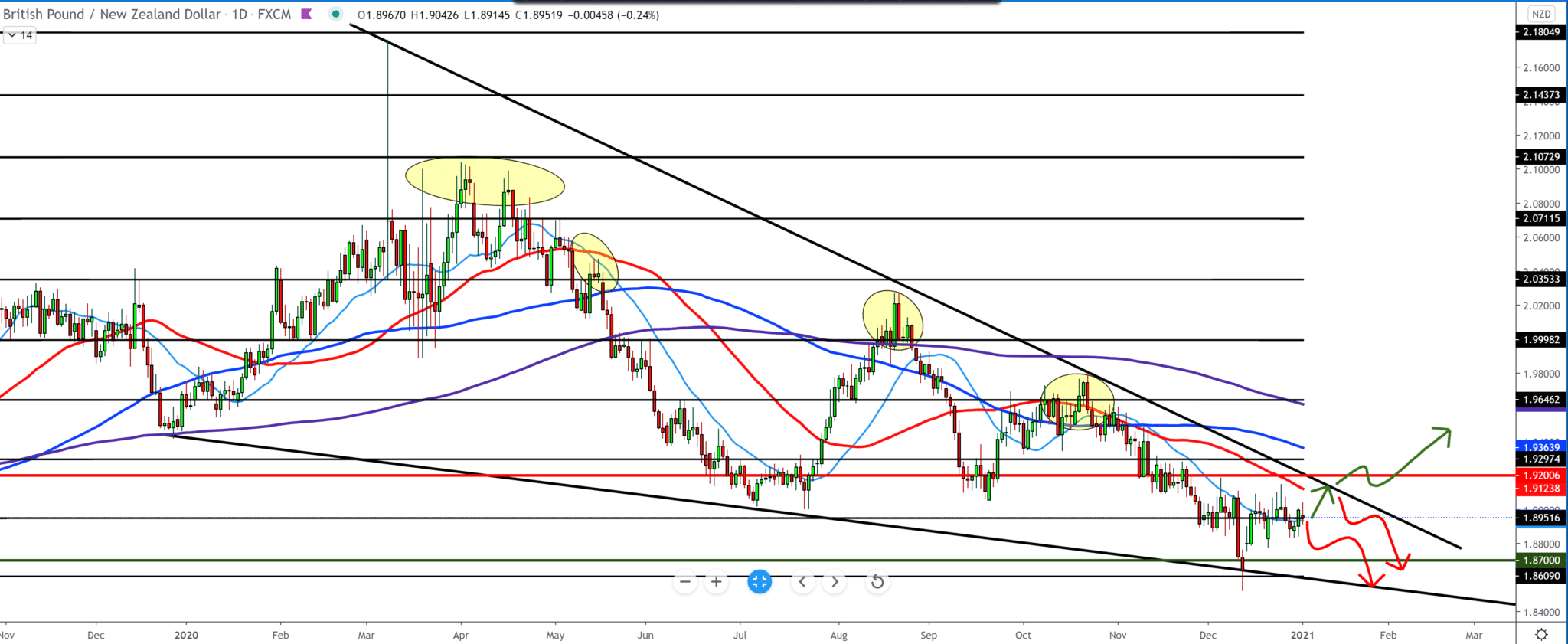

On the daily time frame, we see the pair moving in a descending channel to continue towards lower levels. The pair is currently testing 0.90000, a critical zone for the pound. From the top, we see that we have the pressure of moving averages MA50, MA100, and MA200, while the pair has slight support for MA20. We can expect a pullback from the top line of the descending channel.

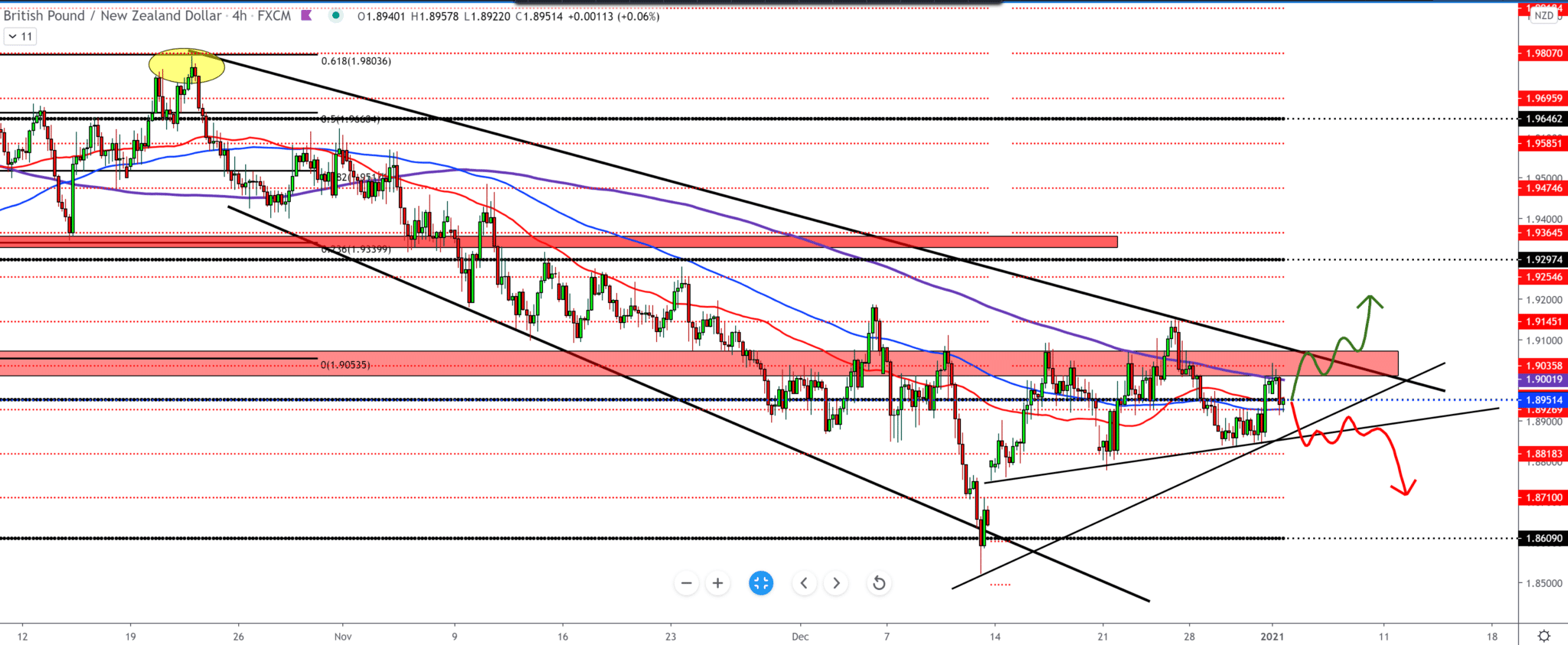

On the four-hour time frame, we see that the pair is likely to consolidate around 1.90000. The moving average of the MA200 is good resistance from the top for now, plus we also have a trend line as a resistance line. We can expect a bigger shift in the chart only next week. For the bullish scenario, we need a break above 1.90500, while a stronger bearish scenario awaits us below 1.88500. We have a lot of news for the British pound this week to expect volatility on this pair. In addition to economic news, any news of a new virus and vaccination will impact the charts.

-

Support

-

Platform

-

Spread

-

Trading Instrument