GBP/NZD forecast for December 08, 2020

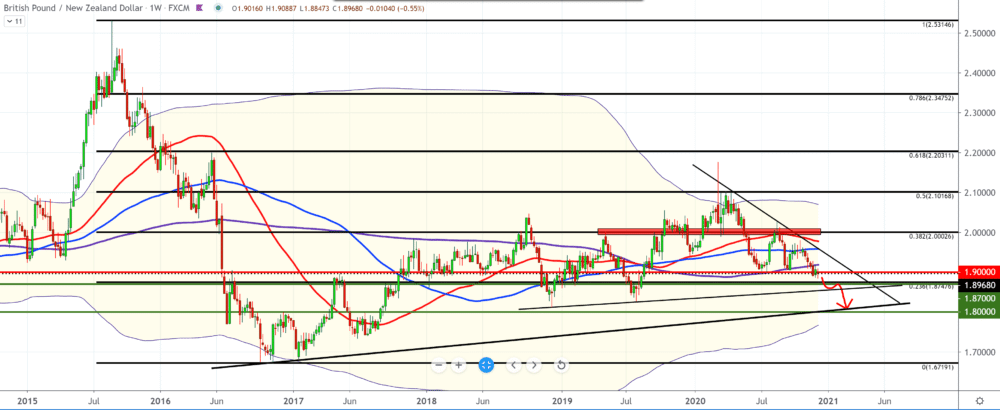

Looking at the chart on the weekly time frame, we see that the GBP/NZD pair has fallen below 1.90000 and made a break below the moving averages of the MA50 and MA100 and the essential MA200 support.

It is necessary to observe how the rear candlestick will close below MA200 or beyond. Brexit pressure is reflected in all currency pairs, including GBP/NZD. The bearish scenario is very likely to some better support in the coming period, either a trend line or a moving average break.

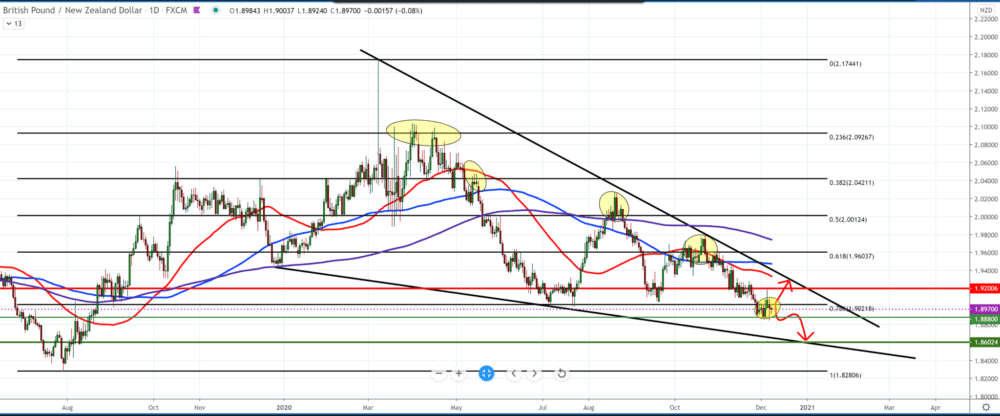

Fibonacci levels dominate the daily time frame of the trend tracking tool. After the first impulse, we see less consolidation, retest, and continuation fall to lower levels during the pullback on each Fibonacci level. From the top, we also see the overlap of the two moving averages MA50 and MA100 that follow the decline of this pair towards lower levels. It will take us another day or two to better confirm the bearish scenario.

The four-hour time frame gives us the best picture of the movement of the GBP/NZD pair. We see that after the rejection at the Fibonacci level of 61.8%, the pair begins to fall sharply, branding one parallel channel, with upper resistance and resistance from the moving averages MA50 and MA100.

It is currently possible to pullback to the upper channel line in zone 1.9000-.1.9050. For the bullish scenario, we need a break outside the parallel channel with MA50 and MA100 support. Otherwise, we have a continuation of the bearish scenario towards lower new ones at 1.8700-1.8800.

From this week’s news for GBP and NZD, we can single out the following: tomorrow’s report for New Zealand Dollar Manufacturing Sales and Australia and New Zealand Banking Group Limited (ANZ) Business Confidence.

GBP/AUD forecast for December 08, 2020

Important economic news for the pound on Wednesday is Gross Domestic Product (GDP) and Manufacturing Production. In addition to this news, a critical factor is Brexit, where political statements can bring additional volatility to the market.

-

Support

-

Platform

-

Spread

-

Trading Instrument