GBP/NZD analysis for April 13, 2021

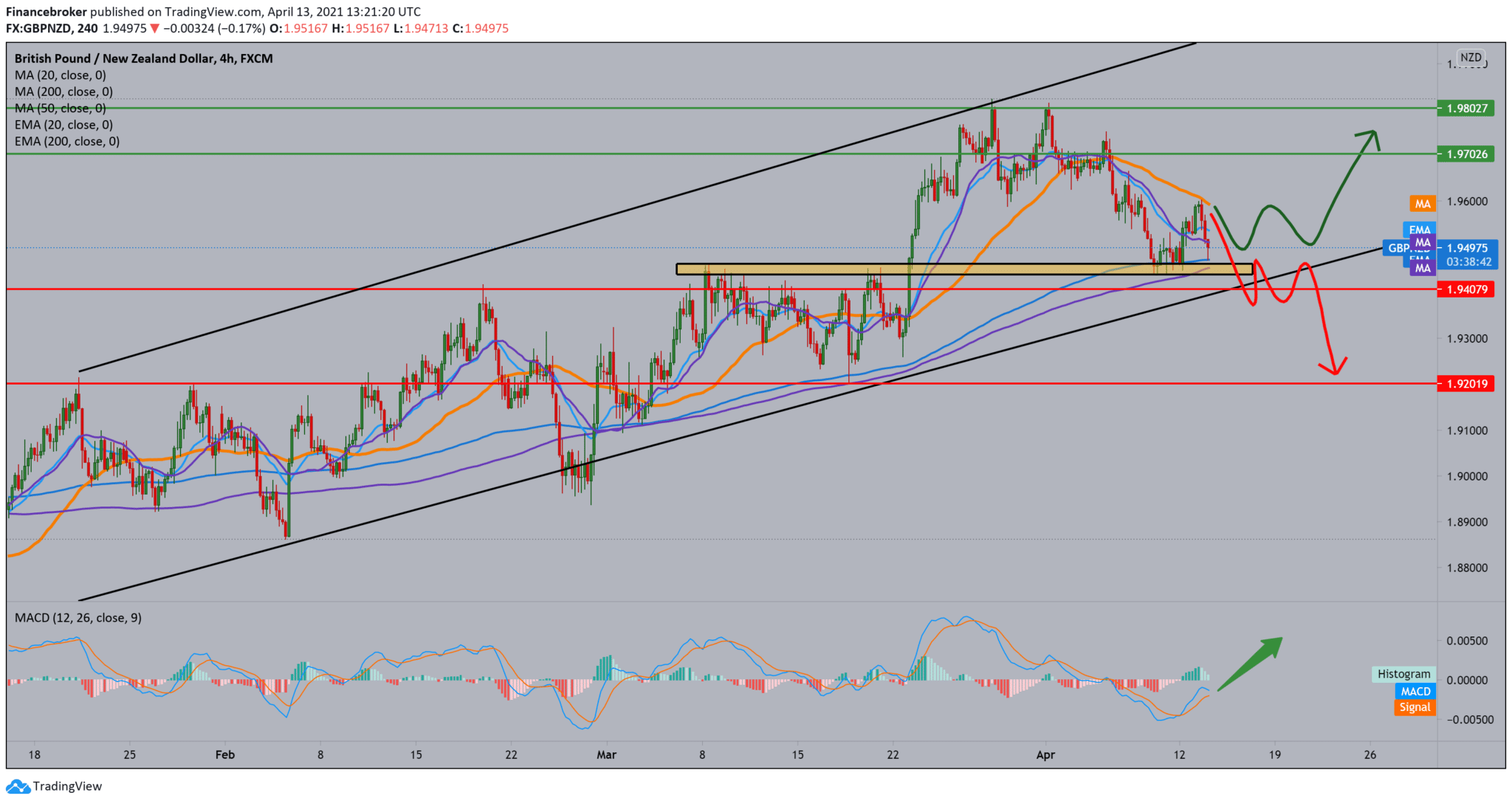

Looking at the chart on the four-hour time frame, we see the movement in a growing channel with support for moving averages, especially with the MA200 and EMA200. For a stronger bullish sequel, we also need a break above the EMA50. The GBP/NZD pair finds support at 1.94500 by retesting the previous higher high. If it doesn’t last and the GBP/NZD pair makes a break below that level and a drop below MA200 and EMA200, as well as the lower support lines, we descend to zone 1.92000-1.94000. If the GBP/NZD pair endures and makes a beak above, we look at the 1.97000 -1.98000 zone with a view to the psychological level at 2.00000.

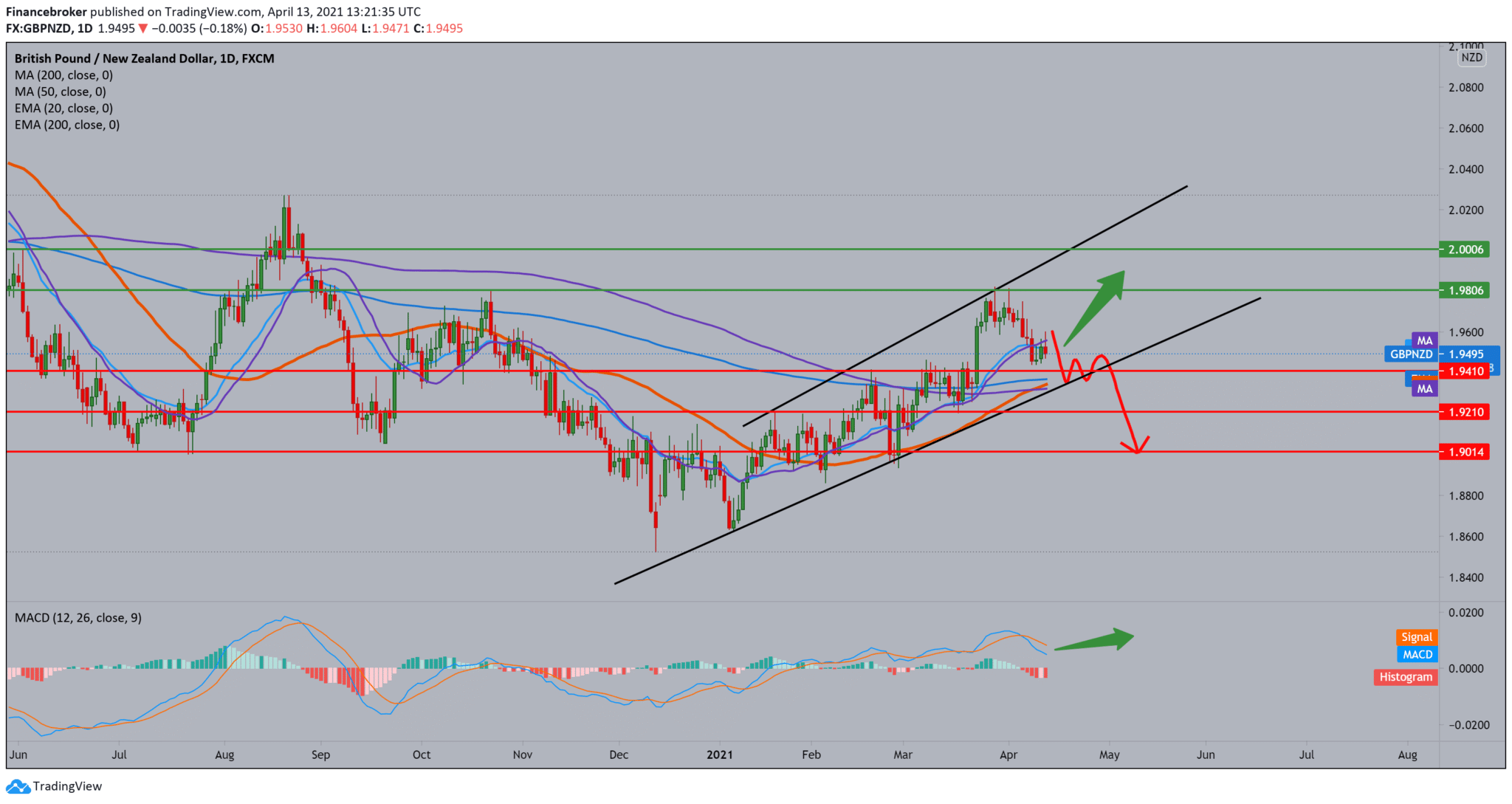

We see a larger growing channel with a break above MA200 and EMA200, which can be good support on the daily time frame. After arriving in the zone at 1.98000, we see a steep drop to 1.94500 and then the consolidation at that level. While we are on this channel, we only watch bullish and continue to conquer new targets. Looking at the MACD indicator, we see that the blue MACD line is for now below the signal line giving a bearish signal. Still, the indicator slows down, moving sideways, making the last two histograms which show that the bearish option is slowly fading.

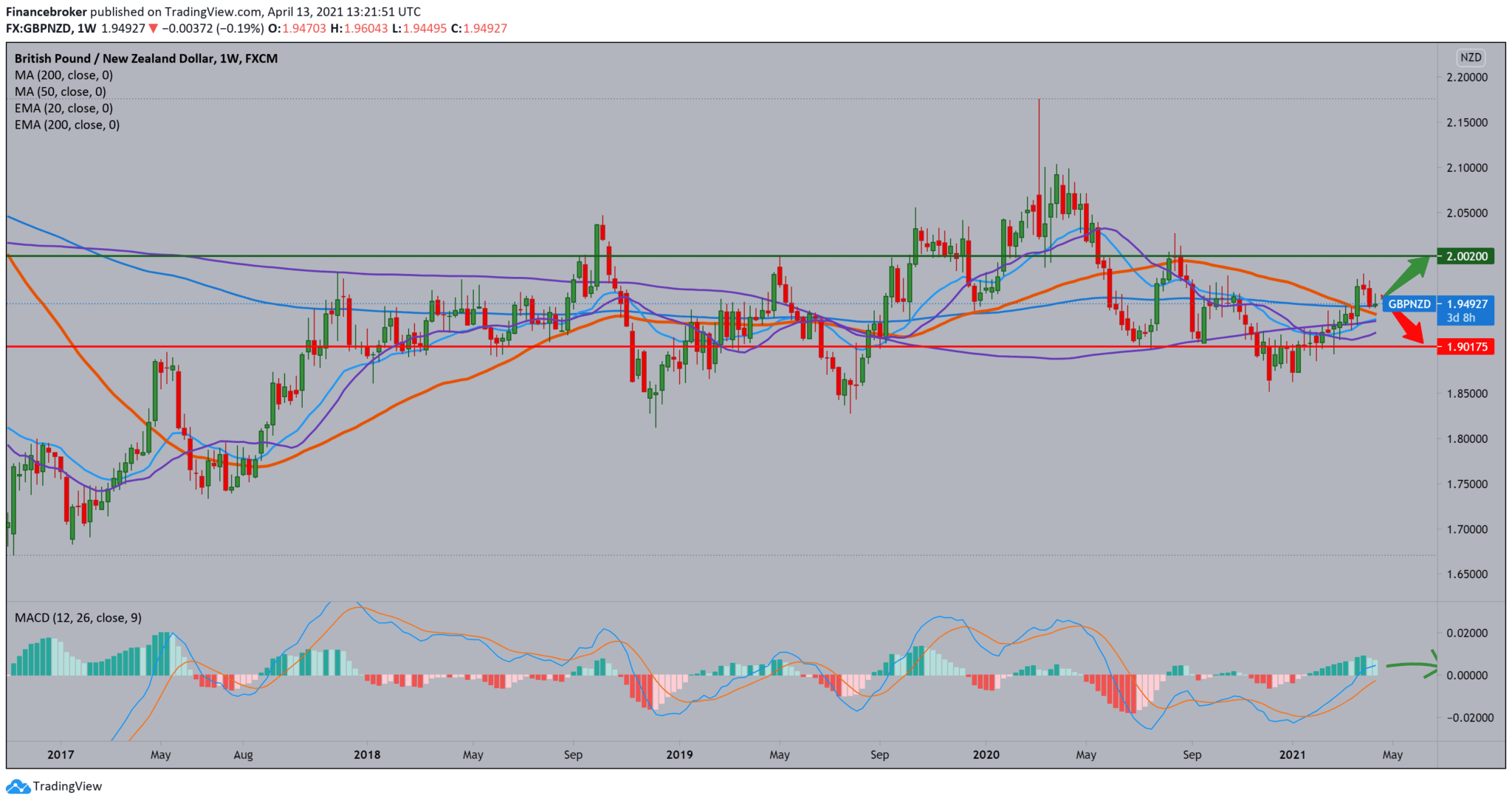

We see that we are above moving averages on the weekly time frame, and they are giving bullish support to the GBP/NZD pair for now. The previous two weeks were negative for the pound, and if the GBP/NZD pair overcomes that, we can expect a continuation towards the psychological level at 2.00000. The pullback is always possible to test moving averages again, but we can’t expect a bigger pullback as we are increasingly lean towards the bullish option. The MACD indicator tells us that we have been in a bullish trend since the beginning of the year and that we are still in it, but there has been a slight slowdown.

-

Support

-

Platform

-

Spread

-

Trading Instrument