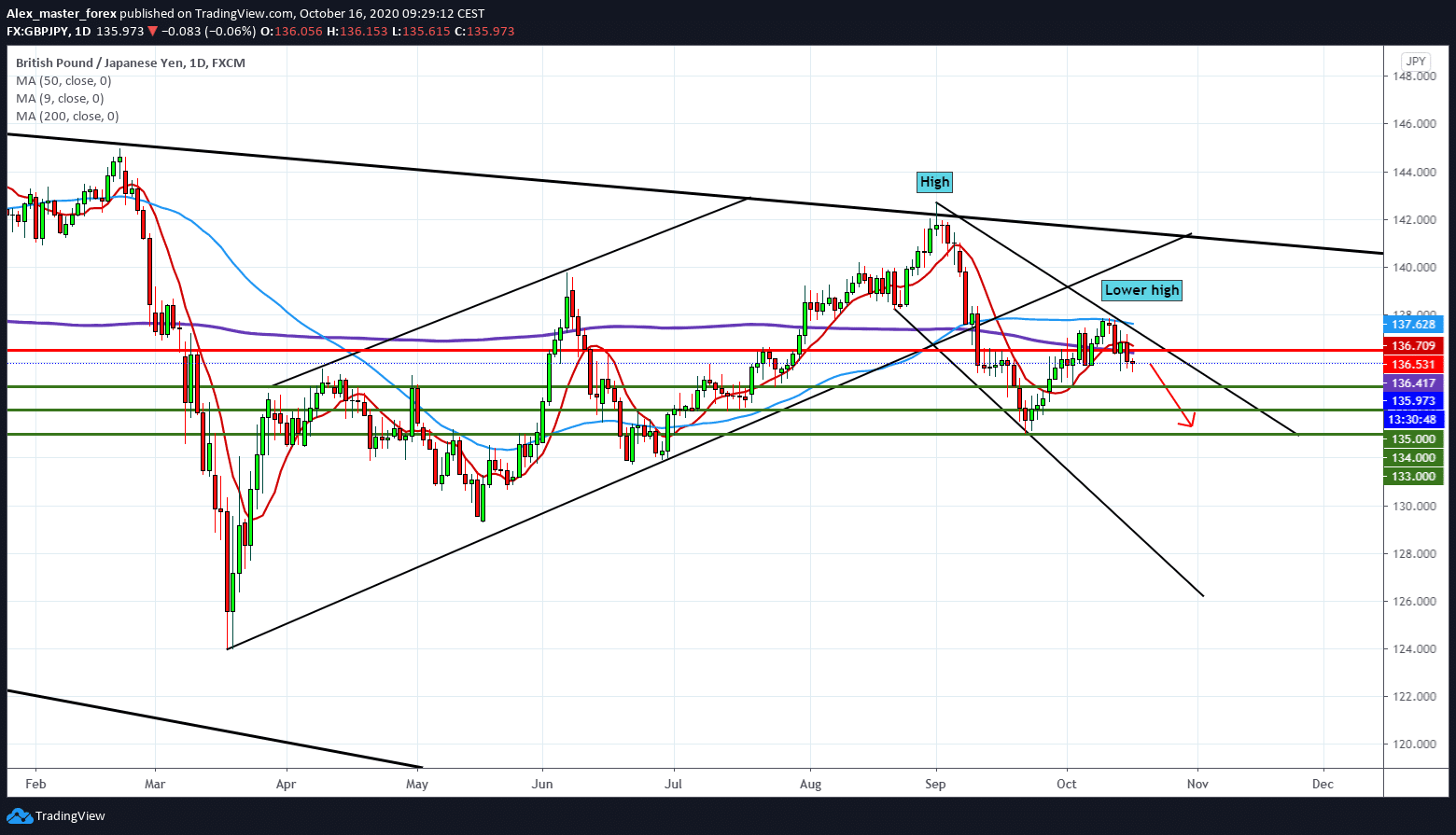

GBP/JPY Possible Bearish Scenario

Technical analysis, looking at the chart on a daily basis, we will see that this pair is slowly going down. We had a growing trend until the first of September and since then it has gone bad for the GBP.

The pound failed to make a new Higher high and started to slide down. That new top exactly matches the intersection of the trend line and made a retest to break.

The Prime Minister of the United Kingdom, Boris Johnson, should announce his decision on whether to continue or give up talks on future relations, so that this news will also have an impact on the chart. German Minister for Europe Michael Roth made his statement that no progress had been made in the talks. In essence, Europe is in no hurry and does not want a contract at any cost, and the pound suffers every blow like this.

The Crown, on the other hand, continues to ravage Britain. Moreover, the number of infected cases is growing and there are no signs that it will fall soon unless the government adopts some new measures.

The BOJ is expected to keep its monetary policy unchanged. It may revise its outlook but it continues in its own style. JPJ as well as CHF are a safe haven for investors in these unstable times.

The pair is currently below MA 200 and if it stays that way until the end of the day, there is a high probability that it will start falling down next week.

The first target we are looking at is 135,000.

-

Support

-

Platform

-

Spread

-

Trading Instrument