GBP/JPY forecast for March 3

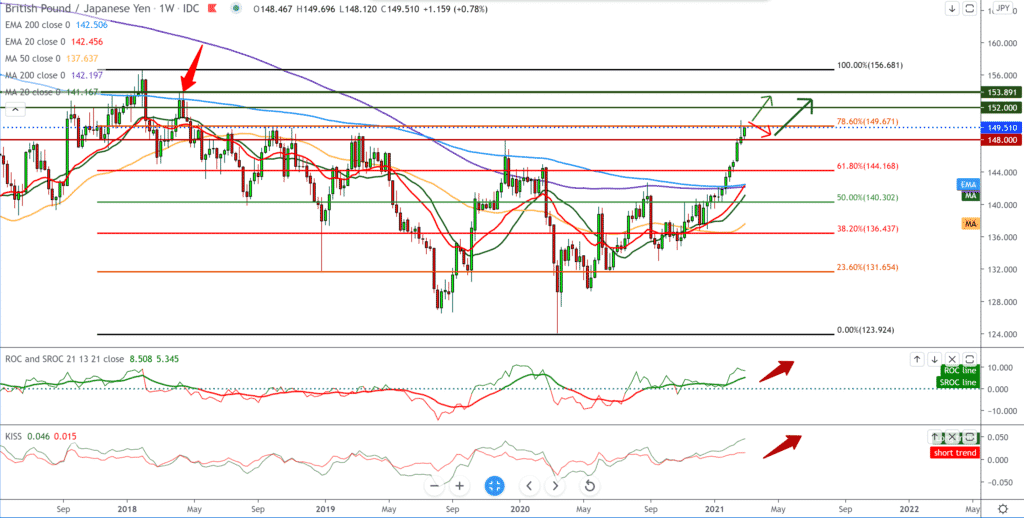

Looking at the chart on the weekly time frame, we see that the pair is coming into potential resistance zones. The first psychological resistance is at 150.00, and the Fibonacci retracement level is 78.6%; the trend is still very bullish, especially after the invention of the vaccine and its increasing use. So in the coming period, we can expect the continuation of this trend. Based on that, we look at the previous high at 153.80. A pullback is certainly possible because we hadn’t had one since December last year.

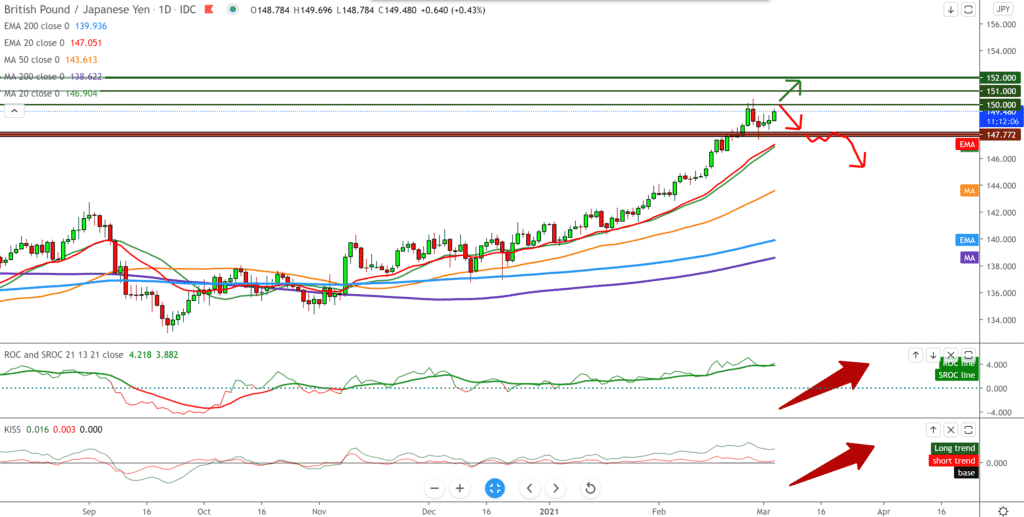

On the daily time frame, we see that the pair is making a FLAG pattern and that we can expect the bullish trend to continue; we have support at 148.00. Even the smallest moving averages of the MA20 and EMA20 provide good support and do not allow a break and change of trend. For now, we are looking towards another break at 150.00, pushing the pair towards the next level at 151.00.

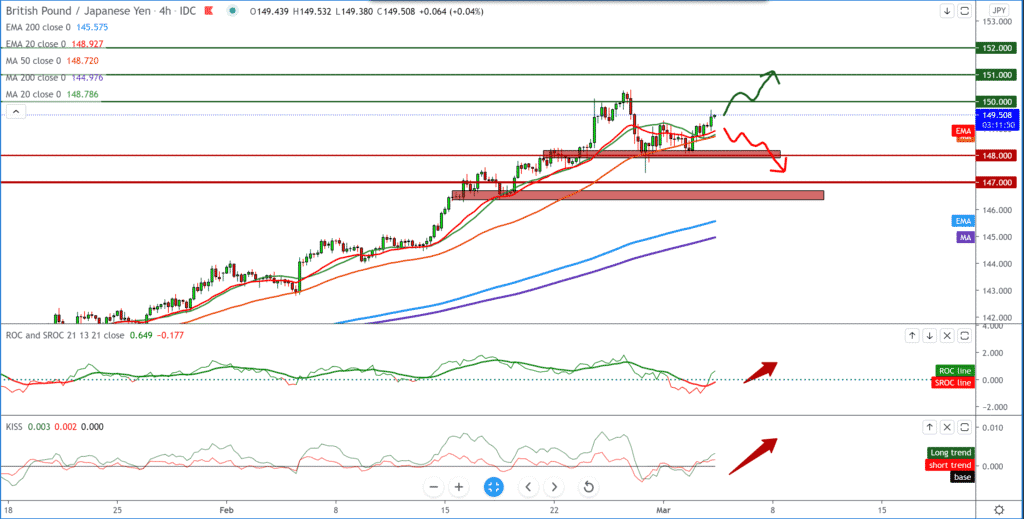

In the four-hour time frame, we see how the pair found support at 148.00 with support for MA20, EMA20, and MA50, and based on that; we expect to see the pair again above 150.00. A break below MA50 can lead to a smaller pullback again to 148.00.

From the news for this currency pair, we can single out the following: Production of the service sector in Great Britain fell only moderately in February after a sharp fall in early 2021 because the third national blockade caused limited damage to the economy, the results of a closely monitored research showed on Wednesday.

The IHS Markit / Chartered Institute of Procurement and Supply final Purchasing Managers ’Index rose to 49.5 in February from an eight-month low of 39.5 in January. The flash result was 49.7. The result was below the key value of 50.0 without changes every month since November 2020, but the latest reading indicated the slowest decline in the service sector’s production during this period. Progress in introducing the vaccine and confidence in the prospect of looser trade restrictions have resulted in the fourth consecutive monthly rise in business expectations in the service economy.

-

Support

-

Platform

-

Spread

-

Trading Instrument