GBP/JPY forecast for March 19, 2021

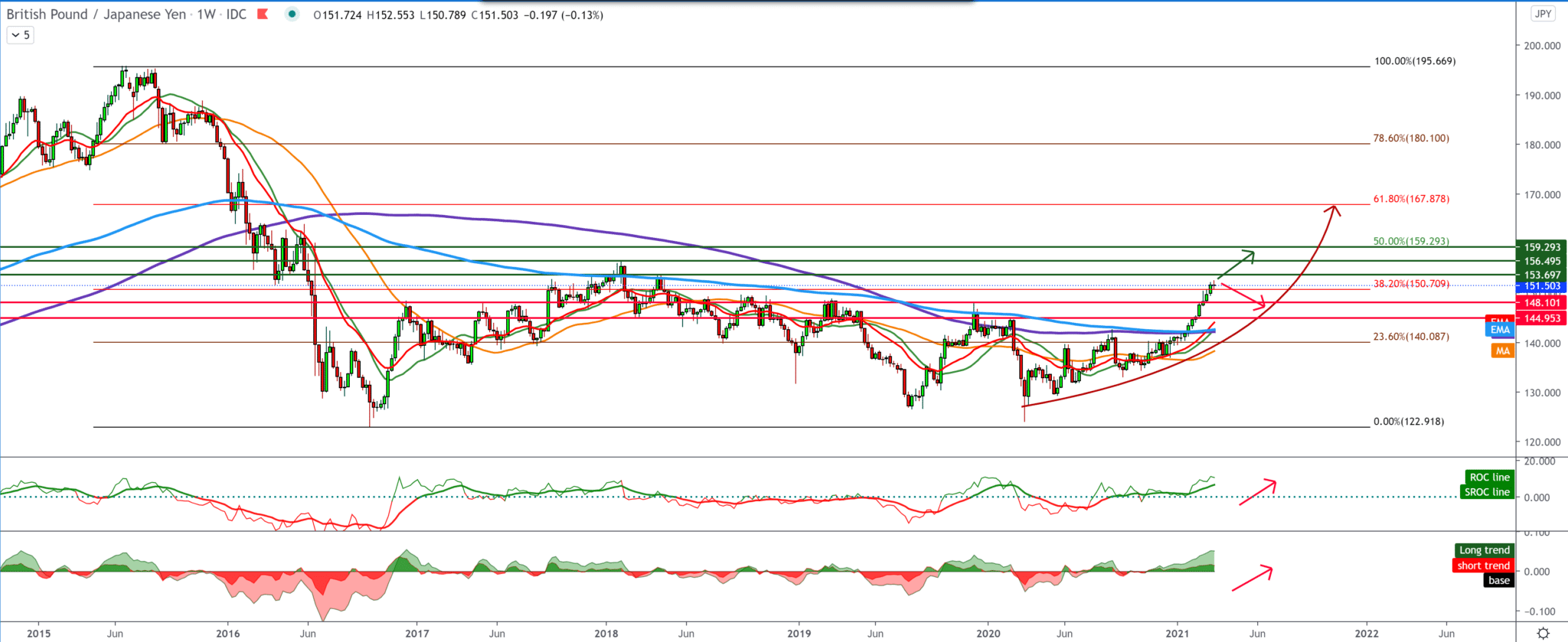

Looking at the chart on the weekly time frame, the GBP/JPY pair is currently testing the Fibonacci retracement 38.2% level at 150.70, and here we can expect potential consolidation around that level. A stronger break above opens the door to Fibonacci’s 50.0% level at 159.00, while on the other side, the consolidation below directs us towards the 23.6% level, but before that, we will seek support in moving averages.

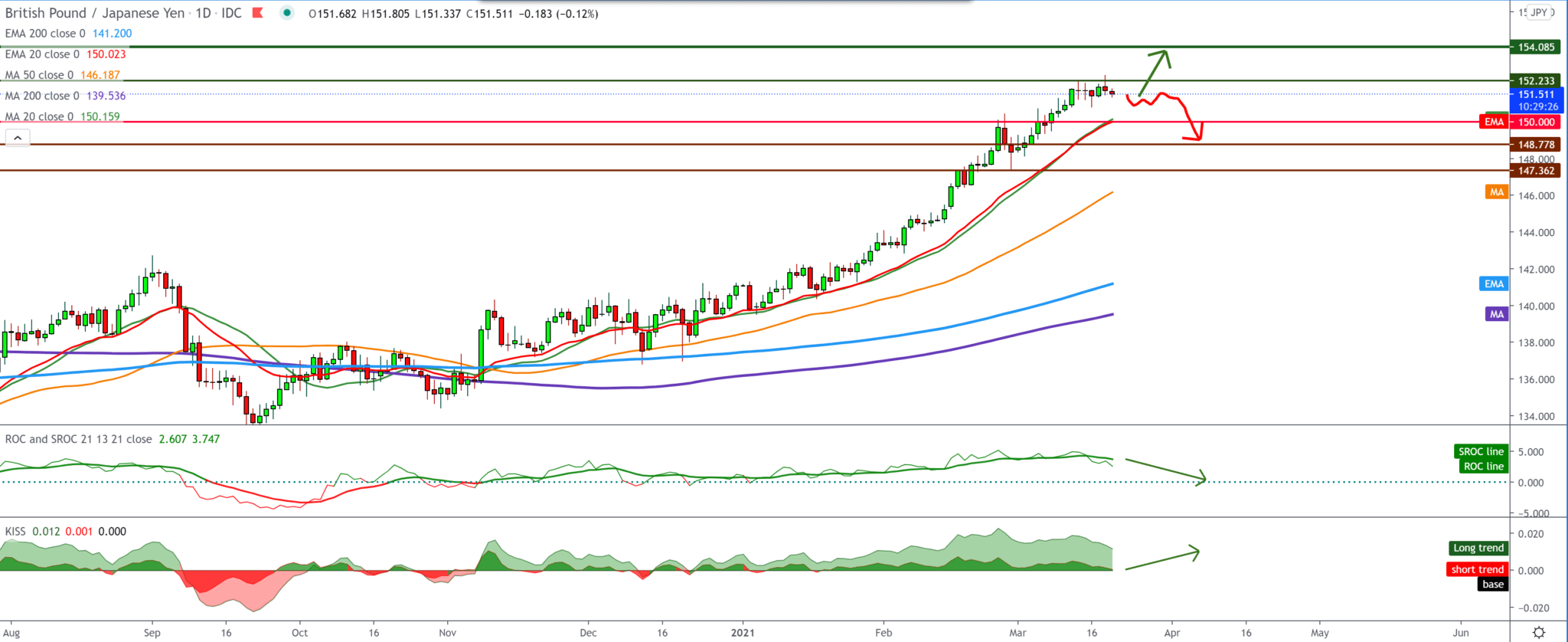

On the daily time frame, we see the GBP/JPY pair consolidating around 151.50-152.00. For now, it has good support for moving averages MA20 and EMA20. The pullback is certainly possible up to moving averages, and the break below them steers the trend towards a 150.00 psychological level that can support good support. And if the GBP/JPY pair manages to climb above this consolidation and resistance at 152.00, we can expect the bullish trend to continue.

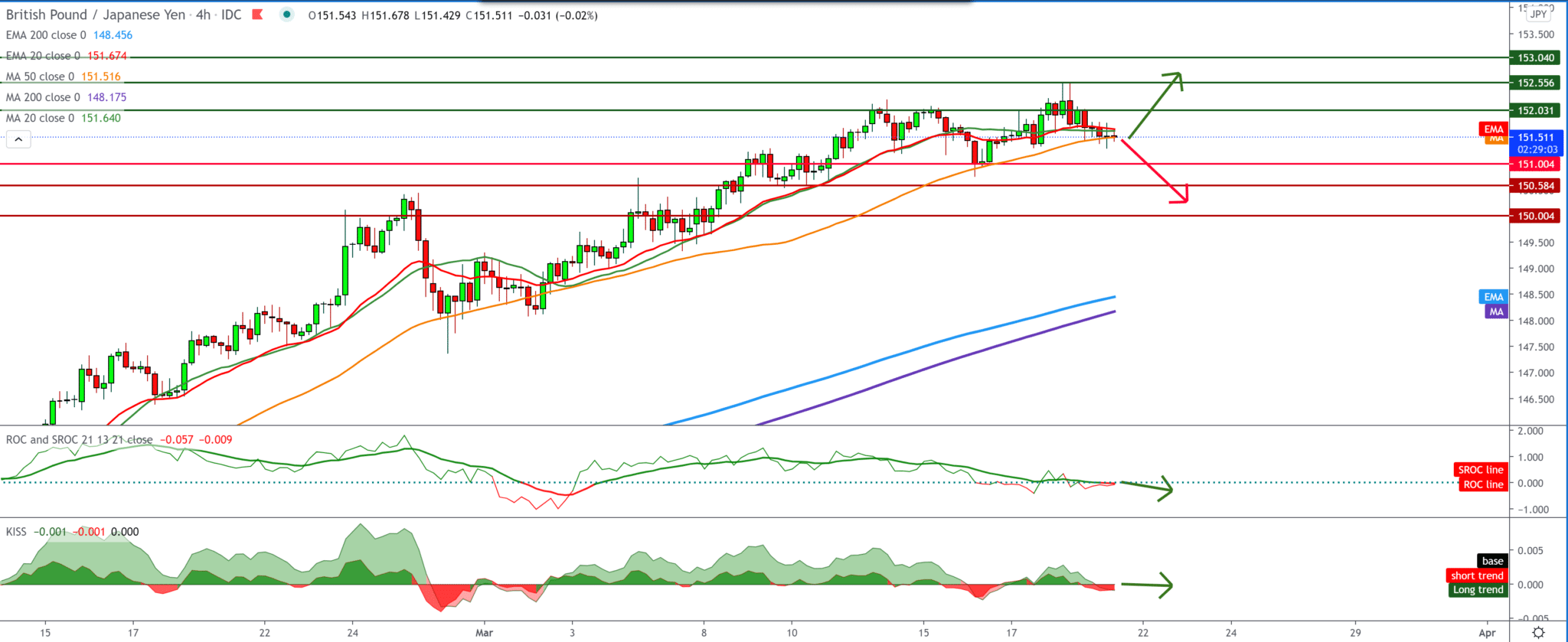

On the four-hour time frame, we see a pull from 152.50 to the current 151.50. Currently, there is a smaller bearish trend testing moving averages that are slowly moving to the bearish side, and based on that, we expect a continued pullback looking for better support on the chart. We need a break above the revolving averages for the bullish trend as we would, with their help, continue up to higher levels above 152.00.

From the news for these two currencies, we can single out the following: The Bank of Japan decided to expand the range on Friday. It allows government bond yields to vary and abolishes the average target of buying funds traded on the stock exchange. The board, led by Haruhiko Kuroda, voted 8-1 to keep the interest rate at -0.1 percent on current financial institutions’ current accounts in the central bank.

Also, the central bank decided to continue buying the required amount of Japanese government bonds without setting a ceiling so that the yields of 10 years of JGB will remain at around zero percent. However, the bank said it would allow the range of ten-year JGB yields to vary between plus and minus 0.25 percent of the target level. Total consumer prices in Japan fell by 0.4 percent year-on-year in February. The Ministry of Internal Affairs and Communications announced on Friday – in line with expectations and an increase of -0.6 percent in January.

-

Support

-

Platform

-

Spread

-

Trading Instrument