GBP/JPY forecast for February 22, 2021

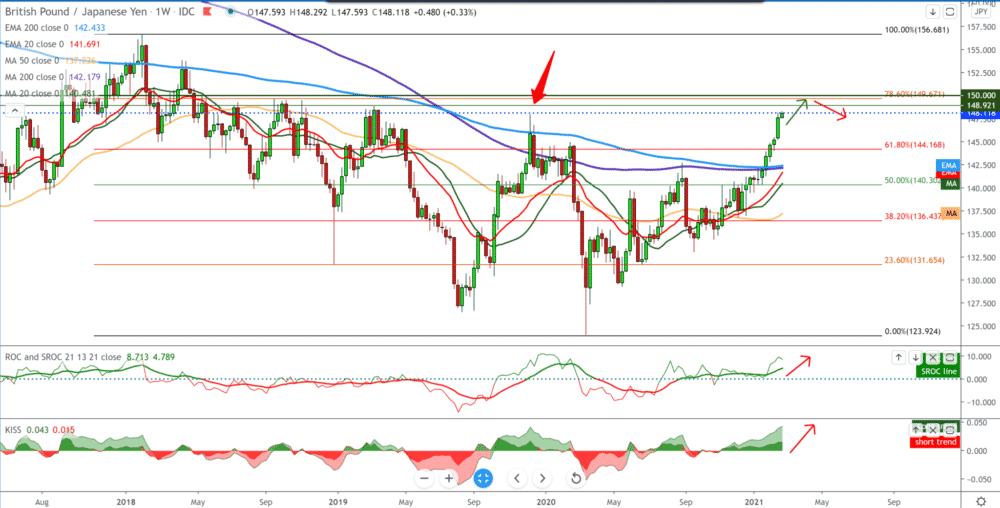

Looking at the chart on the weekly time frame, we see that the GBP/JPY pair managed to surpass the previous high from December 2019, and we are very close to the high from May 2019 at 148.90, approaching the high psychological level at 150.00. By setting the Fibonacci retracement level, we see a break above 61.8% level, and that we are now very close to 78.6% level at 149.60. If we are looking for a bearish scenario, we need to look at it only in the short term due to the consolidation to Fibonacci 61.8% level.

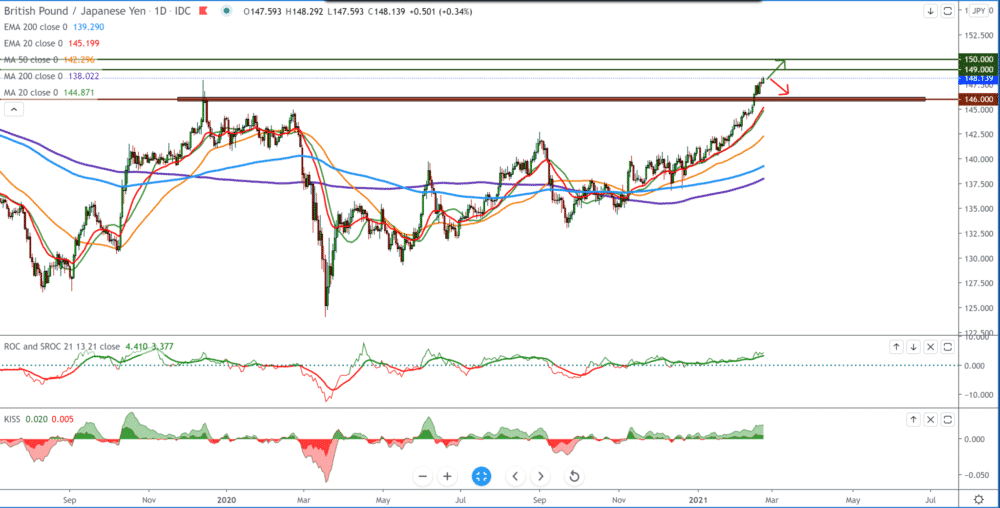

On the daily time frame, we see a very bullish trend since the beginning of November, which coincides with the vaccine’s appearance, then we were at 136.00, and now we are at 148.20, and we are getting closer to the psychological level at 150.00. Moving averages are on the bullish side and, for now, are good support for the GBP/JPY pair towards higher levels. If there is a pullback, we seek support at 146.00, where the pair will meet the lowest moving averages.

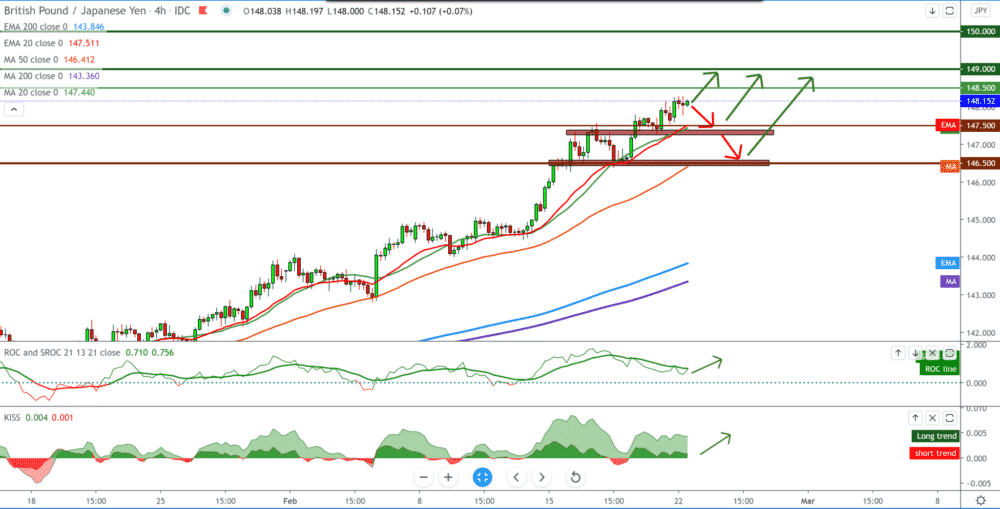

On the four-hour time frame, we see the GBP/JPY pair having good support for moving averages from the bottom, pushing the GBP/JPY pair to higher levels on the chart, the first support at 146.50 and the next at 147.50. We are now looking at 149.00 next target on the pullback chart 148.50. For the bearish scenario, we need a break below MA20 and EMA20 to sign on the chart based on which we can analyze the further descent on the chart.

From the news for the GBP/JPY pair, we can single out the following: Japanese producer prices fell for the fourth month in a row in January, data released by the Bank of Japan on Monday showed.

The producer price index of services fell 0.5 percent year-on-year in January, after falling 0.3 percent in December. This was the fourth consecutive month of decline. On a monthly basis, producer prices fell by 0.6 percent, after rising 0.2 percent in the previous month.

-

Support

-

Platform

-

Spread

-

Trading Instrument