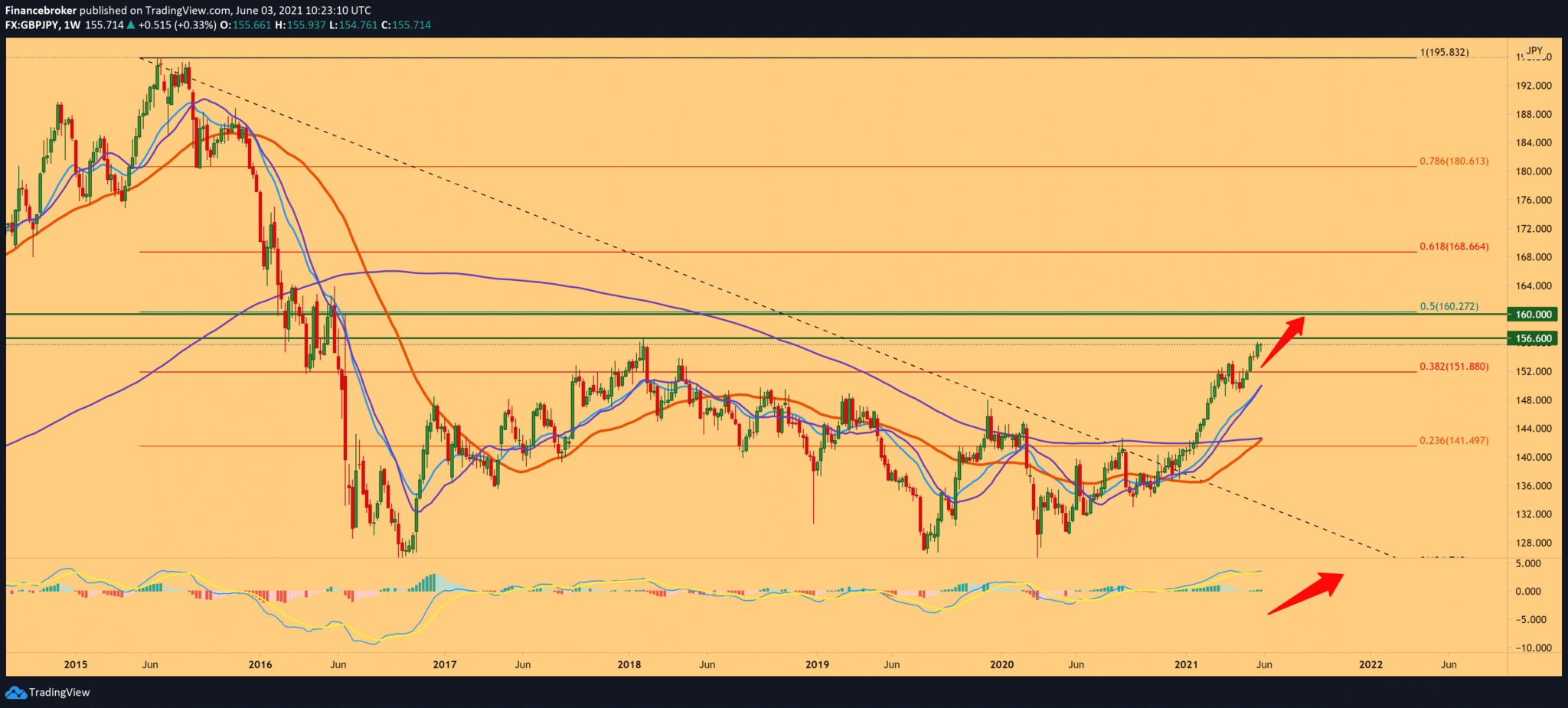

GBP/JPY 160.00 in the coming period

The British Composite PMI 62.9 is greater than the 62.0 previous measurements. Stronger audits only add luster to this report, as service sector output growth in the UK is seen to be the fastest in the last 24 years.

The reopening of the economy and looser restrictions on the virus have also led to improved employment conditions faster in the last over six years. The downside to the report is that input cost inflation remains high – the highest since July 2008 – with the strongest price increase charged by service providers since the start of the 1996 survey. May, because the withdrawal of the pandemic limit slowed down business and consumer spending. The latest research results set the stage for an interesting growth rate of the gross domestic product in the UK. in the second quarter of 2021, driven by the reopening of customer-facing parts of the economy after the winter blockades.

Due to a jump in demand and difficulties in hiring staff, pressure on business capacity emerged as a major challenge for service sector companies in May. Job creation has been strongest for more than six years, but job backlogs have accumulated the most since 2014.

The successful introduction of the vaccine has created a strong willingness to spend and strengthened business optimism in the service economy. Inflationary trends intensified in May when suppliers transferred higher transportation bills, staff costs, and raw material prices.

Looking at the chart on the weekly time frame, we see that the pound is on the rise, making a break above the 38.2% Fibonacci level, coming out of consolidation around 150.00. Following Fibonacci, our next target is 50.0% at 160.00. The weak Japanese yen will continue in the coming period, as the Japanese government extends coronavirus control measures until the start of the Olympics. All indicators and moving and MACD are on the bullish side and will be in the coming period.

-

Support

-

Platform

-

Spread

-

Trading Instrument