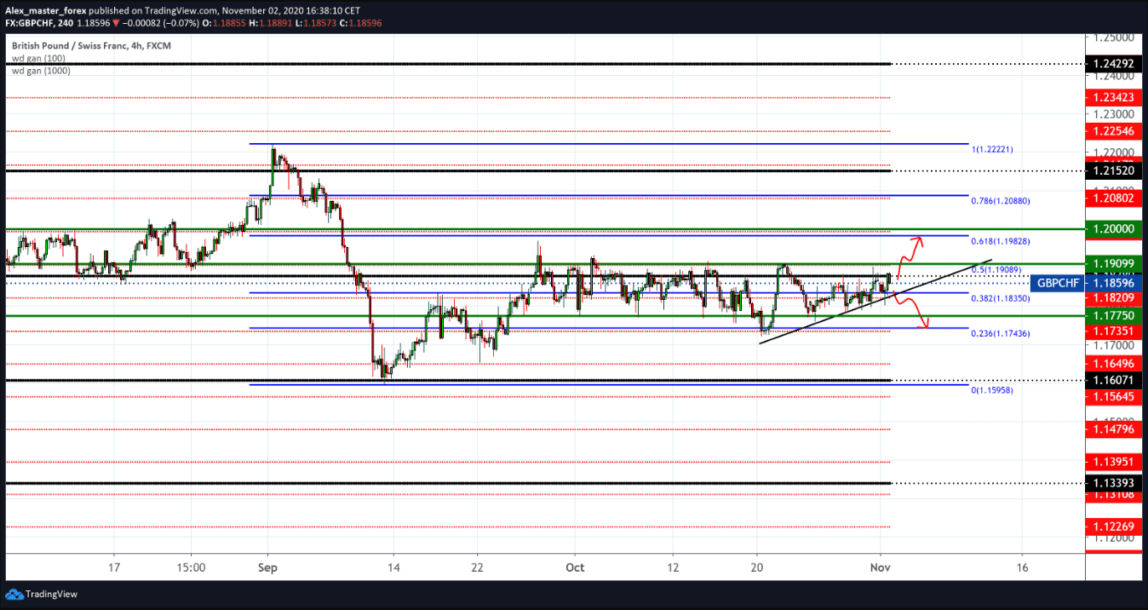

GBP/CHF side consolidation

For a long time, the GBP/CHF pair has been moving sideways in the range of 1.17500-1.19000 for more than a month. Looking at this couple’s chart, he looks very bored, waiting for some stronger movement up or down.

The pound pressed by Brexit and the regional locking of the country due to the increased number of newly infected with Coronavirus is waiting for the Bank of England’s announcement on interest rates on Thursday, which will remain at the same level of 0.10%.

Also, we will have the following reports in the following areas: The Services Purchasing Managers’ Index (PMI) measures, The Chartered Institute of Purchasing and Supply (CIPS) Construction Purchasing Manager’s Index (PMI) measures, The Composite PMI Index measures, Bank of England ( BOE) Governor Andrew Bailey is to speak.

A very volatile week for the pound. The last few weeks, trying to find a balanced approach to the coming tide of the second wave of Coronavirus, the prime minister told a news conference Saturday night that it was time to be “humble before nature.”

England will enter a one-month national blockade on Thursday, Johnson announced, warning that the country could record “several thousand” deaths from COVID-19 in a few weeks a day without stricter restrictions.

Unimportant shops and other places are forced to close. Johnson said the country “has no alternative,” and current models show that an increase in infections could mean jeopardizing Britain’s entire healthcare system.

The new measures, which will be debated and voted on by the British Parliament on Wednesday, will remain in force until December 2, when England will return to its current local (regional) restrictions on Coronavirus, which are now in force.

From the economic news from Switzerland this week, we will follow: The Consumer Price Index (CPI) measures, The State Secretariat for Economic Affairs (SECO) Consumer Climate Index measures the level of consumer confidence in economic activity and speech on Thursday Andrea Maechler serves as Governing Board Member of the Swiss National Bank (SNB).

The Swiss franc is considered one of the safest and most secure currencies for investors during this crisis.

-

Support

-

Platform

-

Spread

-

Trading Instrument