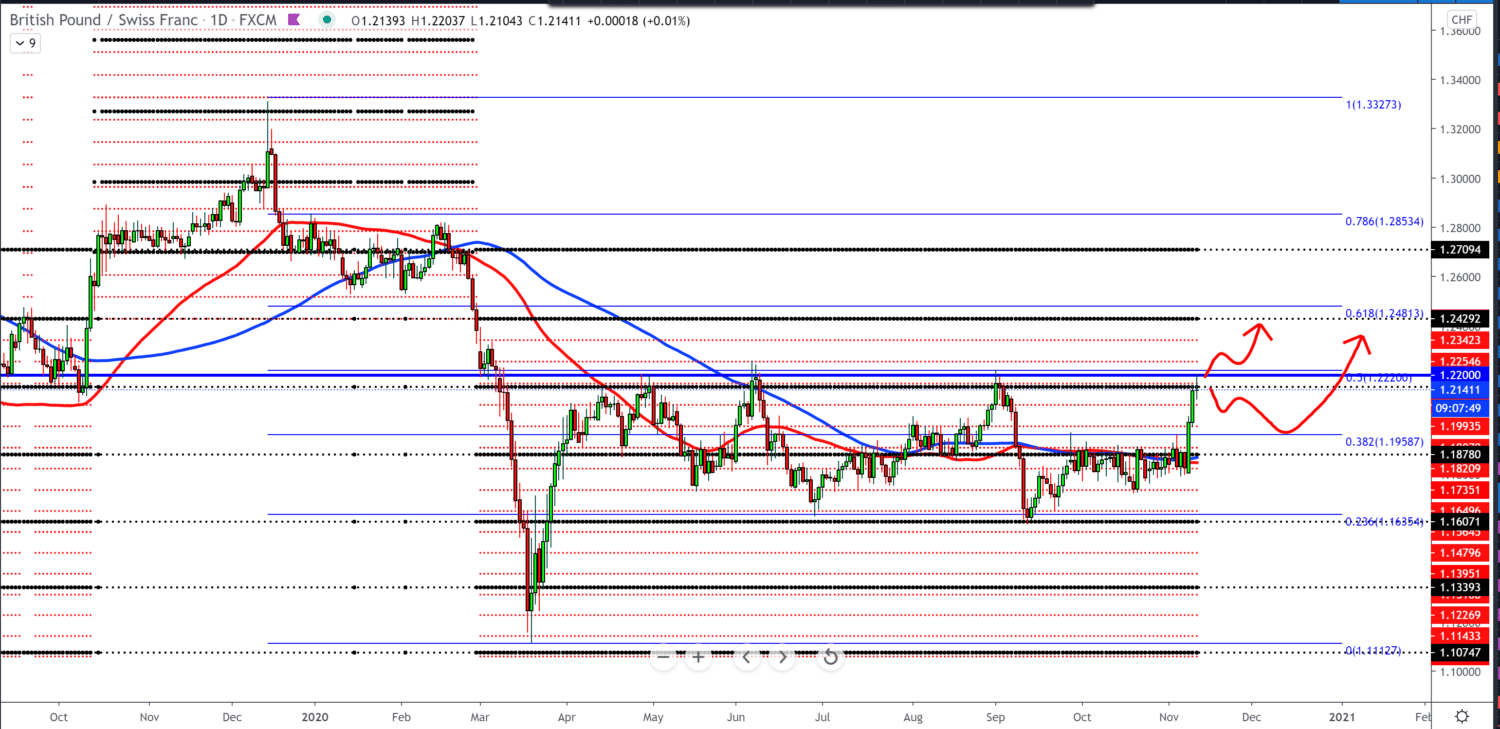

GBP/CHF forecast for November 11, 2020

Looking at the chart, this is the fourth attempt for the GBP/CHF pair to cross the 1.22000 limits. After previous attempts, we saw another pullback below 1.17000, 500 pips. The Brexit agreement and the British vaccine’s advantage put the pound in the pole position to gain an advantage over the Swiss franc.

Negotiators with the EU and the United Kingdom may sign an agreement sometime next week. Although there are open issues, Brussels and London have managed to circumvent some of the red line on sensitive issues such as fisheries and state aid.

Although the whole world will benefit from immunization, Britain is one of the best-positioned countries. In addition to signing an agreement with Pfizer – which together with BioNTech announced 90% efficiency inits preliminary results – its domestic vaccine project is set to be a success.

The University of Oxford and AstraZeneca are using the same mRNA approach to develop their vaccine and release encouraging results in the next few weeks. All this now puts the Swiss franc in an unfavorable position, and the investor is now getting rid of the Swiss franc because the global situation is slowly being resolved.

However, the corona cases have exceeded 50 million infected worldwide. Market sentiment remains optimistic on Wednesday, as major European stock indices are trading in positive territory due to a potential vaccine.

Of the critical news that can affect the GBP/CHF pair, we have tomorrow Gross Domestic Product (GDP) measures for GBP, Manufacturing Production measures, trade balance, and a speech by Governor Andrew Bailey, the Bank of England.

We can also expect some news about Brexit and the number of newly infected with coronavirus, making the market volatile.

-

Support

-

Platform

-

Spread

-

Trading Instrument