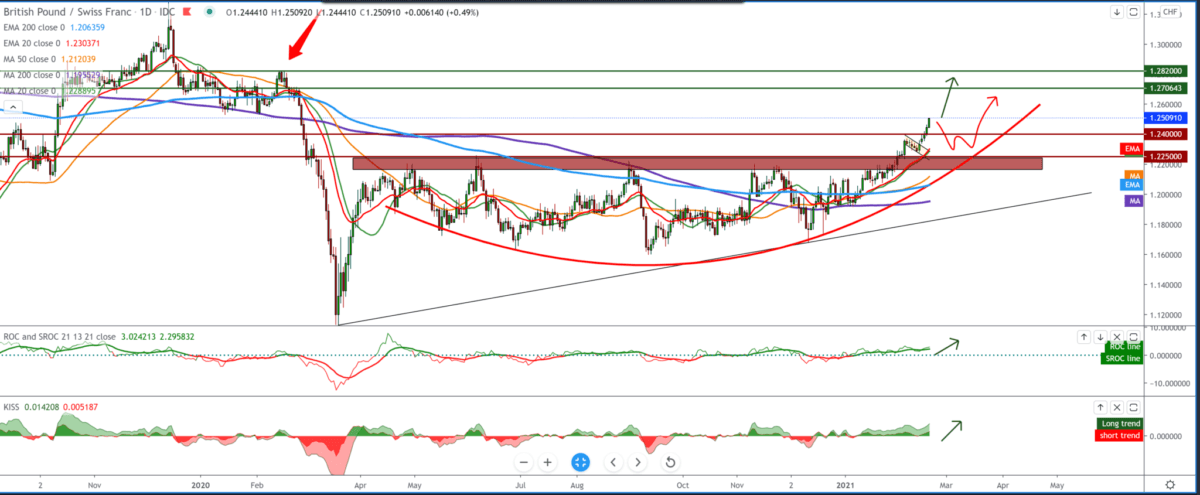

GBP/CHF Forecast for February 18, 2021

Looking at the chart on the weekly time frame, we see that the Pound is progressing very well this year against the Swiss franc. After a break-in in early February above 1.22000, which was a big resistance last year, the GBP/CHF pair climbed to the current 1.25000 and looking in the previous high to 1.28000 from February 2020. What is important and what we need to pay attention to in this time frame are the moving averages of the MA200 and the EMA200, which since 2008 have been a major resistance and an obstacle for the pair to transition to a bullish scenario.

On the daily time frame, we see that the GBP/CHF pair, after the break above 1.22000, made a retest and headed up to conquer the higher peaks, currently testing the psychological level at 1.25000. All moving averages have been on the bullish side since mid-January, and for now, as things stand on the chart, they will remain so in the future unless there are some drastic global events.

In the short next period, we can expect the GBP/CHF pair to reach the previous high of 1.28200 if everything goes according to plan. Otherwise, we expect a pullback first to 1.24000 support and then to 1.22500 breaks of the previous major consolidation.

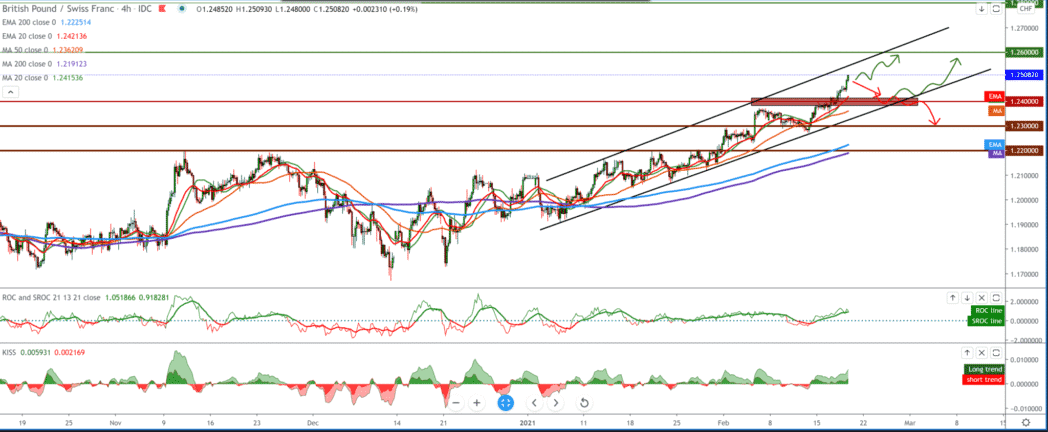

On the four-hour time frame, the GBP/CHF pair is very bullish with the support of all moving averages from below. We can draw a smaller trend line from the bottom that we can use as a support line. after such impulses, it is logical to expect a smaller pullback as part of a larger consolidation within this growing channel. The moving portions of the MA200 and EMA 200 are currently 1.22000-1.22500, and we can expect their value to grow by pushing support to higher levels.

-

Support

-

Platform

-

Spread

-

Trading Instrument