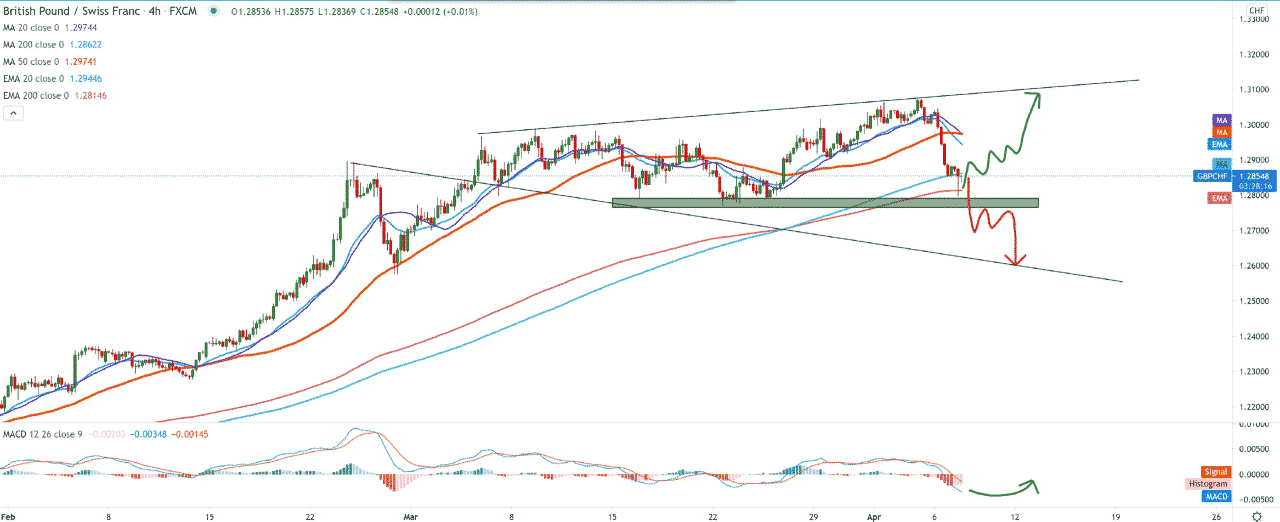

GBP/CHF analysis for April 7, 2021

Looking at the graph on the four-hour time frame, we see that the GBP/CHF pair is in a pullback to the current zone around the moving averages of the MA200 and EMA200 and testing the zone 1.28000 the site of the previous rejection. A break below with a certain consolidation of 1.27500-1.28000 will give us a better signal to continue the bearish trend of 1.27000 and even towards 1.26000.

Otherwise, as far as we see drawn up above 1.29000, we are again moving to 1.30000 and making the potential for the GBP/CHF pair to climb to a new high this year. Following the MACD indicator, we see that we have gone deep into the bearish zone and that the pressure is higher on the pound, pushing it into negative territory.

On the daily time frame, we see that the GBP/CHF pair is in a certain consolidation during March and as if it is under a certain pressure around 1.30000. We had the first pull of 1.27780 and then jump again, making a new high to 1.30700, and then another pullback to the same support zone 1.2770-1.28000. Following the moving averages, the GBP/CHF pair is currently below MA20 and EMA20, and there is a further likelihood that the GBP/CHF pair will go even further down for better support.

Looking at the MACD indicator, we see that the bearish signal is in effect because the blue MACD line is below the signal line. However, it is still in the green territory, so it is still at the beginning, and for a stronger bearish signal, we need to go down to the red zone of the indicator.

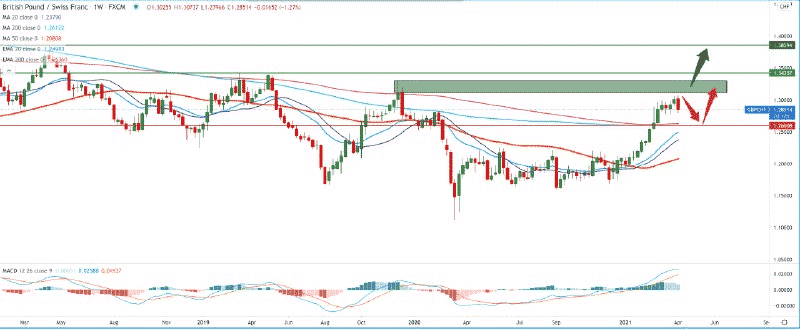

On the weekly time frame, we see that the GBP/CHF pair makes a pullback for a potential new momentum after coming close to the resistance zone. We are looking for the first support at 1.26000, where the moving averages MA200 and EMA200 are waiting for us. If we look at the MACD indicator, we see that the signal is at the maximum of the current bullish trend and that we expect a turn in it, directing us towards the lower levels on the chart.

-

Support

-

Platform

-

Spread

-

Trading Instrument