GBP/AUD forecast for November 27, 2020

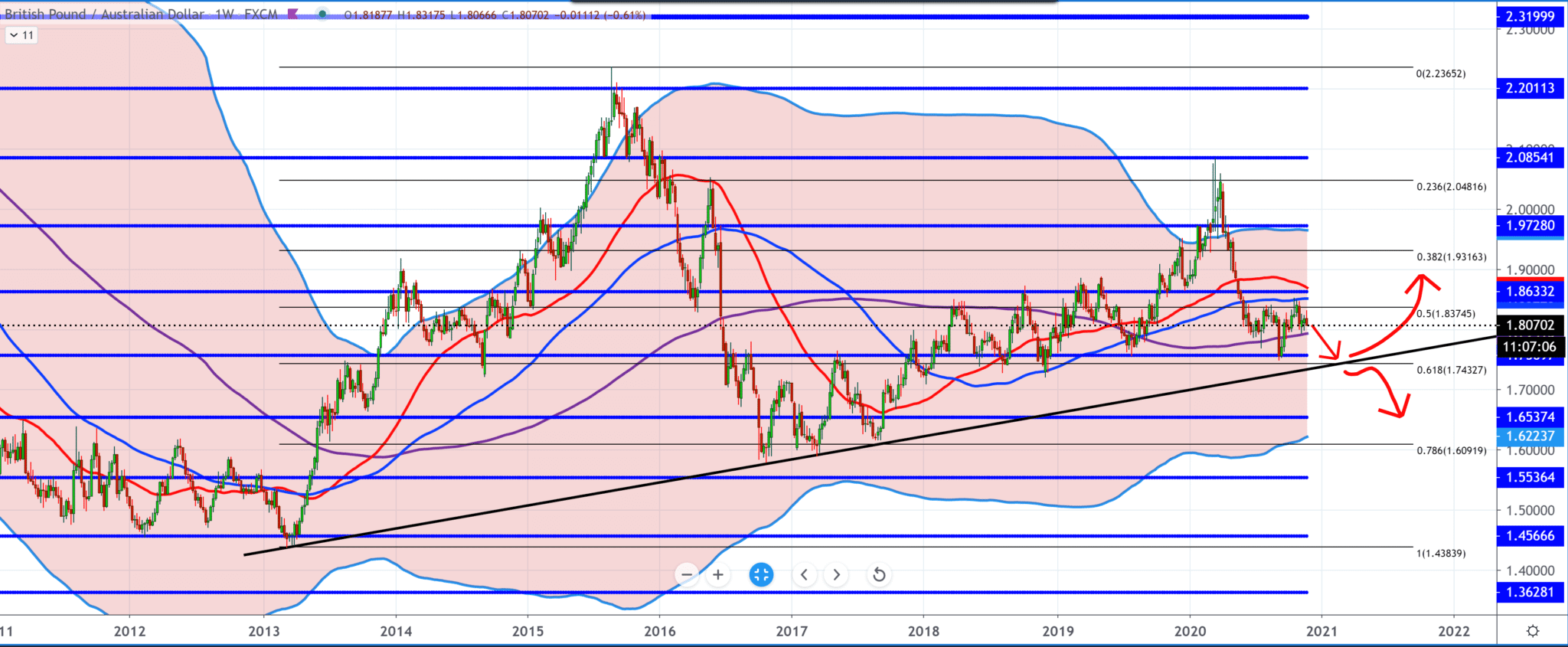

Let’s take a look at the bigger picture of the GBP/AUD chart on the weekly time frame. At the bottom, we have a trend line connected to the previous low, then higher low, and so on; from the top, we see all the lows low and that after that, the other highs are low.

From the upper side, we have a moving average MA50 and MA100 that make a downward turn, while on the lower side, we have a moving average MA200 as support.

Still, we already had a break below, so it is likely that once again, the GBP/AUD pair tests MA200 and level around 1.79500 -1.80000. If we see a break below MA200 support, we can look at the bottom trend line, assuming around 1.75000-1.76000.

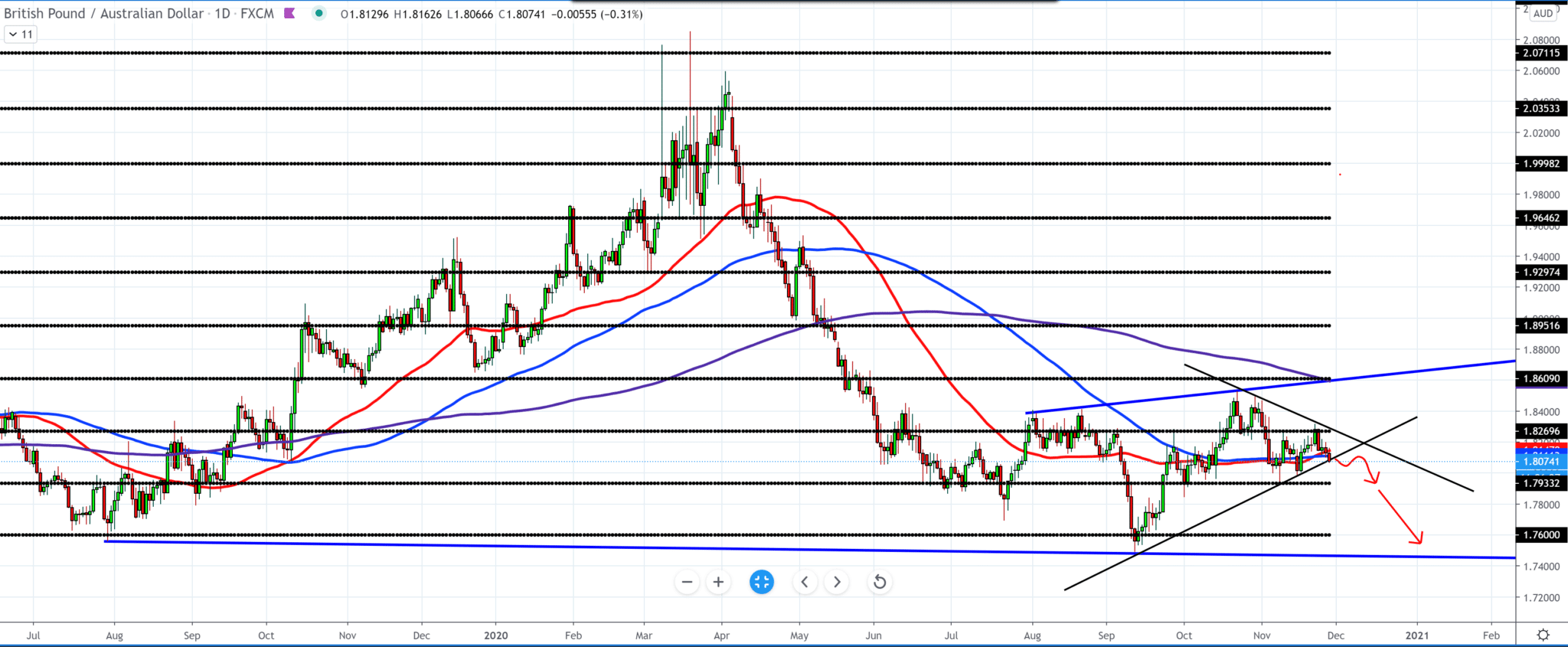

On the daily time frame, we will notice that the GBP/AUD pair is gathering in a triangle on the bottom line of the trend and that there is a probability that it will break below and fall to lower levels below 1.80000. The GBP/AUD pair has fallen below the moving MA50 average and is now testing the MA100.

The bearish scenario is more likely to continue in the next ten days because Britain, which is in lockdown, should open its country in the first week of December, by then bearish scenario.

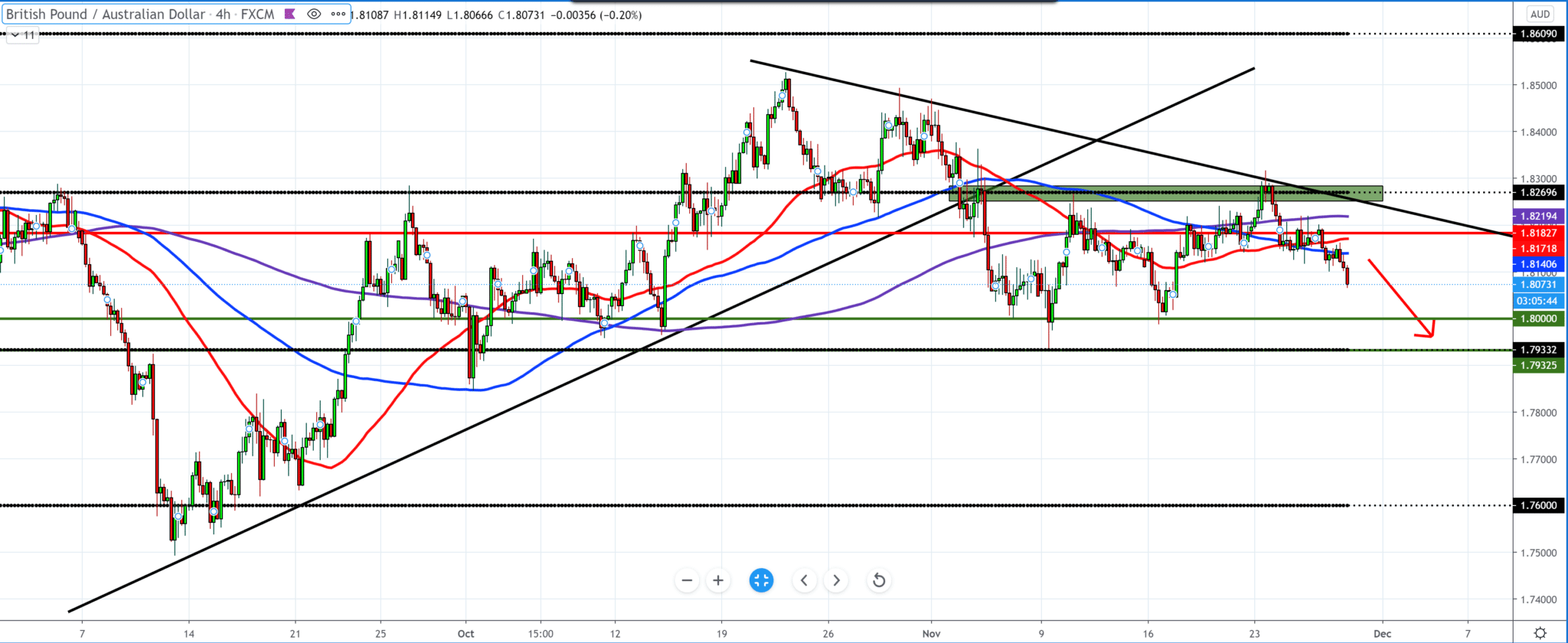

Negotiations on Brexit are also current as the deadline is approaching, and that is 31 December. Looking at the chart on the four-hour time frame, we notice that from the top, we have as resistance all three moving averages MA200, MA100, and MA50, and soon we can see the GBP/AUD pair again at 1.80000, which can be a psychological level for investors.

Today is a day without economic news from Britain and Australia. The GBP/AUD pair is in free fall on the chart. In the afternoon, the market is closed due to holidays in America, and the volatility will probably be lower, an extended weekend for traders and investors.

-

Support

-

Platform

-

Spread

-

Trading Instrument