GBP/AUD forecast for March 17, 2021

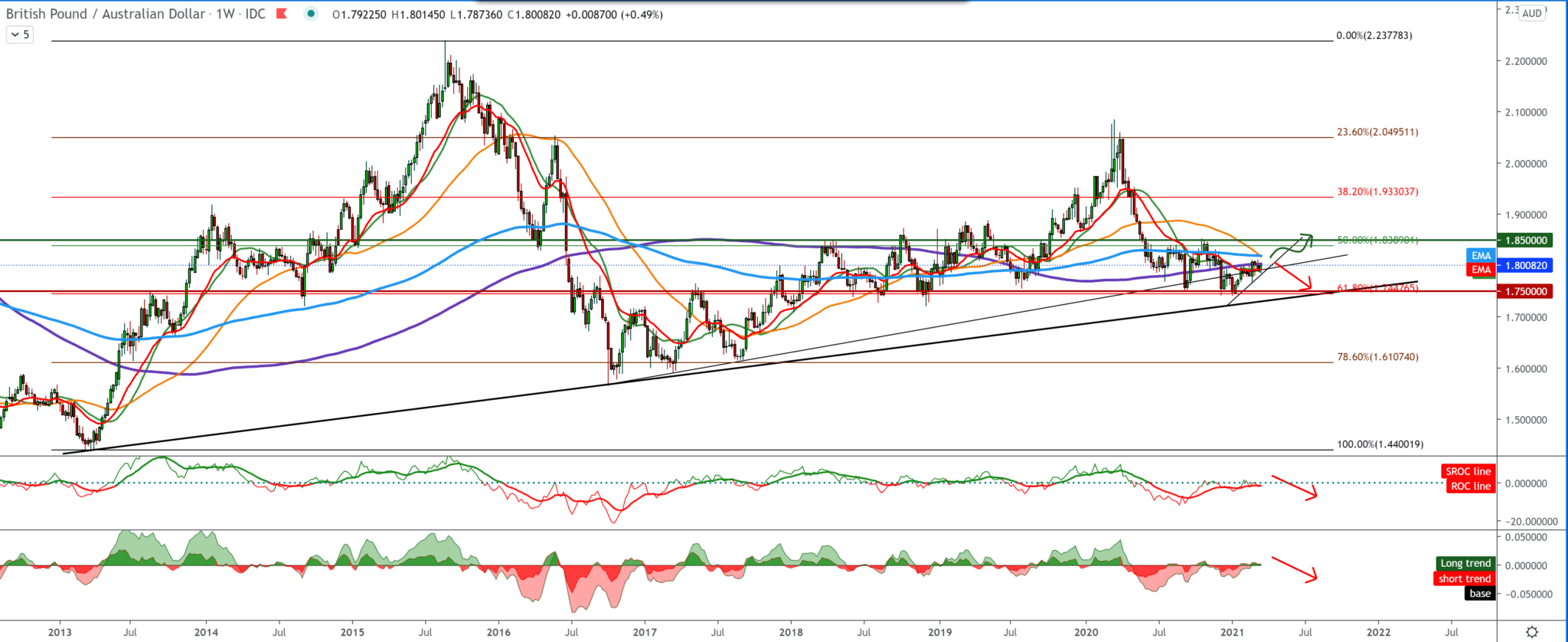

Looking at the chart on the weekly time frame, we see that the GBP/AUD pair has fallen below the moving averages of the MA200 and EMA200 but is close to the bottom trend line, which could be potential support and obstacle to continuing into the bearish trend after this consolidation. Within this consolidation, there is a probability that the GBP/AUD pair will climb to 1.85000 once again, testing the psychological level and Fibonacci retracement 50.0% level to 1.83900.

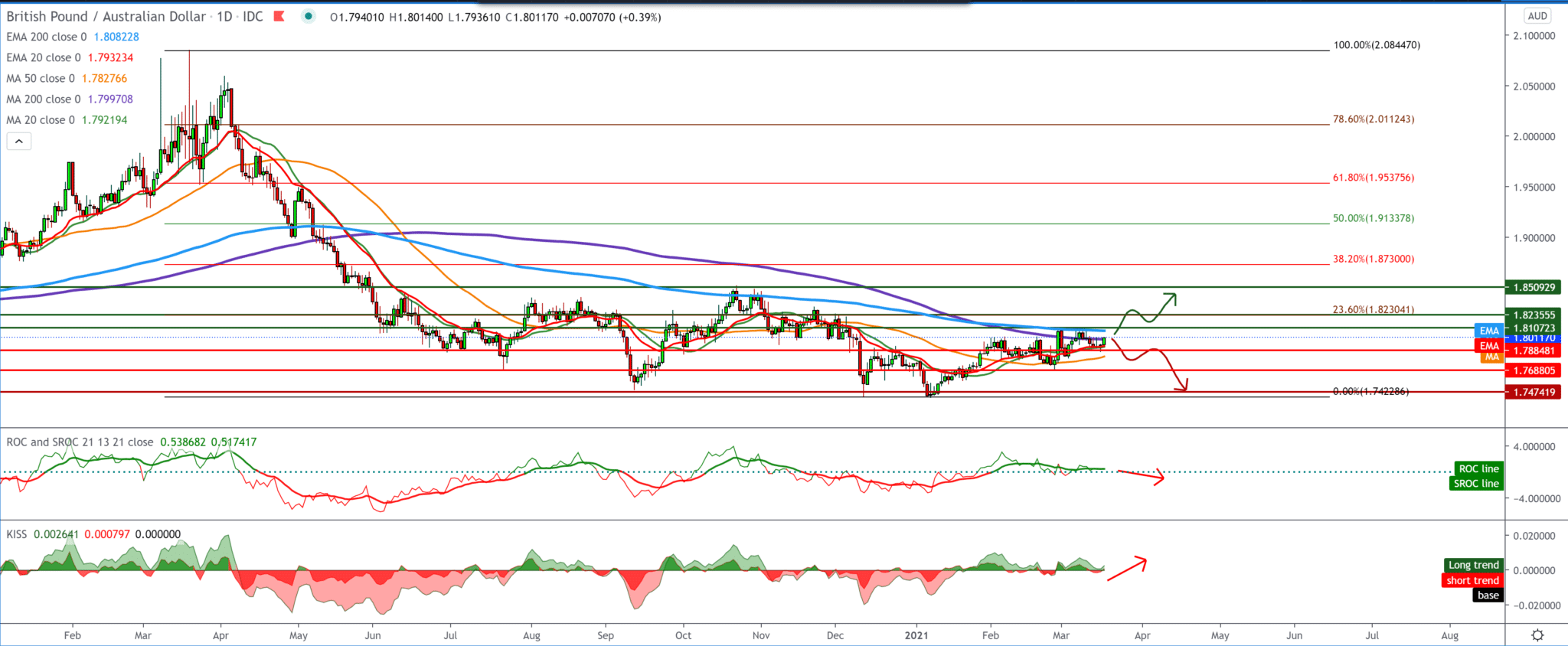

In the daily time frame, we see that the GBP/AUD pair is increasingly finding support at lower levels, gaining support for moving averages, and we are currently testing the MA200, and we can expect the GBP/AUD pair to reach the EMA200 at 1,80700. By setting the Fibonacci retracement level, we see that the pair is making a turn and heading towards a 23.6% level at 1.82300. If the pair fails to climb above the MA200 and bounces down, we look towards 1.75000, looking for first support at 1.76880 with MA50 support.

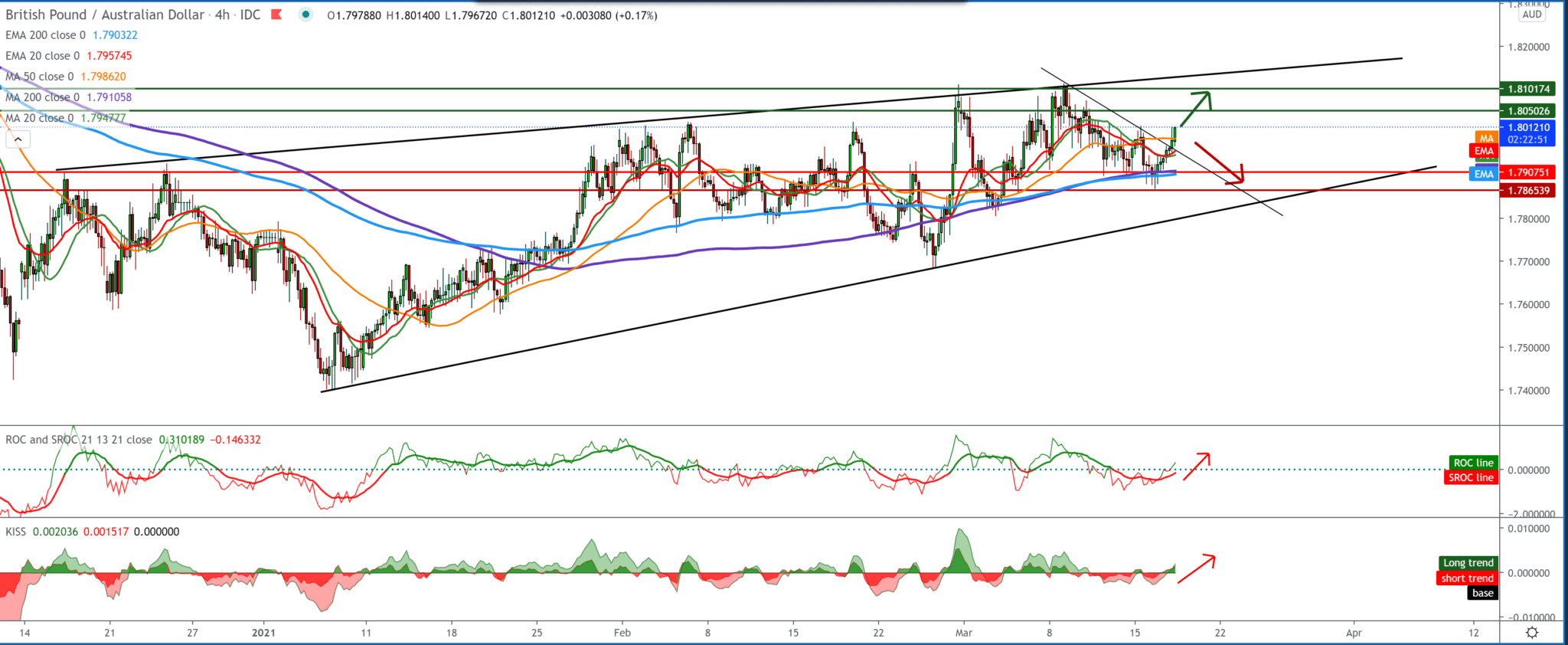

In the four-hour time frame, we see that the GBP/AUD pair moves on one ascending channel with the current support of moving averages, especially with a break above MA200 and EMA200. Our target is the top line of this channel at 1.81000, where we can expect the next resistance to higher levels on the chart.

From the news for the GBP/AUD currency pair, we can single out the following: The leading Australian index continued to suggest that economic growth will remain positive for most of 2021. The latest research results by Westpac and the Melbourne Institute showed on Wednesday.

The six-month annual growth rate in the leading index of the Westpac Melbourne Institute, which indicates the probable pace of economic activity in relation to the trend from three to nine months in the future, fell to 2.64 percent in February from 3.83 percent in January. The economy is expected to grow this year, driven by strong spending of 4.5 percent. Over the past six months, the leading index’s growth rate has risen to 2.64 percent from -0.2 percent.

-

Support

-

Platform

-

Spread

-

Trading Instrument